- Malaysia

- /

- Construction

- /

- KLSE:KKB

Revenue Downgrade: Here's What Analysts Forecast For KKB Engineering Berhad (KLSE:KKB)

Today is shaping up negative for KKB Engineering Berhad (KLSE:KKB) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

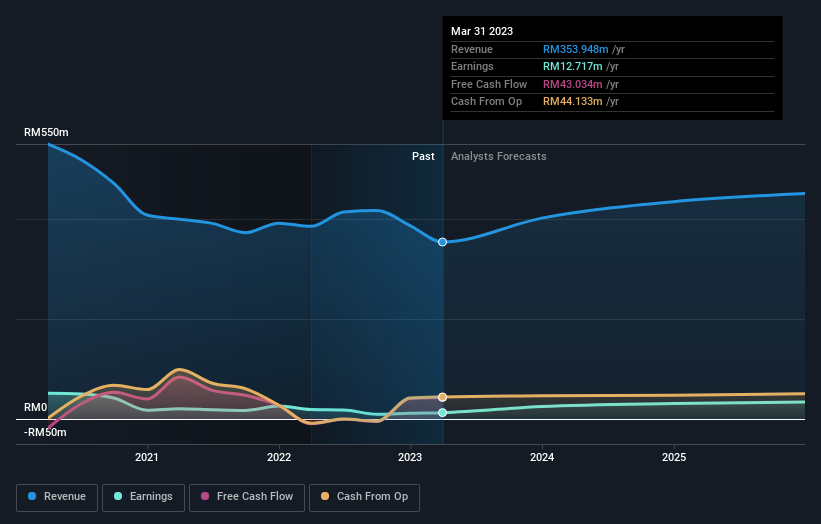

Following the downgrade, the current consensus from KKB Engineering Berhad's twin analysts is for revenues of RM402m in 2023 which - if met - would reflect a solid 13% increase on its sales over the past 12 months. Before the latest update, the analysts were foreseeing RM459m of revenue in 2023. It looks like forecasts have become a fair bit less optimistic on KKB Engineering Berhad, given the substantial drop in revenue estimates.

Check out our latest analysis for KKB Engineering Berhad

We'd point out that there was no major changes to their price target of RM1.69, suggesting the latest estimates were not enough to shift their view on the value of the business. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on KKB Engineering Berhad, with the most bullish analyst valuing it at RM1.80 and the most bearish at RM1.58 per share. Still, with such a tight range of estimates, it suggests the analysts have a pretty good idea of what they think the company is worth.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The analysts are definitely expecting KKB Engineering Berhad's growth to accelerate, with the forecast 13% annualised growth to the end of 2023 ranking favourably alongside historical growth of 0.3% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 13% annually. KKB Engineering Berhad is expected to grow at about the same rate as its industry, so it's not clear that we can draw any conclusions from its growth relative to competitors.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. Analysts also expect revenues to grow approximately in line with the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on KKB Engineering Berhad after today.

Thirsting for more data? We have estimates for KKB Engineering Berhad from its twin analysts out until 2025, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if KKB Engineering Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KKB

KKB Engineering Berhad

Engages in the steel fabrication, civil construction, hot dip galvanizing, and LP gas cylinders manufacturing businesses in Malaysia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success