- Malaysia

- /

- Industrials

- /

- KLSE:KFIMA

Should You Or Shouldn't You: A Dividend Analysis on Kumpulan Fima Berhad (KLSE:KFIMA)

Is Kumpulan Fima Berhad (KLSE:KFIMA) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

A high yield and a long history of paying dividends is an appealing combination for Kumpulan Fima Berhad. We'd guess that plenty of investors have purchased it for the income. The company also bought back stock during the year, equivalent to approximately 0.6% of the company's market capitalisation at the time. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

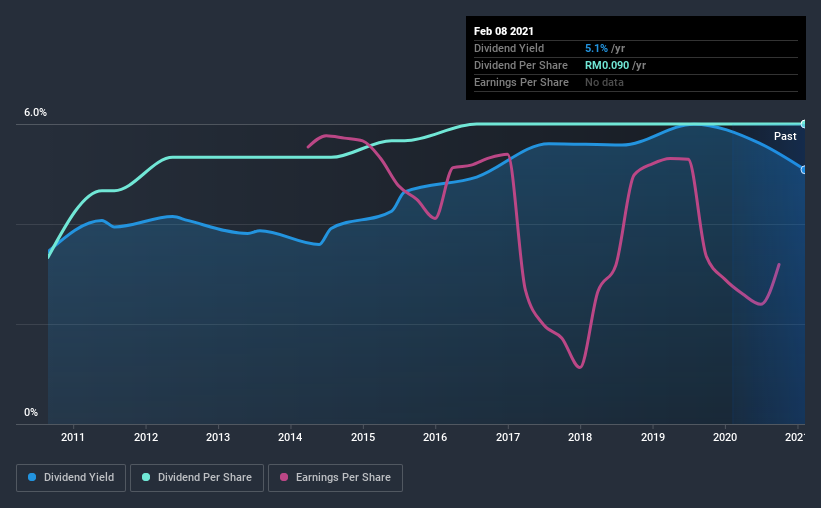

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 71% of Kumpulan Fima Berhad's profits were paid out as dividends in the last 12 months. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Kumpulan Fima Berhad paid out 99% of its free cash flow last year, which we think is concerning if cash flows do not improve. While Kumpulan Fima Berhad's dividends were covered by the company's reported profits, free cash flow is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were Kumpulan Fima Berhad to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

While the above analysis focuses on dividends relative to a company's earnings, we do note Kumpulan Fima Berhad's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Consider getting our latest analysis on Kumpulan Fima Berhad's financial position here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of Kumpulan Fima Berhad's dividend payments. The dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends. During the past 10-year period, the first annual payment was RM0.05 in 2011, compared to RM0.09 last year. This works out to be a compound annual growth rate (CAGR) of approximately 6.1% a year over that time.

Dividends have grown at a reasonable rate over this period, and without any major cuts in the payment over time, we think this is an attractive combination.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. It's not great to see that Kumpulan Fima Berhad's have fallen at approximately 6.6% over the past five years. Declining earnings per share over a number of years is not a great sign for the dividend investor. Without some improvement, this does not bode well for the long term value of a company's dividend.

Conclusion

To summarise, shareholders should always check that Kumpulan Fima Berhad's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Kumpulan Fima Berhad gets a pass on its dividend payout ratio, but it paid out virtually all of its cash flow as dividends. This may just be a one-off, but we'd keep an eye on this. It's not great to see earnings per share shrinking. The dividends have been relatively consistent, but we wonder for how much longer this will be true. In summary, Kumpulan Fima Berhad has a number of shortcomings that we'd find it hard to get past. Things could change, but we think there are a number of better ideas out there.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Just as an example, we've come accross 2 warning signs for Kumpulan Fima Berhad you should be aware of, and 1 of them doesn't sit too well with us.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you decide to trade Kumpulan Fima Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kumpulan Fima Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:KFIMA

Kumpulan Fima Berhad

An investment holding company, engages in bulking, plantation, food, and manufacturing businesses in Malaysia, Indonesia, and Papua New Guinea.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026