- Malaysia

- /

- Construction

- /

- KLSE:KERJAYA

Kerjaya Prospek Group Berhad's (KLSE:KERJAYA) Returns On Capital Not Reflecting Well On The Business

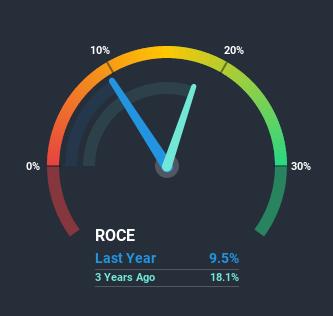

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. In light of that, when we looked at Kerjaya Prospek Group Berhad (KLSE:KERJAYA) and its ROCE trend, we weren't exactly thrilled.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Kerjaya Prospek Group Berhad:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.095 = RM119m ÷ (RM1.5b - RM245m) (Based on the trailing twelve months to December 2020).

Thus, Kerjaya Prospek Group Berhad has an ROCE of 9.5%. In absolute terms, that's a low return, but it's much better than the Construction industry average of 4.8%.

See our latest analysis for Kerjaya Prospek Group Berhad

In the above chart we have measured Kerjaya Prospek Group Berhad's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Kerjaya Prospek Group Berhad here for free.

How Are Returns Trending?

On the surface, the trend of ROCE at Kerjaya Prospek Group Berhad doesn't inspire confidence. Around five years ago the returns on capital were 19%, but since then they've fallen to 9.5%. And considering revenue has dropped while employing more capital, we'd be cautious. This could mean that the business is losing its competitive advantage or market share, because while more money is being put into ventures, it's actually producing a lower return - "less bang for their buck" per se.

On a related note, Kerjaya Prospek Group Berhad has decreased its current liabilities to 16% of total assets. So we could link some of this to the decrease in ROCE. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE.

In Conclusion...

We're a bit apprehensive about Kerjaya Prospek Group Berhad because despite more capital being deployed in the business, returns on that capital and sales have both fallen. But investors must be expecting an improvement of sorts because over the last five yearsthe stock has delivered a respectable 86% return. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

Kerjaya Prospek Group Berhad does have some risks though, and we've spotted 2 warning signs for Kerjaya Prospek Group Berhad that you might be interested in.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you’re looking to trade Kerjaya Prospek Group Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kerjaya Prospek Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:KERJAYA

Kerjaya Prospek Group Berhad

An investment holding company, provides building construction, project management, and commercial buildings services in Malaysia.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives