Is Now The Time To Put Kein Hing International Berhad (KLSE:KEINHIN) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Kein Hing International Berhad (KLSE:KEINHIN). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Kein Hing International Berhad with the means to add long-term value to shareholders.

See our latest analysis for Kein Hing International Berhad

How Fast Is Kein Hing International Berhad Growing Its Earnings Per Share?

Over the last three years, Kein Hing International Berhad has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, Kein Hing International Berhad's EPS catapulted from RM0.13 to RM0.23, over the last year. It's not often a company can achieve year-on-year growth of 86%. The best case scenario? That the business has hit a true inflection point.

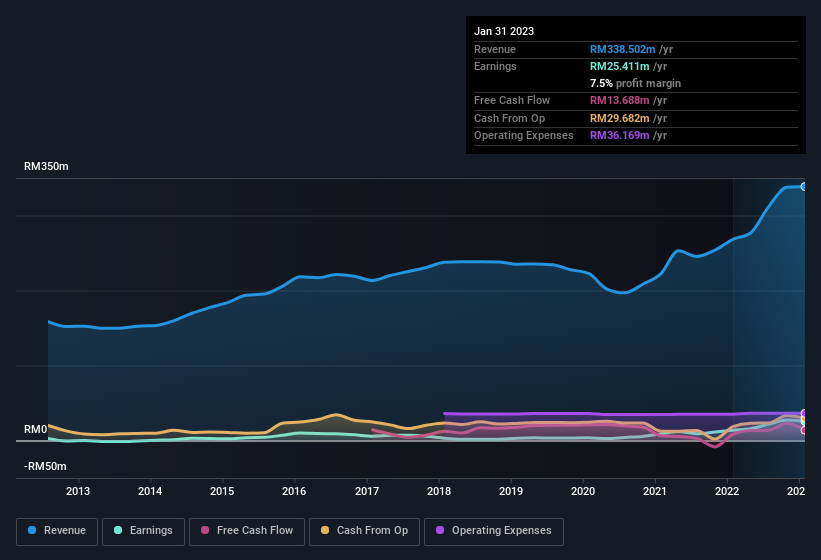

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Kein Hing International Berhad maintained stable EBIT margins over the last year, all while growing revenue 26% to RM339m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Kein Hing International Berhad isn't a huge company, given its market capitalisation of RM155m. That makes it extra important to check on its balance sheet strength.

Are Kein Hing International Berhad Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So those who are interested in Kein Hing International Berhad will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. In fact, they own 72% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. In terms of absolute value, insiders have RM111m invested in the business, at the current share price. So there's plenty there to keep them focused!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Kein Hing International Berhad with market caps under RM933m is about RM511k.

The Kein Hing International Berhad CEO received total compensation of only RM85k in the year to April 2022. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Kein Hing International Berhad To Your Watchlist?

Kein Hing International Berhad's earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The sharp increase in earnings could signal good business momentum. Kein Hing International Berhad certainly ticks a few boxes, so we think it's probably well worth further consideration. You still need to take note of risks, for example - Kein Hing International Berhad has 2 warning signs we think you should be aware of.

Although Kein Hing International Berhad certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kein Hing International Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KEINHIN

Kein Hing International Berhad

An investment holding company, engages in the sheet metal forming, precision machining, and assembly of components for electronic, automotive, and other industries.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives