- Malaysia

- /

- Construction

- /

- KLSE:KAB

Despite the downward trend in earnings at Kejuruteraanstera Berhad (KLSE:KAB) the stock pops 20%, bringing three-year gains to 571%

While Kejuruteraan Asastera Berhad (KLSE:KAB) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 23% in the last quarter. But that doesn't displace its brilliant performance over three years. The longer term view reveals that the share price is up 543% in that period. Arguably, the recent fall is to be expected after such a strong rise. Only time will tell if there is still too much optimism currently reflected in the share price. Anyone who held for that rewarding ride would probably be keen to talk about it.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

See our latest analysis for Kejuruteraanstera Berhad

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years of share price growth, Kejuruteraanstera Berhad actually saw its earnings per share (EPS) drop 21% per year.

So we doubt that the market is looking to EPS for its main judge of the company's value. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

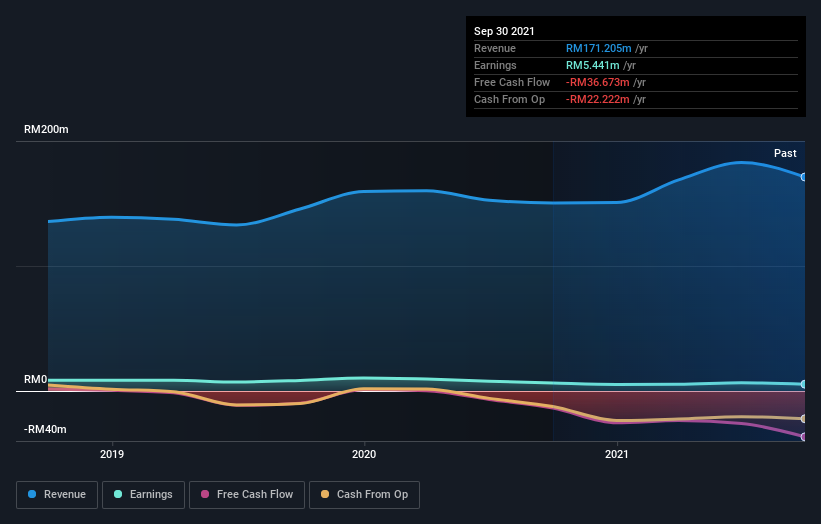

It could be that the revenue growth of 8.8% per year is viewed as evidence that Kejuruteraanstera Berhad is growing. If the company is being managed for the long term good, today's shareholders might be right to hold on.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Kejuruteraanstera Berhad's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Kejuruteraanstera Berhad's TSR of 571% for the 3 years exceeded its share price return, because it has paid dividends.

A Different Perspective

Over the last year, Kejuruteraanstera Berhad shareholders took a loss of 47%. In contrast the market gained about 1.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Fortunately the longer term story is brighter, with total returns averaging about 89% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Kejuruteraanstera Berhad has 5 warning signs (and 3 which shouldn't be ignored) we think you should know about.

Of course Kejuruteraanstera Berhad may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you're looking to trade Kinergy Advancement Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kinergy Advancement Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KAB

Kinergy Advancement Berhad

Provides electrical and mechanical engineering services for commercial, industrial, and residential buildings in Malaysia, Vietnam, Thailand, Indonesia, and Hong Kong.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives