- Malaysia

- /

- Construction

- /

- KLSE:JAKS

Shareholders May Not Be So Generous With JAKS Resources Berhad's (KLSE:JAKS) CEO Compensation And Here's Why

Key Insights

- JAKS Resources Berhad to hold its Annual General Meeting on 27th of June

- Total pay for CEO Lam Ang includes RM1.80m salary

- The overall pay is 1,288% above the industry average

- JAKS Resources Berhad's EPS grew by 63% over the past three years while total shareholder loss over the past three years was 63%

In the past three years, the share price of JAKS Resources Berhad (KLSE:JAKS) has struggled to grow and now shareholders are sitting on a loss. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. These are some of the concerns that shareholders may want to bring up at the next AGM held on 27th of June. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

View our latest analysis for JAKS Resources Berhad

Comparing JAKS Resources Berhad's CEO Compensation With The Industry

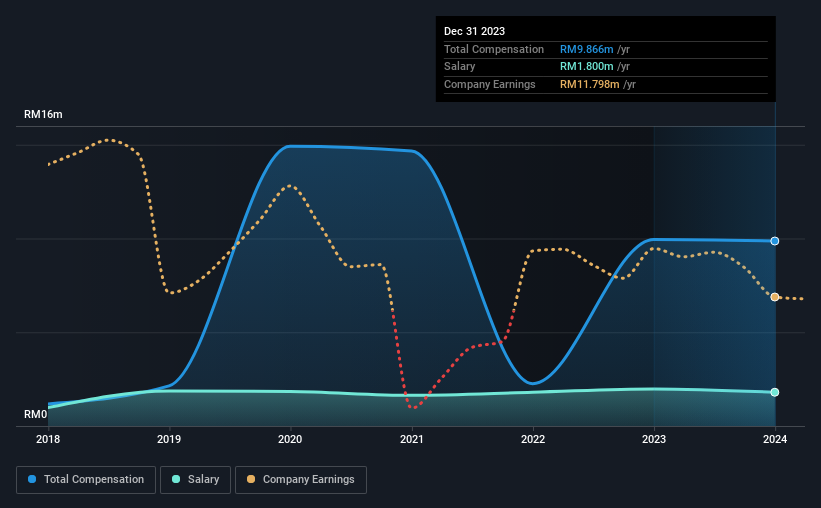

Our data indicates that JAKS Resources Berhad has a market capitalization of RM438m, and total annual CEO compensation was reported as RM9.9m for the year to December 2023. This means that the compensation hasn't changed much from last year. We think total compensation is more important but our data shows that the CEO salary is lower, at RM1.8m.

For comparison, other companies in the Malaysian Construction industry with market capitalizations below RM942m, reported a median total CEO compensation of RM711k. This suggests that Lam Ang is paid more than the median for the industry. Moreover, Lam Ang also holds RM62m worth of JAKS Resources Berhad stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | RM1.8m | RM2.0m | 18% |

| Other | RM8.1m | RM8.0m | 82% |

| Total Compensation | RM9.9m | RM10.0m | 100% |

Speaking on an industry level, nearly 77% of total compensation represents salary, while the remainder of 23% is other remuneration. JAKS Resources Berhad sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

JAKS Resources Berhad's Growth

JAKS Resources Berhad's earnings per share (EPS) grew 63% per year over the last three years. It saw its revenue drop 56% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has JAKS Resources Berhad Been A Good Investment?

The return of -63% over three years would not have pleased JAKS Resources Berhad shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 6 warning signs for JAKS Resources Berhad you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:JAKS

JAKS Resources Berhad

An investment holding company, operates as a general contractor in Malaysia and Vietnam.

Solid track record with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion