- Malaysia

- /

- Construction

- /

- KLSE:JAKS

Shareholders in JAKS Resources Berhad (KLSE:JAKS) are in the red if they invested five years ago

We think intelligent long term investing is the way to go. But along the way some stocks are going to perform badly. Zooming in on an example, the JAKS Resources Berhad (KLSE:JAKS) share price dropped 82% in the last half decade. That is extremely sub-optimal, to say the least. And we doubt long term believers are the only worried holders, since the stock price has declined 34% over the last twelve months. The falls have accelerated recently, with the share price down 25% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

View our latest analysis for JAKS Resources Berhad

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

JAKS Resources Berhad became profitable within the last five years. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics might give us a better handle on how its value is changing over time.

Arguably, the revenue drop of 62% a year for half a decade suggests that the company can't grow in the long term. This has probably encouraged some shareholders to sell down the stock.

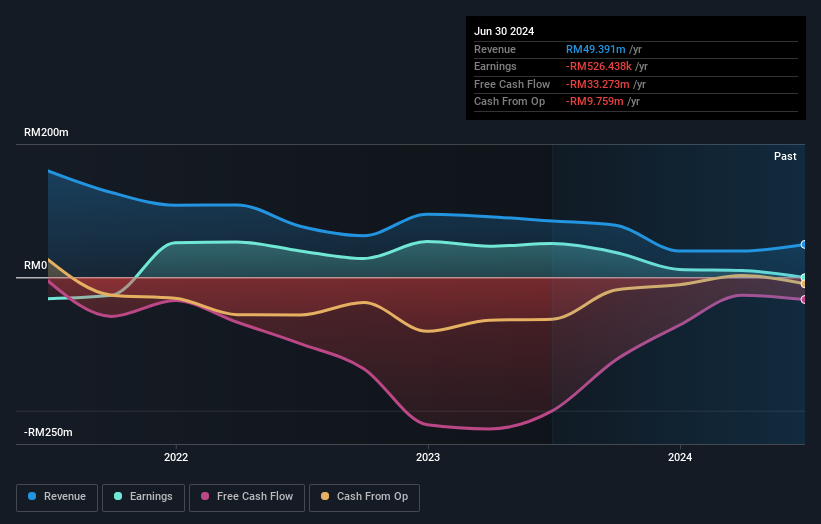

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

We've already covered JAKS Resources Berhad's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. JAKS Resources Berhad hasn't been paying dividends, but its TSR of -67% exceeds its share price return of -82%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

While the broader market gained around 15% in the last year, JAKS Resources Berhad shareholders lost 34%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand JAKS Resources Berhad better, we need to consider many other factors. Even so, be aware that JAKS Resources Berhad is showing 4 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

Of course JAKS Resources Berhad may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:JAKS

JAKS Resources Berhad

An investment holding company, operates as a general contractor in Malaysia and Vietnam.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives