- Malaysia

- /

- Construction

- /

- KLSE:INTA

Declining Stock and Solid Fundamentals: Is The Market Wrong About Inta Bina Group Berhad (KLSE:INTA)?

With its stock down 8.2% over the past three months, it is easy to disregard Inta Bina Group Berhad (KLSE:INTA). However, stock prices are usually driven by a company’s financial performance over the long term, which in this case looks quite promising. Specifically, we decided to study Inta Bina Group Berhad's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Inta Bina Group Berhad

How To Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Inta Bina Group Berhad is:

6.9% = RM9.7m ÷ RM141m (Based on the trailing twelve months to September 2020).

The 'return' is the income the business earned over the last year. So, this means that for every MYR1 of its shareholder's investments, the company generates a profit of MYR0.07.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Inta Bina Group Berhad's Earnings Growth And 6.9% ROE

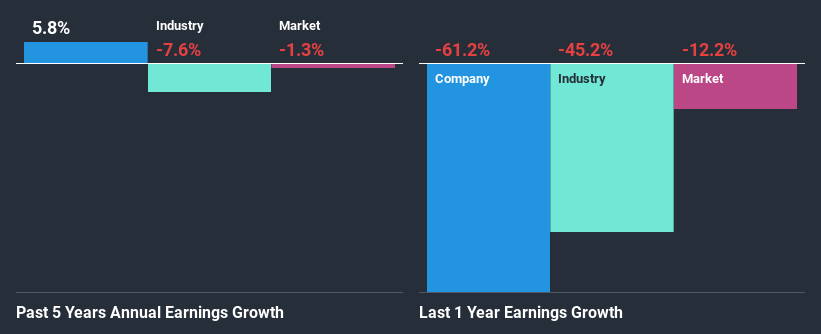

At first glance, Inta Bina Group Berhad's ROE doesn't look very promising. However, the fact that the company's ROE is higher than the average industry ROE of 4.7%, is definitely interesting. This probably goes some way in explaining Inta Bina Group Berhad's moderate 5.8% growth over the past five years amongst other factors. Bear in mind, the company does have a moderately low ROE. It is just that the industry ROE is lower. Therefore, the growth in earnings could also be the result of other factors. E.g the company has a low payout ratio or could belong to a high growth industry.

Next, on comparing with the industry net income growth, we found that the growth figure reported by Inta Bina Group Berhad compares quite favourably to the industry average, which shows a decline of 7.6% in the same period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Inta Bina Group Berhad's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Inta Bina Group Berhad Making Efficient Use Of Its Profits?

With a three-year median payout ratio of 27% (implying that the company retains 73% of its profits), it seems that Inta Bina Group Berhad is reinvesting efficiently in a way that it sees respectable amount growth in its earnings and pays a dividend that's well covered.

While Inta Bina Group Berhad has seen growth in its earnings, it only recently started to pay a dividend. It is most likely that the company decided to impress new and existing shareholders with a dividend. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 17% over the next three years.

Conclusion

Overall, we are quite pleased with Inta Bina Group Berhad's performance. Specifically, we like that it has been reinvesting a high portion of its profits at a moderate rate of return, resulting in earnings expansion. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Remember, the price of a stock is also dependent on the perceived risk. Therefore investors must keep themselves informed about the risks involved before investing in any company. Our risks dashboard would have the 3 risks we have identified for Inta Bina Group Berhad.

When trading Inta Bina Group Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:INTA

Inta Bina Group Berhad

An investment holding company, undertakes building construction projects in Malaysia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion