- Malaysia

- /

- Electrical

- /

- KLSE:HWGB

Ho Wah Genting Berhad (KLSE:HWGB) Is Experiencing Growth In Returns On Capital

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. With that in mind, we've noticed some promising trends at Ho Wah Genting Berhad (KLSE:HWGB) so let's look a bit deeper.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Ho Wah Genting Berhad:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

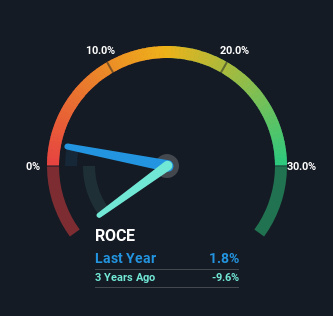

0.018 = RM1.6m ÷ (RM132m - RM45m) (Based on the trailing twelve months to December 2022).

Therefore, Ho Wah Genting Berhad has an ROCE of 1.8%. Ultimately, that's a low return and it under-performs the Electrical industry average of 11%.

See our latest analysis for Ho Wah Genting Berhad

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Ho Wah Genting Berhad, check out these free graphs here.

The Trend Of ROCE

We're delighted to see that Ho Wah Genting Berhad is reaping rewards from its investments and is now generating some pre-tax profits. The company was generating losses five years ago, but now it's earning 1.8% which is a sight for sore eyes. In addition to that, Ho Wah Genting Berhad is employing 119% more capital than previously which is expected of a company that's trying to break into profitability. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, both common traits of a multi-bagger.

In another part of our analysis, we noticed that the company's ratio of current liabilities to total assets decreased to 34%, which broadly means the business is relying less on its suppliers or short-term creditors to fund its operations. Therefore we can rest assured that the growth in ROCE is a result of the business' fundamental improvements, rather than a cooking class featuring this company's books.

Our Take On Ho Wah Genting Berhad's ROCE

Long story short, we're delighted to see that Ho Wah Genting Berhad's reinvestment activities have paid off and the company is now profitable. And since the stock has fallen 59% over the last five years, there might be an opportunity here. So researching this company further and determining whether or not these trends will continue seems justified.

If you want to know some of the risks facing Ho Wah Genting Berhad we've found 3 warning signs (1 is significant!) that you should be aware of before investing here.

While Ho Wah Genting Berhad may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if Ho Wah Genting Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HWGB

Ho Wah Genting Berhad

An investment holding company, manufactures and sells wires and cables, moulded power supply cord sets, and cable assemblies for electrical and electronic devices and equipment in Malaysia, rest of Asia, and North America.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives