- Malaysia

- /

- Electrical

- /

- KLSE:HWGB

Ho Wah Genting Berhad (KLSE:HWGB) Has A Somewhat Strained Balance Sheet

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Ho Wah Genting Berhad (KLSE:HWGB) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Ho Wah Genting Berhad

What Is Ho Wah Genting Berhad's Net Debt?

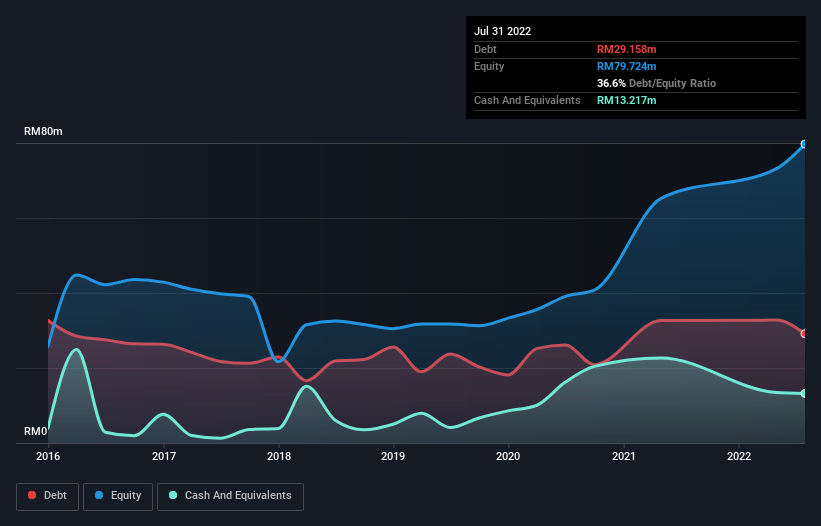

The image below, which you can click on for greater detail, shows that Ho Wah Genting Berhad had debt of RM29.2m at the end of July 2022, a reduction from RM32.6m over a year. On the flip side, it has RM13.2m in cash leading to net debt of about RM15.9m.

How Healthy Is Ho Wah Genting Berhad's Balance Sheet?

According to the last reported balance sheet, Ho Wah Genting Berhad had liabilities of RM84.2m due within 12 months, and liabilities of RM13.4m due beyond 12 months. On the other hand, it had cash of RM13.2m and RM47.5m worth of receivables due within a year. So its liabilities total RM36.9m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Ho Wah Genting Berhad has a market capitalization of RM89.4m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Ho Wah Genting Berhad has a quite reasonable net debt to EBITDA multiple of 2.3, its interest cover seems weak, at 1.3. The main reason for this is that it has such high depreciation and amortisation. These charges may be non-cash, so they could be excluded when it comes to paying down debt. But the accounting charges are there for a reason -- some assets are seen to be losing value. In any case, it's safe to say the company has meaningful debt. Notably, Ho Wah Genting Berhad made a loss at the EBIT level, last year, but improved that to positive EBIT of RM2.3m in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Ho Wah Genting Berhad will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, Ho Wah Genting Berhad saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Ho Wah Genting Berhad's interest cover and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. Having said that, its ability to grow its EBIT isn't such a worry. Looking at the bigger picture, it seems clear to us that Ho Wah Genting Berhad's use of debt is creating risks for the company. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for Ho Wah Genting Berhad you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Ho Wah Genting Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HWGB

Ho Wah Genting Berhad

An investment holding company, manufactures and sells wires and cables, moulded power supply cord sets, and cable assemblies for electrical and electronic devices and equipment in Malaysia, rest of Asia, and North America.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives