- Malaysia

- /

- Industrials

- /

- KLSE:HLIND

Hong Leong Industries Berhad (KLSE:HLIND) Seems To Use Debt Rather Sparingly

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Hong Leong Industries Berhad (KLSE:HLIND) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Hong Leong Industries Berhad

How Much Debt Does Hong Leong Industries Berhad Carry?

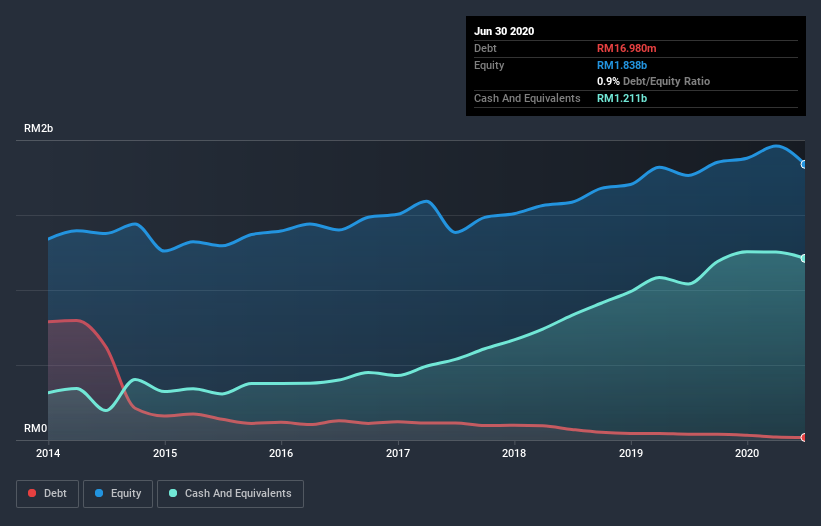

As you can see below, Hong Leong Industries Berhad had RM17.0m of debt at June 2020, down from RM38.7m a year prior. However, it does have RM1.21b in cash offsetting this, leading to net cash of RM1.19b.

How Strong Is Hong Leong Industries Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Hong Leong Industries Berhad had liabilities of RM319.8m due within 12 months and liabilities of RM41.2m due beyond that. On the other hand, it had cash of RM1.21b and RM235.9m worth of receivables due within a year. So it can boast RM1.09b more liquid assets than total liabilities.

This surplus strongly suggests that Hong Leong Industries Berhad has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this basis we think its balance sheet is strong like a sleek panther or even a proud lion. Succinctly put, Hong Leong Industries Berhad boasts net cash, so it's fair to say it does not have a heavy debt load!

In fact Hong Leong Industries Berhad's saving grace is its low debt levels, because its EBIT has tanked 33% in the last twelve months. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Hong Leong Industries Berhad will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Hong Leong Industries Berhad has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, Hong Leong Industries Berhad actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

While it is always sensible to investigate a company's debt, in this case Hong Leong Industries Berhad has RM1.19b in net cash and a decent-looking balance sheet. And it impressed us with free cash flow of RM366m, being 131% of its EBIT. So we don't think Hong Leong Industries Berhad's use of debt is risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for Hong Leong Industries Berhad that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Hong Leong Industries Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Hong Leong Industries Berhad, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hong Leong Industries Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:HLIND

Hong Leong Industries Berhad

An investment holding company, engages in the manufacture and sale of consumer and industrial products in Malaysia, Australia, Vietnam, Thailand, Singapore, Taiwan, and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives