- Malaysia

- /

- Construction

- /

- KLSE:HEGROUP

HE Group Berhad (KLSE:HEGROUP) Looks Inexpensive After Falling 30% But Perhaps Not Attractive Enough

To the annoyance of some shareholders, HE Group Berhad (KLSE:HEGROUP) shares are down a considerable 30% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 57% share price decline.

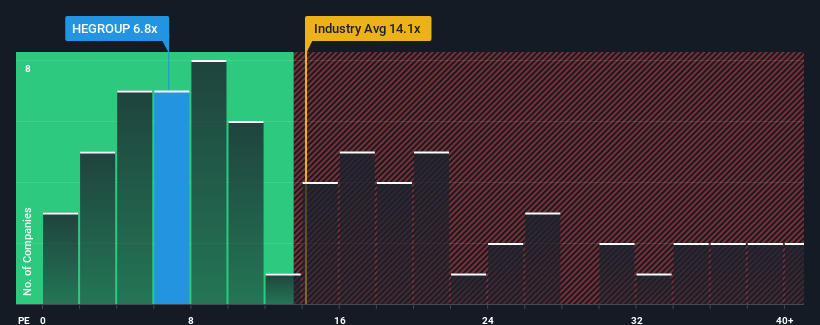

Although its price has dipped substantially, given about half the companies in Malaysia have price-to-earnings ratios (or "P/E's") above 14x, you may still consider HE Group Berhad as an attractive investment with its 6.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that HE Group Berhad's financial performance has been pretty ordinary lately as earnings growth is non-existent. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for HE Group Berhad

Does Growth Match The Low P/E?

In order to justify its P/E ratio, HE Group Berhad would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 99% decline in EPS over the last three years in total. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 15% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we are not surprised that HE Group Berhad is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

HE Group Berhad's P/E has taken a tumble along with its share price. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that HE Group Berhad maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for HE Group Berhad that you should be aware of.

If you're unsure about the strength of HE Group Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if HE Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HEGROUP

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives