- Malaysia

- /

- Construction

- /

- KLSE:GDB

Downgrade: Here's How Analysts See GDB Holdings Berhad (KLSE:GDB) Performing In The Near Term

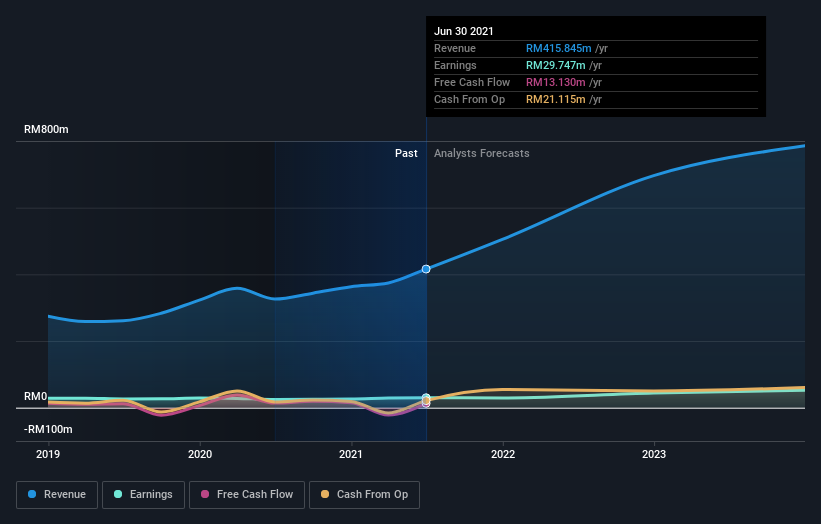

The latest analyst coverage could presage a bad day for GDB Holdings Berhad (KLSE:GDB), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Both revenue and earnings per share (EPS) estimates were cut sharply as analysts factored in the latest outlook for the business, concluding that they were too optimistic previously. Bidders are definitely seeing a different story, with the stock price of RM0.43 reflecting a 19% rise in the past week. With such a sharp increase, it seems brokers may have seen something that is not yet being priced in by the wider market.

After this downgrade, GDB Holdings Berhad's dual analysts are now forecasting revenues of RM505m in 2021. This would be a huge 21% improvement in sales compared to the last 12 months. Statutory earnings per share are supposed to decrease 6.9% to RM0.029 in the same period. Previously, the analysts had been modelling revenues of RM645m and earnings per share (EPS) of RM0.047 in 2021. Indeed, we can see that the analysts are a lot more bearish about GDB Holdings Berhad's prospects, administering a sizeable cut to revenue estimates and slashing their EPS estimates to boot.

Check out our latest analysis for GDB Holdings Berhad

It'll come as no surprise then, to learn that the analysts have cut their price target 27% to RM0.57. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values GDB Holdings Berhad at RM0.63 per share, while the most bearish prices it at RM0.51. With such a narrow range of valuations, analysts apparently share similar views on what they think the business is worth.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that GDB Holdings Berhad's revenue growth is expected to slow, with the forecast 21% annualised growth rate until the end of 2021 being well below the historical 28% growth over the last year. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 11% annually. Even after the forecast slowdown in growth, it seems obvious that GDB Holdings Berhad is also expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of GDB Holdings Berhad.

That said, the analysts might have good reason to be negative on GDB Holdings Berhad, given concerns around earnings quality. For more information, you can click here to discover this and the 3 other risks we've identified.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:GDB

GDB Holdings Berhad

An investment holding company, engages in the provision of construction services in Malaysia.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion