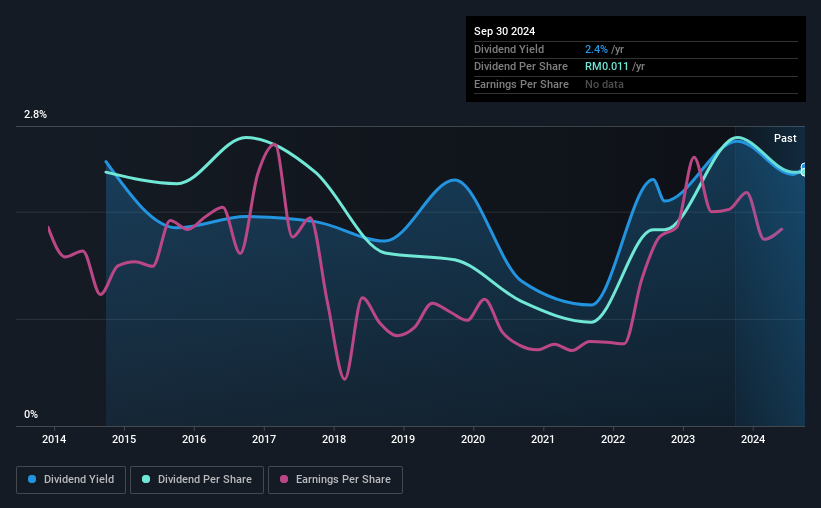

Fibon Berhad (KLSE:FIBON) is reducing its dividend to MYR0.011 on the 27th of Decemberwhich is 12% less than last year's comparable payment of MYR0.0125. This means that the annual payment will be 2.4% of the current stock price, which is in line with the average for the industry.

Check out our latest analysis for Fibon Berhad

Fibon Berhad's Payment Could Potentially Have Solid Earnings Coverage

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Before making this announcement, Fibon Berhad was easily earning enough to cover the dividend. This means that most of what the business earns is being used to help it grow.

Over the next year, EPS could expand by 9.9% if recent trends continue. If the dividend continues on this path, the payout ratio could be 21% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The last annual payment of MYR0.011 was flat on the annual payment from10 years ago. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

We Could See Fibon Berhad's Dividend Growing

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Fibon Berhad has impressed us by growing EPS at 9.9% per year over the past five years. Growth in EPS bodes well for the dividend, as does the low payout ratio that the company is currently reporting.

Fibon Berhad Looks Like A Great Dividend Stock

In general, we don't like to see the dividend being cut, especially when the company has such high potential like Fibon Berhad does. Reducing the amount it is paying as a dividend can protect the company's balance sheet, keeping the dividend sustainable for longer. All of these factors considered, we think this has solid potential as a dividend stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 4 warning signs for Fibon Berhad that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:FIBON

Fibon Berhad

Manufactures and trades in electrical insulators and enclosures, meter boards, switchboards, and other equipment parts in Malaysia, rest of Asia, Australia, Oceania, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026