- Malaysia

- /

- Trade Distributors

- /

- KLSE:ENGTEX

How Much Did Engtex Group Berhad's(KLSE:ENGTEX) Shareholders Earn From Share Price Movements Over The Last Five Years?

Engtex Group Berhad (KLSE:ENGTEX) shareholders will doubtless be very grateful to see the share price up 62% in the last quarter. But that doesn't change the fact that the returns over the last five years have been less than pleasing. In fact, the share price is down 41%, which falls well short of the return you could get by buying an index fund.

View our latest analysis for Engtex Group Berhad

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Engtex Group Berhad moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

The modest 0.8% dividend yield is unlikely to be guiding the market view of the stock. The revenue fall of 0.9% per year for five years is neither good nor terrible. But if the market expected durable top line growth, then that could explain the share price weakness.

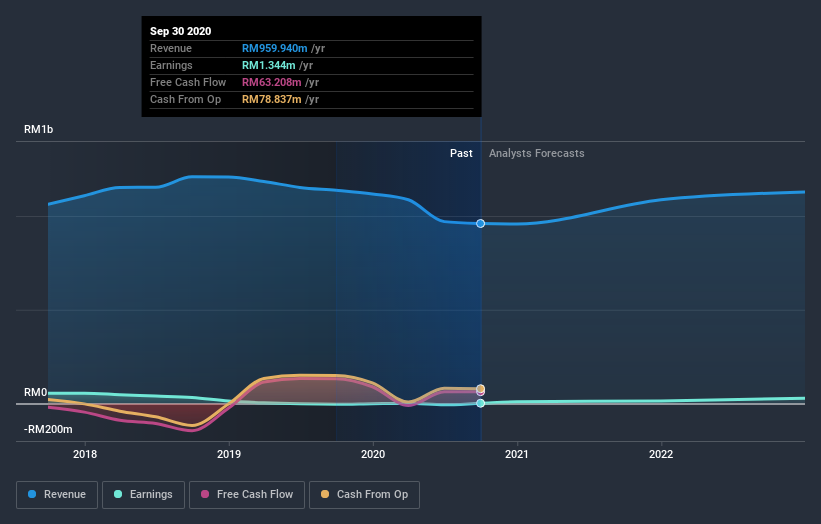

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Engtex Group Berhad the TSR over the last 5 years was -37%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Engtex Group Berhad provided a TSR of 4.7% over the last twelve months. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 7% per year, over five years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Engtex Group Berhad has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

When trading Engtex Group Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Engtex Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:ENGTEX

Engtex Group Berhad

Engages in the wholesale and distribution of pipes, valves, fittings, plumbing materials, steel related products, general hardware products, and construction materials in Malaysia.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives