- Malaysia

- /

- Trade Distributors

- /

- KLSE:ENGTEX

Does Engtex Group Berhad (KLSE:ENGTEX) Deserve A Spot On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Engtex Group Berhad (KLSE:ENGTEX). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Engtex Group Berhad

Engtex Group Berhad's Improving Profits

Over the last three years, Engtex Group Berhad has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. Engtex Group Berhad's EPS skyrocketed from RM0.12 to RM0.18, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 47%.

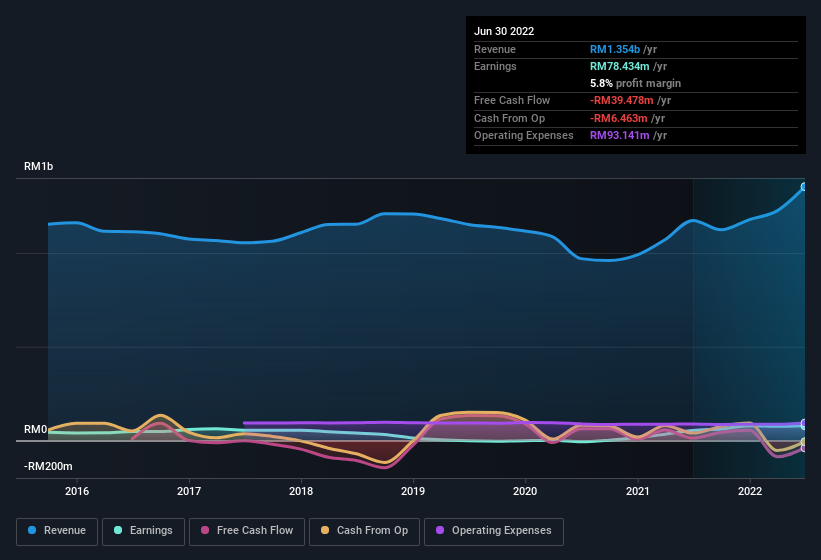

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Engtex Group Berhad remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 15% to RM1.4b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Since Engtex Group Berhad is no giant, with a market capitalisation of RM274m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Engtex Group Berhad Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Engtex Group Berhad insiders own a meaningful share of the business. Actually, with 50% of the company to their names, insiders are profoundly invested in the business. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. With that sort of holding, insiders have about RM136m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Engtex Group Berhad with market caps under RM898m is about RM498k.

The Engtex Group Berhad CEO received total compensation of only RM50k in the year to December 2021. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Engtex Group Berhad Worth Keeping An Eye On?

For growth investors, Engtex Group Berhad's raw rate of earnings growth is a beacon in the night. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. Everyone has their own preferences when it comes to investing but it definitely makes Engtex Group Berhad look rather interesting indeed. Before you take the next step you should know about the 2 warning signs for Engtex Group Berhad (1 is potentially serious!) that we have uncovered.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Engtex Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ENGTEX

Engtex Group Berhad

Engages in the wholesale and distribution of pipes, valves, fittings, plumbing materials, steel related products, general hardware products, and construction materials in Malaysia.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives