- Malaysia

- /

- Construction

- /

- KLSE:EKOVEST

Here's What Ekovest Berhad's (KLSE:EKOVEST) Shareholder Ownership Structure Looks Like

A look at the shareholders of Ekovest Berhad (KLSE:EKOVEST) can tell us which group is most powerful. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. Warren Buffett said that he likes "a business with enduring competitive advantages that is run by able and owner-oriented people." So it's nice to see some insider ownership, because it may suggest that management is owner-oriented.

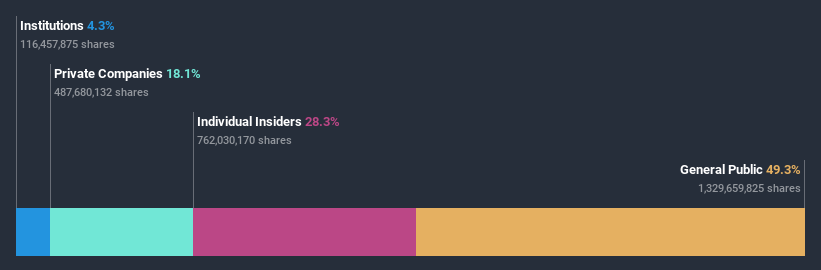

Ekovest Berhad is a smaller company with a market capitalization of RM1.5b, so it may still be flying under the radar of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions are not really that prevalent on the share registry. Let's take a closer look to see what the different types of shareholders can tell us about Ekovest Berhad.

View our latest analysis for Ekovest Berhad

What Does The Institutional Ownership Tell Us About Ekovest Berhad?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

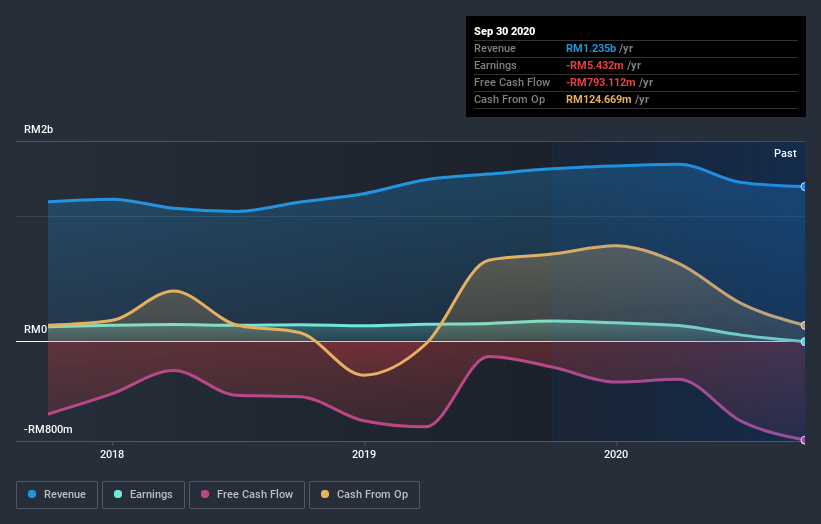

Institutions have a very small stake in Ekovest Berhad. That indicates that the company is on the radar of some funds, but it isn't particularly popular with professional investors at the moment. If the company is growing earnings, that may indicate that it is just beginning to catch the attention of these deep-pocketed investors. It is not uncommon to see a big share price rise if multiple institutional investors are trying to buy into a stock at the same time. So check out the historic earnings trajectory, below, but keep in mind it's the future that counts most.

Ekovest Berhad is not owned by hedge funds. Because actions speak louder than words, we consider it a good sign when insiders own a significant stake in a company. In Ekovest Berhad's case, its Top Key Executive, Kang Lim, is the largest shareholder, holding 20% of shares outstanding. In comparison, the second and third largest shareholders hold about 11% and 5.0% of the stock.

A closer look at our ownership figures suggests that the top 20 shareholders have a combined ownership of 50% implying that no single shareholder has a majority.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Ekovest Berhad

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our information suggests that insiders maintain a significant holding in Ekovest Berhad. It has a market capitalization of just RM1.5b, and insiders have RM415m worth of shares in their own names. This may suggest that the founders still own a lot of shares. You can click here to see if they have been buying or selling.

General Public Ownership

With a 49% ownership, the general public have some degree of sway over Ekovest Berhad. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

We can see that Private Companies own 18%, of the shares on issue. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Ekovest Berhad , and understanding them should be part of your investment process.

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading Ekovest Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Ekovest Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:EKOVEST

Ekovest Berhad

An investment holding company, engages in civil engineering and building works in Malaysia, the United States, Japan, and the People’s Republic of China.

Slightly overvalued very low.

Market Insights

Community Narratives