If EPS Growth Is Important To You, Econframe Berhad (KLSE:EFRAME) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Econframe Berhad (KLSE:EFRAME). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Econframe Berhad

Econframe Berhad's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. We can see that in the last three years Econframe Berhad grew its EPS by 10% per year. That growth rate is fairly good, assuming the company can keep it up.

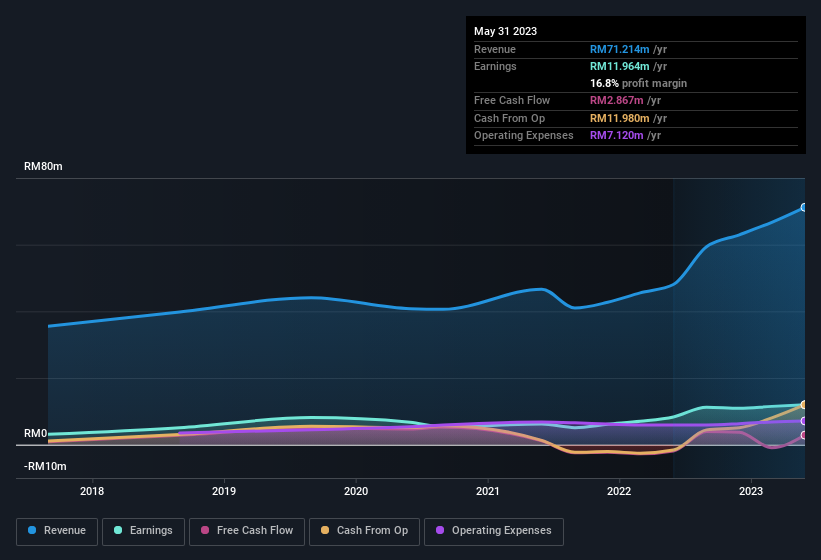

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Econframe Berhad achieved similar EBIT margins to last year, revenue grew by a solid 48% to RM71m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Econframe Berhad is no giant, with a market capitalisation of RM318m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Econframe Berhad Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in Econframe Berhad will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. To be exact, company insiders hold 59% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. To give you an idea, the value of insiders' holdings in the business are valued at RM188m at the current share price. That's nothing to sneeze at!

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations under RM932m, like Econframe Berhad, the median CEO pay is around RM515k.

Econframe Berhad's CEO only received compensation totalling RM21k in the year to August 2022. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Econframe Berhad To Your Watchlist?

As previously touched on, Econframe Berhad is a growing business, which is encouraging. The fact that EPS is growing is a genuine positive for Econframe Berhad, but the pleasant picture gets better than that. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. You should always think about risks though. Case in point, we've spotted 3 warning signs for Econframe Berhad you should be aware of, and 1 of them doesn't sit too well with us.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Econframe Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:EFRAME

Econframe Berhad

An investment holding company, manufactures and sells doors, and door and window frames in Malaysia.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026