- Malaysia

- /

- Construction

- /

- KLSE:ECONBHD

Econpile Holdings Berhad's (KLSE:ECONBHD) Shares Climb 29% But Its Business Is Yet to Catch Up

Those holding Econpile Holdings Berhad (KLSE:ECONBHD) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last month tops off a massive increase of 132% in the last year.

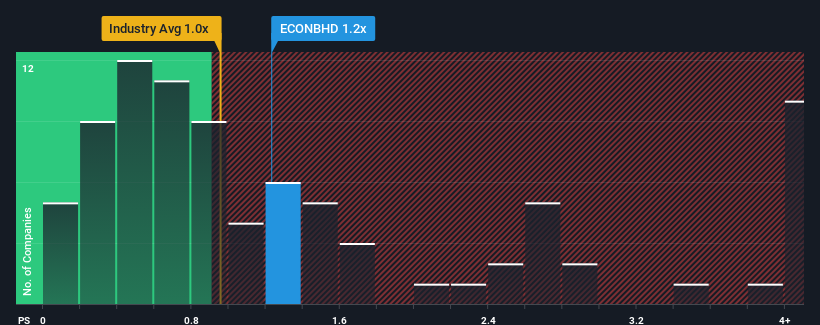

In spite of the firm bounce in price, there still wouldn't be many who think Econpile Holdings Berhad's price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S in Malaysia's Construction industry is similar at about 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Econpile Holdings Berhad

What Does Econpile Holdings Berhad's Recent Performance Look Like?

Econpile Holdings Berhad could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Econpile Holdings Berhad will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Econpile Holdings Berhad?

Econpile Holdings Berhad's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. The latest three year period has also seen a 12% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 13% over the next year. Meanwhile, the broader industry is forecast to expand by 18%, which paints a poor picture.

In light of this, it's somewhat alarming that Econpile Holdings Berhad's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Final Word

Econpile Holdings Berhad appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our check of Econpile Holdings Berhad's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Econpile Holdings Berhad with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Econpile Holdings Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Econpile Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:ECONBHD

Econpile Holdings Berhad

An investment holding company, provides piling and foundation services for high-rise property developments and infrastructure projects in Malaysia and Cambodia.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives