Would CME Group Berhad (KLSE:CME) Be Better Off With Less Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, CME Group Berhad (KLSE:CME) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for CME Group Berhad

How Much Debt Does CME Group Berhad Carry?

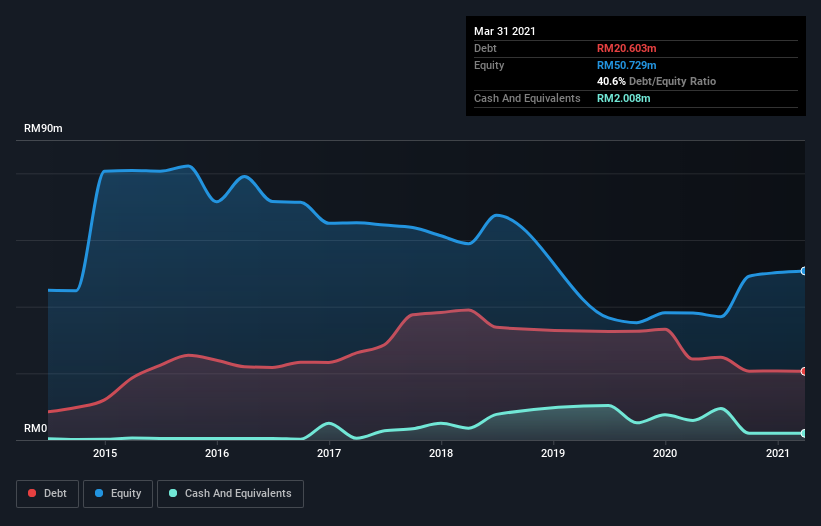

As you can see below, CME Group Berhad had RM20.6m of debt at March 2021, down from RM24.3m a year prior. However, because it has a cash reserve of RM2.01m, its net debt is less, at about RM18.6m.

How Strong Is CME Group Berhad's Balance Sheet?

We can see from the most recent balance sheet that CME Group Berhad had liabilities of RM40.8m falling due within a year, and liabilities of RM7.67m due beyond that. Offsetting this, it had RM2.01m in cash and RM16.2m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM30.2m.

This is a mountain of leverage relative to its market capitalization of RM48.4m. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. When analysing debt levels, the balance sheet is the obvious place to start. But it is CME Group Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, CME Group Berhad made a loss at the EBIT level, and saw its revenue drop to RM5.6m, which is a fall of 89%. To be frank that doesn't bode well.

Caveat Emptor

Not only did CME Group Berhad's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost RM2.4m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. However, it doesn't help that it burned through RM17m of cash over the last year. So suffice it to say we consider the stock very risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for CME Group Berhad (2 are significant) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:CME

CME Group Berhad

An investment holding company, designs, manufactures, sells, and services firefighting and specialist vehicles primarily in Malaysia.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026