- Malaysia

- /

- Trade Distributors

- /

- KLSE:CHINHIN

Here's Why Chin Hin Group Berhad (KLSE:CHINHIN) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Chin Hin Group Berhad (KLSE:CHINHIN), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Chin Hin Group Berhad with the means to add long-term value to shareholders.

See our latest analysis for Chin Hin Group Berhad

How Fast Is Chin Hin Group Berhad Growing Its Earnings Per Share?

In the last three years Chin Hin Group Berhad's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. To the delight of shareholders, Chin Hin Group Berhad's EPS soared from RM0.055 to RM0.085, over the last year. That's a impressive gain of 55%.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Chin Hin Group Berhad shareholders can take confidence from the fact that EBIT margins are up from 1.4% to 3.5%, and revenue is growing. That's great to see, on both counts.

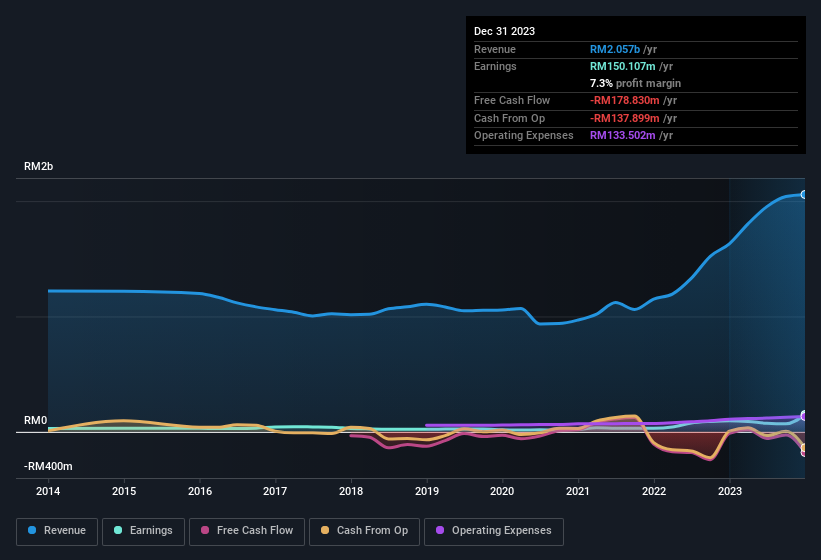

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Chin Hin Group Berhad Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that Chin Hin Group Berhad insiders have a significant amount of capital invested in the stock. Notably, they have an enviable stake in the company, worth RM3.0b. This totals to 28% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Looking very optimistic for investors.

Should You Add Chin Hin Group Berhad To Your Watchlist?

You can't deny that Chin Hin Group Berhad has grown its earnings per share at a very impressive rate. That's attractive. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. You should always think about risks though. Case in point, we've spotted 2 warning signs for Chin Hin Group Berhad you should be aware of, and 1 of them doesn't sit too well with us.

Although Chin Hin Group Berhad certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Malaysian companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CHINHIN

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives