- Malaysia

- /

- Construction

- /

- KLSE:BPURI

Bina Puri Holdings Bhd (KLSE:BPURI) shareholder returns have been strong, earning 134% in 1 year

Unless you borrow money to invest, the potential losses are limited. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! Take, for example Bina Puri Holdings Bhd (KLSE:BPURI). Its share price is already up an impressive 134% in the last twelve months. Better yet, the share price has risen 11% in the last week. Having said that, the longer term returns aren't so impressive, with stock gaining just 17% in three years.

Since the stock has added RM27m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Bina Puri Holdings Bhd

Bina Puri Holdings Bhd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Bina Puri Holdings Bhd actually shrunk its revenue over the last year, with a reduction of 29%. We're a little surprised to see the share price pop 134% in the last year. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. Of course, it could be that the market expected this revenue drop.

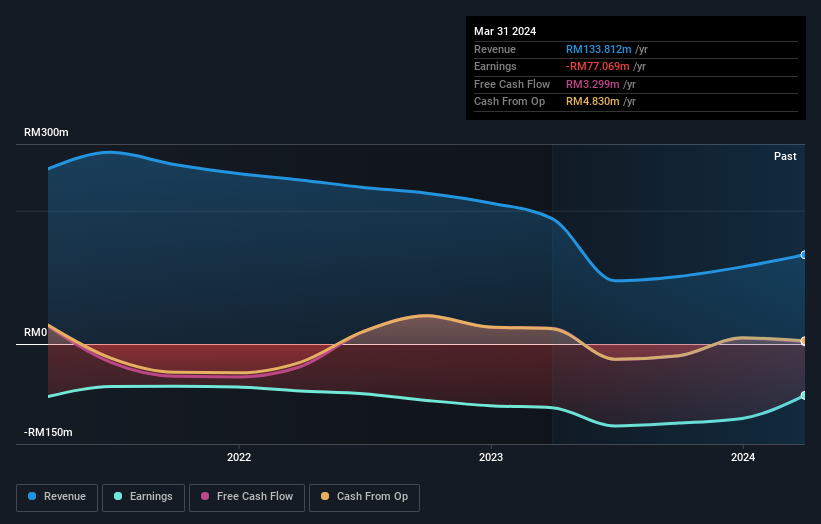

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Bina Puri Holdings Bhd's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Bina Puri Holdings Bhd shareholders have received a total shareholder return of 134% over one year. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Bina Puri Holdings Bhd (1 can't be ignored) that you should be aware of.

But note: Bina Puri Holdings Bhd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bina Puri Holdings Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:BPURI

Bina Puri Holdings Bhd

An investment holding company, engages in the construction and property development businesses in Malaysia and other Asian countries.

Adequate balance sheet very low.