Boustead Heavy Industries Corporation Berhad (KLSE:BHIC) Is Finding It Tricky To Allocate Its Capital

When researching a stock for investment, what can tell us that the company is in decline? When we see a declining return on capital employed (ROCE) in conjunction with a declining base of capital employed, that's often how a mature business shows signs of aging. This indicates the company is producing less profit from its investments and its total assets are decreasing. In light of that, from a first glance at Boustead Heavy Industries Corporation Berhad (KLSE:BHIC), we've spotted some signs that it could be struggling, so let's investigate.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Boustead Heavy Industries Corporation Berhad:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.13 = RM21m ÷ (RM510m - RM348m) (Based on the trailing twelve months to September 2022).

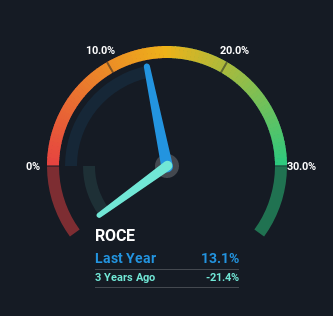

Therefore, Boustead Heavy Industries Corporation Berhad has an ROCE of 13%. By itself that's a normal return on capital and it's in line with the industry's average returns of 13%.

Check out our latest analysis for Boustead Heavy Industries Corporation Berhad

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Boustead Heavy Industries Corporation Berhad has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

The trend of returns that Boustead Heavy Industries Corporation Berhad is generating are raising some concerns. To be more specific, today's ROCE was 21% five years ago but has since fallen to 13%. On top of that, the business is utilizing 57% less capital within its operations. The fact that both are shrinking is an indication that the business is going through some tough times. If these underlying trends continue, we wouldn't be too optimistic going forward.

On a side note, Boustead Heavy Industries Corporation Berhad's current liabilities have increased over the last five years to 68% of total assets, effectively distorting the ROCE to some degree. Without this increase, it's likely that ROCE would be even lower than 13%. What this means is that in reality, a rather large portion of the business is being funded by the likes of the company's suppliers or short-term creditors, which can bring some risks of its own.

The Bottom Line

In short, lower returns and decreasing amounts capital employed in the business doesn't fill us with confidence. This could explain why the stock has sunk a total of 78% in the last five years. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

Boustead Heavy Industries Corporation Berhad does come with some risks though, we found 4 warning signs in our investment analysis, and 3 of those are concerning...

While Boustead Heavy Industries Corporation Berhad may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if Boustead Heavy Industries Corporation Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BHIC

Boustead Heavy Industries Corporation Berhad

Provides defense and security related services primarily in Malaysia.

Flawless balance sheet slight.

Market Insights

Community Narratives