- Malaysia

- /

- Construction

- /

- KLSE:AWC

Revenues Not Telling The Story For AWC Berhad (KLSE:AWC) After Shares Rise 31%

AWC Berhad (KLSE:AWC) shareholders have had their patience rewarded with a 31% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 62%.

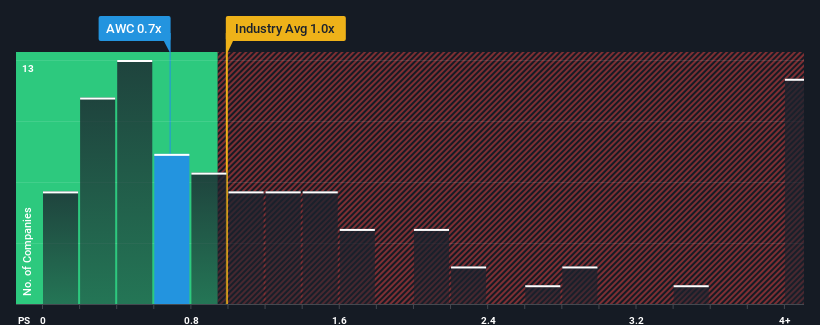

In spite of the firm bounce in price, there still wouldn't be many who think AWC Berhad's price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S in Malaysia's Construction industry is similar at about 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for AWC Berhad

How Has AWC Berhad Performed Recently?

With revenue growth that's inferior to most other companies of late, AWC Berhad has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AWC Berhad.How Is AWC Berhad's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like AWC Berhad's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Fortunately, a few good years before that means that it was still able to grow revenue by 26% in total over the last three years. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 2.2% as estimated by the dual analysts watching the company. With the industry predicted to deliver 12% growth, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that AWC Berhad's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

AWC Berhad's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that AWC Berhad's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for AWC Berhad that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:AWC

AWC Berhad

An investment holding company, provides integrated facilities management and engineering services.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives