Can You Imagine How Jubilant AT Systematization Berhad's (KLSE:AT) Shareholders Feel About Its 300% Share Price Gain?

The last three months have been tough on AT Systematization Berhad (KLSE:AT) shareholders, who have seen the share price decline a rather worrying 33%. But that doesn't detract from the splendid returns of the last year. We're very pleased to report the share price shot up 300% in that time. So we think most shareholders won't be too upset about the recent fall. More important, going forward, is how the business itself is going.

Check out our latest analysis for AT Systematization Berhad

Because AT Systematization Berhad made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

AT Systematization Berhad grew its revenue by 46% last year. That's a head and shoulders above most loss-making companies. And the share price has responded, gaining 300% as we previously mentioned. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. The strong share price rise indicates optimism, so there may be a better opportunity for buyers as the hype fades a bit.

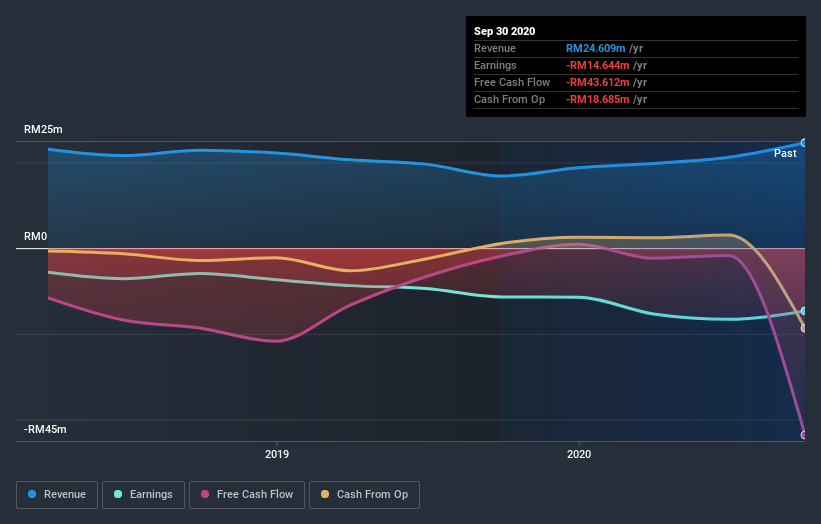

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on AT Systematization Berhad's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that AT Systematization Berhad shareholders have received a total shareholder return of 300% over the last year. There's no doubt those recent returns are much better than the TSR loss of 8% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with AT Systematization Berhad (at least 3 which are potentially serious) , and understanding them should be part of your investment process.

We will like AT Systematization Berhad better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you decide to trade AT Systematization Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Erdasan Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:ERDASAN

Erdasan Group Berhad

An investment holding company, designs, manufactures, and fabricates industrial automation systems, machinery, and industrial and engineering parts.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives