Here's Why We're Not At All Concerned With AbleGroup Berhad's (KLSE:ABLEGRP) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given this risk, we thought we'd take a look at whether AbleGroup Berhad (KLSE:ABLEGRP) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for AbleGroup Berhad

How Long Is AbleGroup Berhad's Cash Runway?

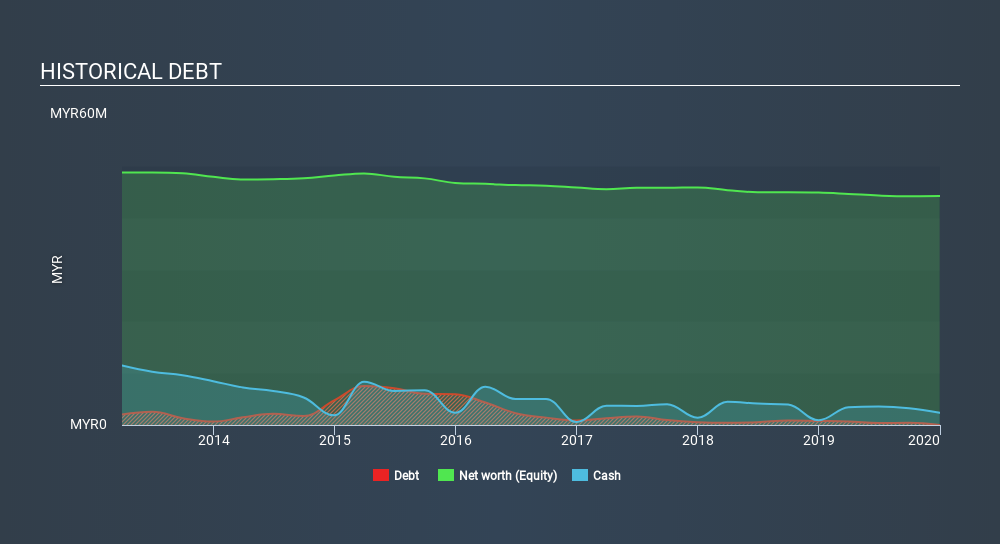

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at December 2019, AbleGroup Berhad had cash of RM2.4m and no debt. Importantly, its cash burn was RM401k over the trailing twelve months. So it had a cash runway of about 5.9 years from December 2019. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. Depicted below, you can see how its cash holdings have changed over time.

How Is AbleGroup Berhad's Cash Burn Changing Over Time?

Although AbleGroup Berhad had revenue of RM5.5m in the last twelve months, its operating revenue was only RM5.5m in that time period. We don't think that's enough operating revenue for us to understand too much from revenue growth rates, since the company is growing off a low base. So we'll focus on the cash burn, today. Even though it doesn't get us excited, the 53% reduction in cash burn year on year does suggest the company can continue operating for quite some time. In reality, this article only makes a short study of the company's growth data. You can take a look at how AbleGroup Berhad is growing revenue over time by checking this visualization of past revenue growth.

Can AbleGroup Berhad Raise More Cash Easily?

There's no doubt AbleGroup Berhad's rapidly reducing cash burn brings comfort, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund further growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash to drive growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

AbleGroup Berhad has a market capitalisation of RM13m and burnt through RM401k last year, which is 3.0% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is AbleGroup Berhad's Cash Burn A Worry?

It may already be apparent to you that we're relatively comfortable with the way AbleGroup Berhad is burning through its cash. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. And even its cash burn reduction was very encouraging. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash. On another note, AbleGroup Berhad has 5 warning signs (and 2 which are significant) we think you should know about.

Of course AbleGroup Berhad may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About KLSE:ABLEGRP

AbleGroup Berhad

An investment holding company, engages in the processing, trading, and contract workmanship of marble and granite slabs in Malaysia.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives