Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies UMW Holdings Berhad (KLSE:UMW) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for UMW Holdings Berhad

What Is UMW Holdings Berhad's Debt?

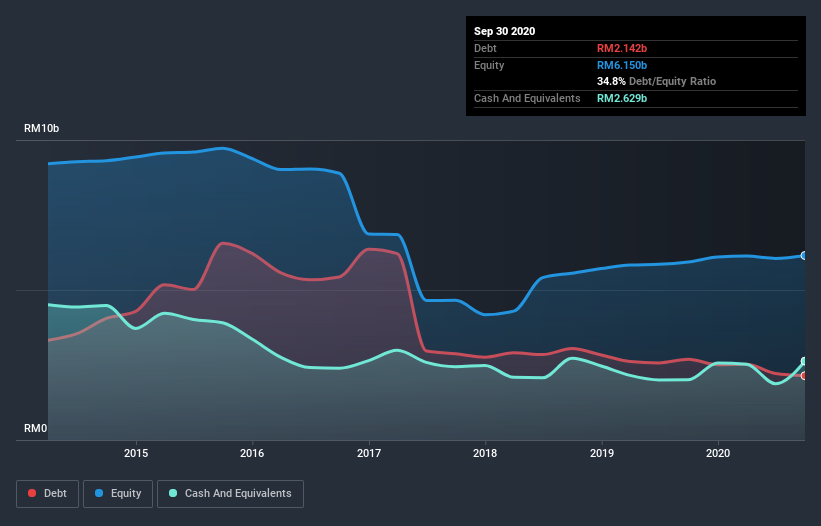

The image below, which you can click on for greater detail, shows that UMW Holdings Berhad had debt of RM2.14b at the end of September 2020, a reduction from RM2.69b over a year. But on the other hand it also has RM2.63b in cash, leading to a RM486.7m net cash position.

How Strong Is UMW Holdings Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that UMW Holdings Berhad had liabilities of RM2.28b due within 12 months and liabilities of RM1.91b due beyond that. Offsetting this, it had RM2.63b in cash and RM986.5m in receivables that were due within 12 months. So its liabilities total RM574.3m more than the combination of its cash and short-term receivables.

Of course, UMW Holdings Berhad has a market capitalization of RM3.36b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, UMW Holdings Berhad also has more cash than debt, so we're pretty confident it can manage its debt safely.

Shareholders should be aware that UMW Holdings Berhad's EBIT was down 69% last year. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine UMW Holdings Berhad's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While UMW Holdings Berhad has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Looking at the most recent three years, UMW Holdings Berhad recorded free cash flow of 40% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing up

While UMW Holdings Berhad does have more liabilities than liquid assets, it also has net cash of RM486.7m. So although we see some areas for improvement, we're not too worried about UMW Holdings Berhad's balance sheet. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for UMW Holdings Berhad that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade UMW Holdings Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:UMW

UMW Holdings Berhad

UMW Holdings Berhad engages in the automotive, equipment, and manufacturing, engineering, and aerospace businesses in Malaysia and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives