- Malaysia

- /

- Auto Components

- /

- KLSE:EPMB

We Think EP Manufacturing Bhd (KLSE:EPMB) Is Taking Some Risk With Its Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that EP Manufacturing Bhd (KLSE:EPMB) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for EP Manufacturing Bhd

How Much Debt Does EP Manufacturing Bhd Carry?

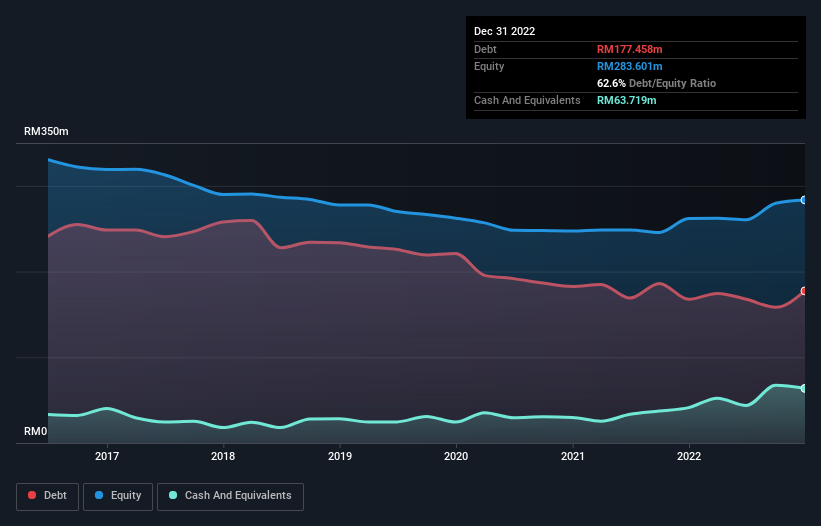

As you can see below, at the end of December 2022, EP Manufacturing Bhd had RM177.5m of debt, up from RM167.7m a year ago. Click the image for more detail. However, it does have RM63.7m in cash offsetting this, leading to net debt of about RM113.7m.

How Strong Is EP Manufacturing Bhd's Balance Sheet?

According to the last reported balance sheet, EP Manufacturing Bhd had liabilities of RM284.4m due within 12 months, and liabilities of RM44.8m due beyond 12 months. Offsetting these obligations, it had cash of RM63.7m as well as receivables valued at RM92.1m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by RM173.4m.

When you consider that this deficiency exceeds the company's RM136.6m market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While EP Manufacturing Bhd's debt to EBITDA ratio (3.7) suggests that it uses some debt, its interest cover is very weak, at 0.60, suggesting high leverage. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. The silver lining is that EP Manufacturing Bhd grew its EBIT by 1,358% last year, which nourishing like the idealism of youth. If that earnings trend continues it will make its debt load much more manageable in the future. When analysing debt levels, the balance sheet is the obvious place to start. But it is EP Manufacturing Bhd's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Happily for any shareholders, EP Manufacturing Bhd actually produced more free cash flow than EBIT over the last two years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

While EP Manufacturing Bhd's interest cover has us nervous. To wit both its conversion of EBIT to free cash flow and EBIT growth rate were encouraging signs. We think that EP Manufacturing Bhd's debt does make it a bit risky, after considering the aforementioned data points together. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for EP Manufacturing Bhd (1 is significant!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if EP Manufacturing Bhd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:EPMB

EP Manufacturing Bhd

An investment holding company, engages in the manufacture, distribution, and sale of automotive parts and components in Malaysia and Saudi Arabia.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives