- Mexico

- /

- Renewable Energy

- /

- BMV:COXA *

Cox Energy América, S.A.B. de C.V.'s (BMV:COXA) Earnings Haven't Escaped The Attention Of Investors

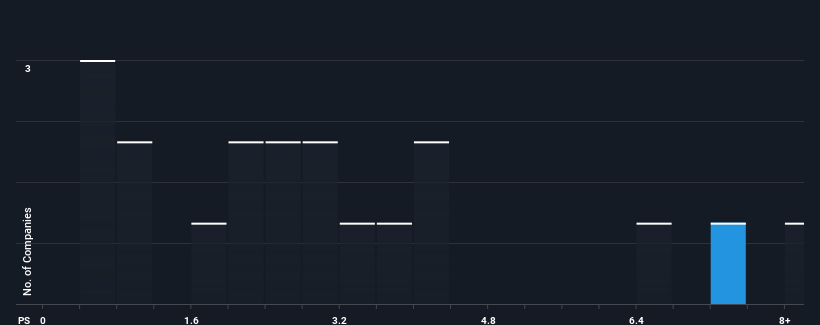

When you see that almost half of the companies in the Renewable Energy industry in Mexico have price-to-sales ratios (or "P/S") below 2.5x, Cox Energy América, S.A.B. de C.V. (BMV:COXA) looks to be giving off strong sell signals with its 7.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Cox Energy América. de

What Does Cox Energy América. de's Recent Performance Look Like?

Cox Energy América. de certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Cox Energy América. de's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Cox Energy América. de's to be considered reasonable.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The amazing performance means it was also able to deliver huge revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

In contrast to the company, the rest of the industry is expected to decline by 2.3% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's understandable that Cox Energy América. de's P/S sits above the majority of other companies. Investors are willing to pay more for a stock they hope will buck the trend of the broader industry going backwards. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

What We Can Learn From Cox Energy América. de's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Cox Energy América. de revealed its growing revenue over the medium-term is helping prop up its high P/S compared to its peers, given the industry is set to shrink. It could be said that investors feel this revenue growth will continue into the future, justifying a higher P/S ratio. However, it'd be fair to raise concerns over whether this level of revenue performance will continue given the harsh conditions facing the industry. If things remain consistent though, shareholders shouldn't expect any major share price shocks in the near term.

It is also worth noting that we have found 3 warning signs for Cox Energy América. de that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:COXA *

Cox Energy. de

Engages in the management, development, and operation of portfolio of renewable energy projects in Europe and Latin America.

Low risk with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026