Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (BMV:VOLARA) Stock Rockets 36% As Investors Are Less Pessimistic Than Expected

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (BMV:VOLARA) shareholders would be excited to see that the share price has had a great month, posting a 36% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.7% in the last twelve months.

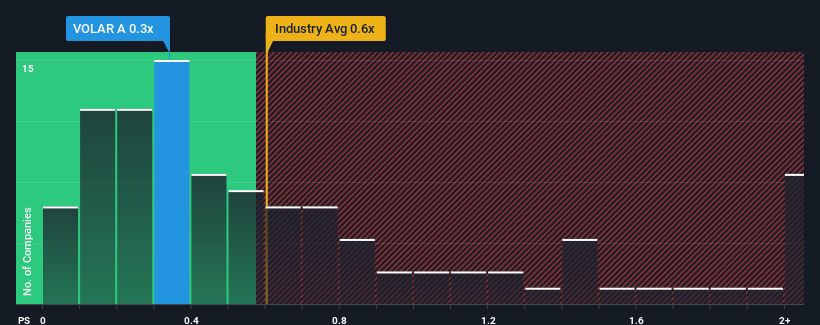

Even after such a large jump in price, it's still not a stretch to say that Controladora Vuela Compañía de Aviación. de's price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Airlines industry in Mexico, where the median P/S ratio is around 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Controladora Vuela Compañía de Aviación. de

How Has Controladora Vuela Compañía de Aviación. de Performed Recently?

Recent times haven't been great for Controladora Vuela Compañía de Aviación. de as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Controladora Vuela Compañía de Aviación. de.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Controladora Vuela Compañía de Aviación. de's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. Pleasingly, revenue has also lifted 195% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 1.8% over the next year. Meanwhile, the rest of the industry is forecast to expand by 15%, which is noticeably more attractive.

With this in mind, we find it intriguing that Controladora Vuela Compañía de Aviación. de's P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Its shares have lifted substantially and now Controladora Vuela Compañía de Aviación. de's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that Controladora Vuela Compañía de Aviación. de's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for Controladora Vuela Compañía de Aviación. de you should be aware of.

If these risks are making you reconsider your opinion on Controladora Vuela Compañía de Aviación. de, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:VOLAR A

Controladora Vuela Compañía de Aviación. de

Controladora Vuela Compañía de Aviación, S.A.B.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success