As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing a mixed performance across sectors, with financials and energy gaining traction while healthcare faces challenges. Amidst these shifting dynamics, dividend stocks remain an attractive option for those seeking steady income streams, offering potential stability in times of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.15% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.15% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.76% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.37% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.75% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.80% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

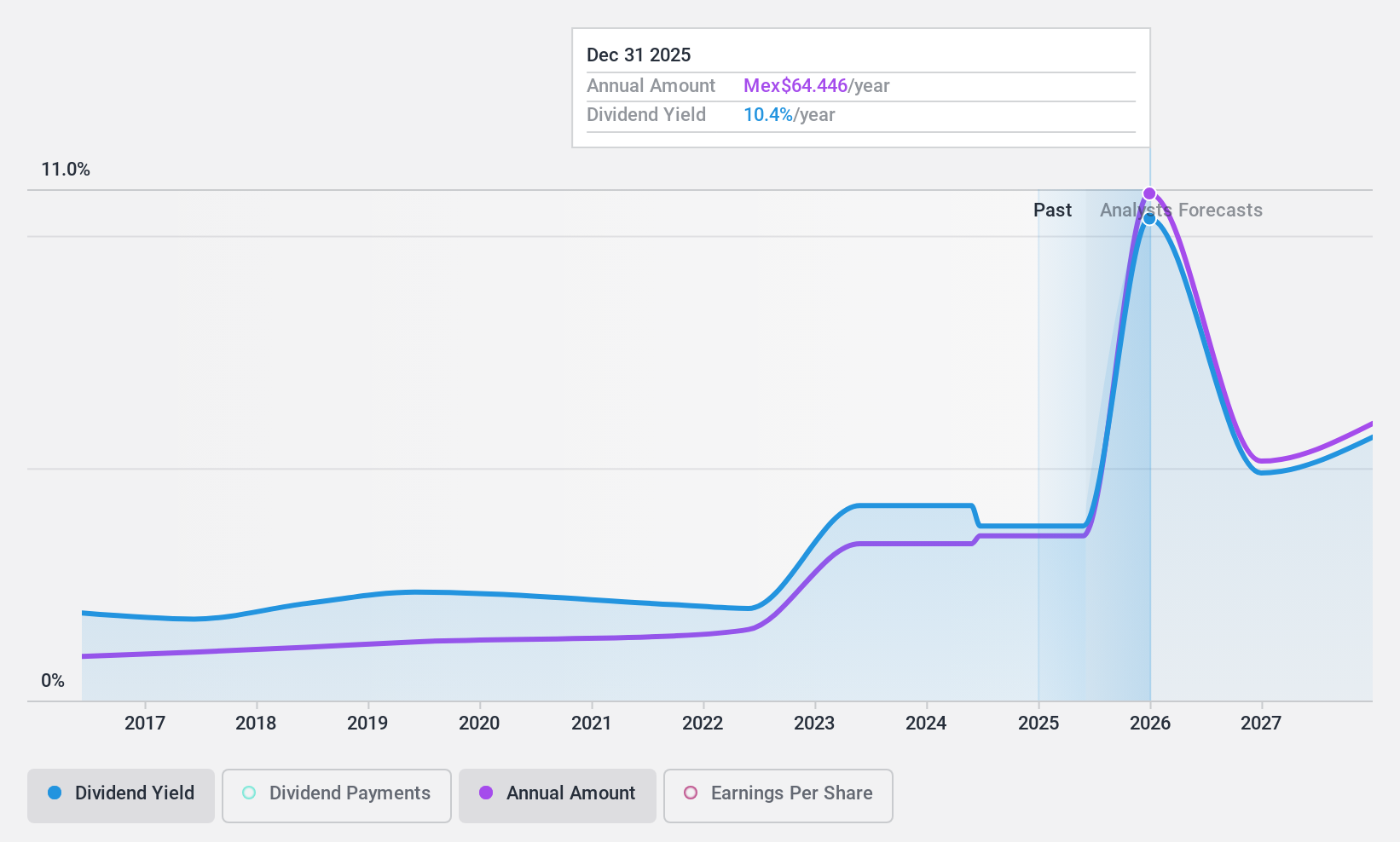

Grupo Aeroportuario del Sureste S. A. B. de C. V (BMV:ASUR B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Grupo Aeroportuario del Sureste, S.A.B. operates airports in Mexico and internationally, with a market cap of MX$164.01 billion.

Operations: Grupo Aeroportuario del Sureste, S.A.B.'s revenue segments include Cancun at MX$17.17 billion, Colombia at MX$3.12 billion, San Juan, Puerto Rico, US at MX$4.50 billion, Merida at MX$1.41 billion, and Villahermosa at MX$599.27 million.

Dividend Yield: 3.8%

Grupo Aeroportuario del Sureste S.A.B. de C.V. offers a mixed dividend profile with a yield of 3.83%, below the top quartile in Mexico, and an unstable history marked by volatility over the past decade. Despite this, dividends are well-covered by earnings (25.9% payout ratio) and cash flows (54.9% cash payout ratio). Recent results show robust financial growth with Q3 net income rising to MXN 3.38 billion from MXN 2.71 billion year-on-year, supporting dividend sustainability amidst fluctuating passenger traffic figures.

- Click here to discover the nuances of Grupo Aeroportuario del Sureste S. A. B. de C. V with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Grupo Aeroportuario del Sureste S. A. B. de C. V is priced lower than what may be justified by its financials.

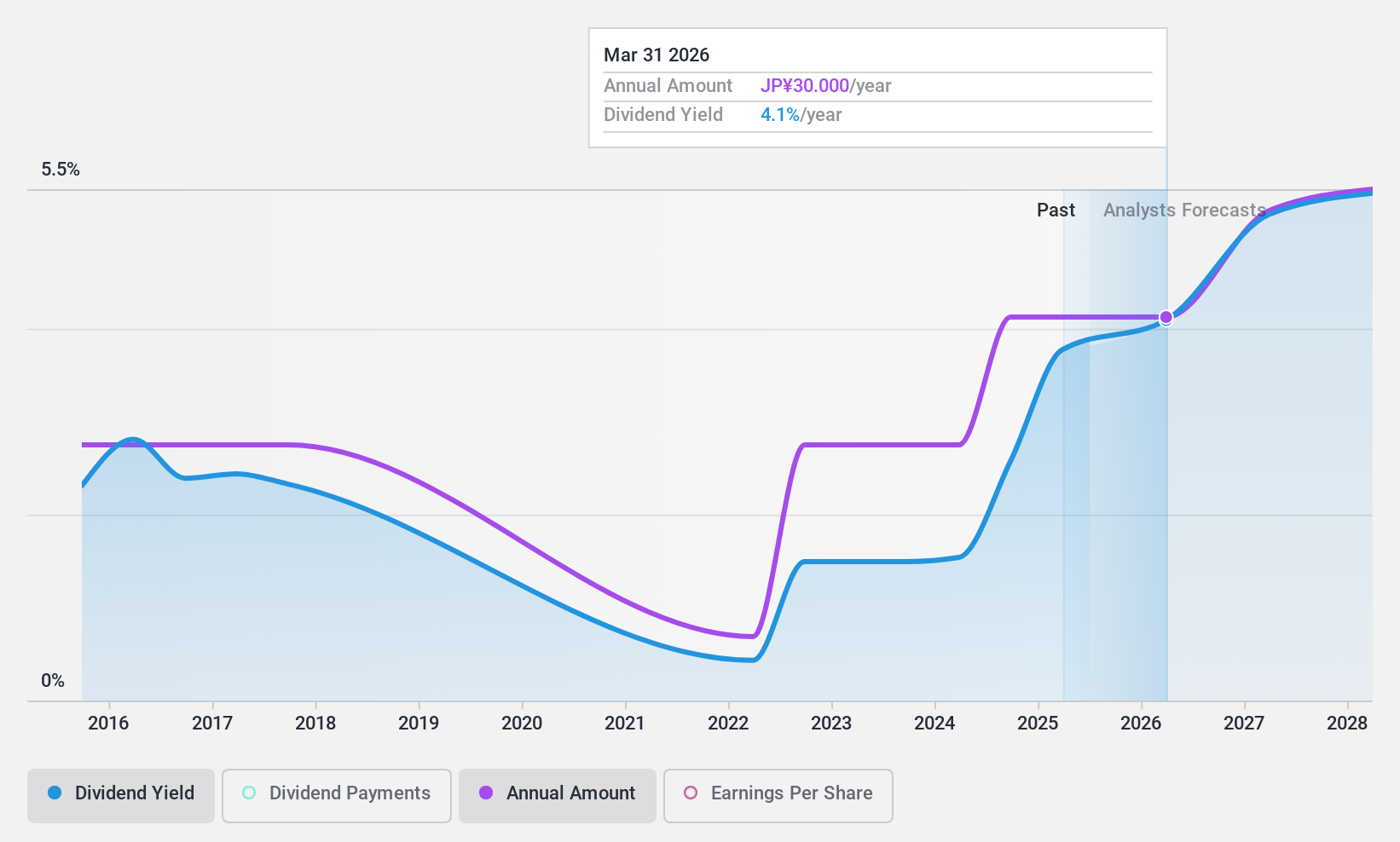

Nihon Dempa Kogyo (TSE:6779)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nihon Dempa Kogyo Co., Ltd. manufactures and sells quartz crystal devices across Japan, the rest of Asia, Europe, and North America, with a market cap of ¥22.44 billion.

Operations: Nihon Dempa Kogyo Co., Ltd.'s revenue is derived from its operations in the manufacture and sale of quartz crystal devices across various regions including Japan, other parts of Asia, Europe, and North America.

Dividend Yield: 3.1%

Nihon Dempa Kogyo's dividend profile shows mixed attributes. With a low payout ratio of 13.6%, dividends are well-covered by earnings, and the cash payout ratio of 67.4% indicates coverage by cash flows. However, its dividend yield of 3.08% is below Japan's top quartile, and payments have been volatile over the past decade, raising concerns about reliability despite trading at a significant discount to its estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of Nihon Dempa Kogyo.

- In light of our recent valuation report, it seems possible that Nihon Dempa Kogyo is trading behind its estimated value.

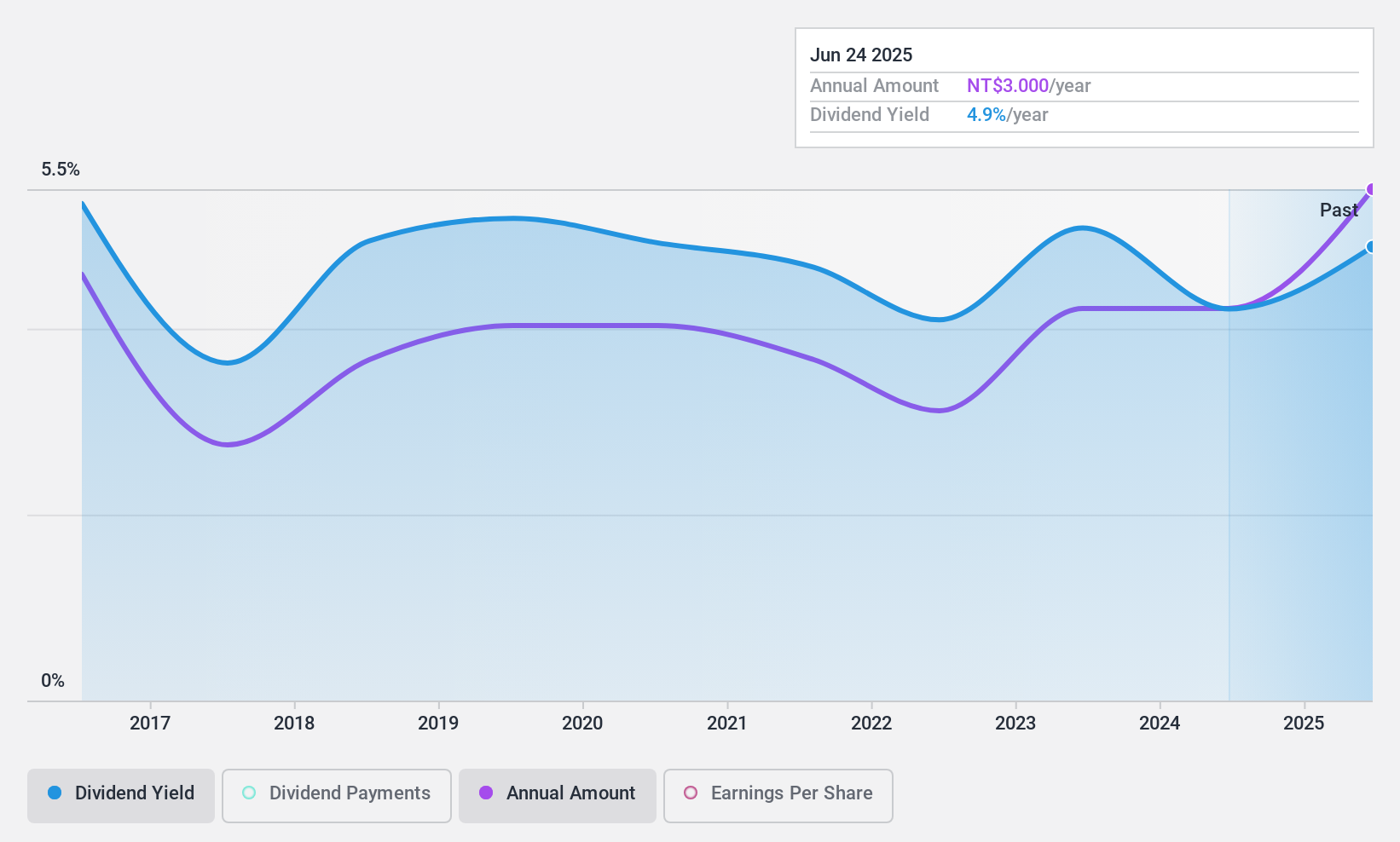

YungShin Global Holding (TWSE:3705)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: YungShin Global Holding Corporation, with a market cap of NT$14.92 billion, operates through its subsidiaries to invest in, manufacture, and sell medicines, animal drugs, agricultural chemicals, industrial medicines, and cosmetics across Taiwan, Mainland China, Japan, and the United States.

Operations: YungShin Global Holding Corporation generates revenue through its subsidiaries by engaging in the production and sale of pharmaceuticals, veterinary products, agrochemicals, industrial medicines, and cosmetics across various international markets.

Dividend Yield: 4.1%

YungShin Global Holding's dividend profile reflects both strengths and weaknesses. Despite a reasonable payout ratio of 59.5% and cash payout ratio of 56.2%, indicating coverage by earnings and cash flows, the dividends have been volatile over the past decade, with annual drops exceeding 20%. Although earnings grew significantly by TWD 201.98 million over the past year, suggesting potential for future stability, its dividend yield of 4.11% remains below Taiwan's top quartile benchmark.

- Take a closer look at YungShin Global Holding's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of YungShin Global Holding shares in the market.

Summing It All Up

- Get an in-depth perspective on all 1963 Top Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3705

YungShin Global Holding

Through its subsidiaries, invests in, manufactures, and sells medicines, animal drugs, agricultural chemicals, industrial medicines, and cosmetics.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives