- Mexico

- /

- Telecom Services and Carriers

- /

- BMV:SITES1 A-1

Some Operadora de Sites Mexicanos, S.A.B. de C.V. (BMV:SITES1A-1) Shareholders Look For Exit As Shares Take 29% Pounding

To the annoyance of some shareholders, Operadora de Sites Mexicanos, S.A.B. de C.V. (BMV:SITES1A-1) shares are down a considerable 29% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 54% share price decline.

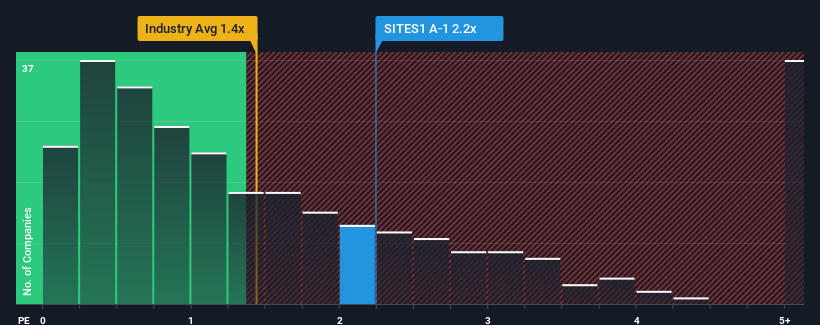

In spite of the heavy fall in price, you could still be forgiven for thinking Operadora de Sites Mexicanos. de is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.2x, considering almost half the companies in Mexico's Telecom industry have P/S ratios below 1.1x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Operadora de Sites Mexicanos. de

How Operadora de Sites Mexicanos. de Has Been Performing

Operadora de Sites Mexicanos. de certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Operadora de Sites Mexicanos. de will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Operadora de Sites Mexicanos. de would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.3%. Pleasingly, revenue has also lifted 47% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 3.7% as estimated by the three analysts watching the company. With the industry predicted to deliver 43% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Operadora de Sites Mexicanos. de is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Operadora de Sites Mexicanos. de's P/S remain high even after its stock plunged. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Operadora de Sites Mexicanos. de, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You need to take note of risks, for example - Operadora de Sites Mexicanos. de has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:SITES1 A-1

Operadora de Sites Mexicanos. de

Operadora de Sites Mexicanos, S.A.B. de C.V.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026