- China

- /

- Communications

- /

- SZSE:300394

3 Global Stocks That May Be Trading At Up To 43.8% Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As global markets face renewed volatility amid tariff threats and rising yields, investors are grappling with the implications of geopolitical tensions and fiscal policies. Despite these challenges, opportunities may exist for discerning investors to identify stocks that are trading below their intrinsic value estimates. In such an environment, a good stock might be one that demonstrates strong fundamentals and resilience against economic uncertainties, offering potential value even in turbulent times.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pansoft (SZSE:300996) | CN¥14.42 | CN¥28.31 | 49.1% |

| H.U. Group Holdings (TSE:4544) | ¥3056.00 | ¥6040.33 | 49.4% |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥13.38 | CN¥27.11 | 50.7% |

| Brangista (TSE:6176) | ¥594.00 | ¥1176.85 | 49.5% |

| Kanto Denka Kogyo (TSE:4047) | ¥834.00 | ¥1644.42 | 49.3% |

| Lectra (ENXTPA:LSS) | €23.70 | €47.09 | 49.7% |

| Clemondo Group (OM:CLEM) | SEK10.70 | SEK21.24 | 49.6% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.79 | NZ$1.58 | 50% |

| Dive (TSE:151A) | ¥923.00 | ¥1821.34 | 49.3% |

| Northern Data (DB:NB2) | €24.70 | €49.40 | 50% |

Underneath we present a selection of stocks filtered out by our screen.

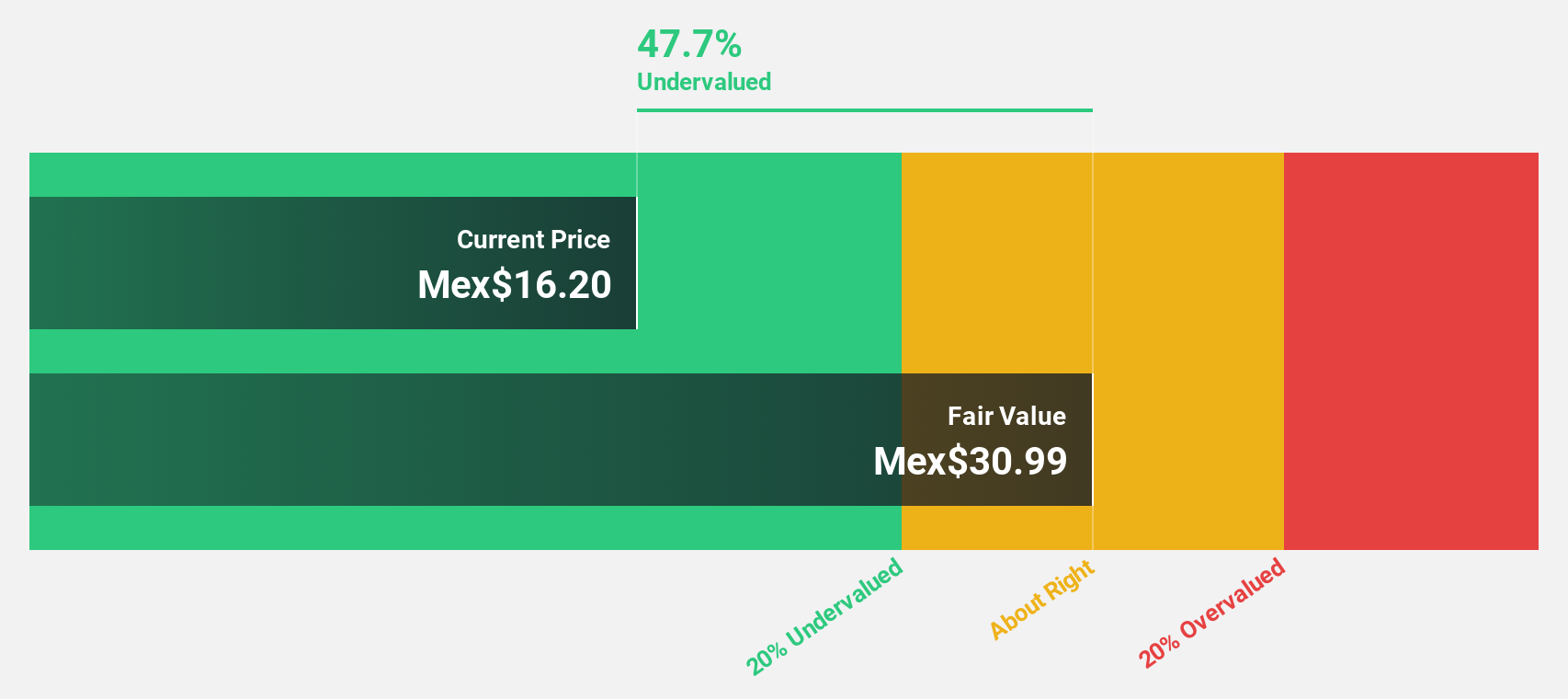

América Móvil. de (BMV:AMX B)

Overview: América Móvil, S.A.B. de C.V. offers telecommunications services across Latin America and internationally, with a market capitalization of MX$1.02 trillion.

Operations: The company's revenue from cellular services amounts to MX$897.96 billion.

Estimated Discount To Fair Value: 43.8%

América Móvil appears undervalued, trading at MX$16.83, significantly below its estimated fair value of MX$29.94. Despite a high debt level and declining profit margins from 7.3% to 3.7%, earnings are forecast to grow at 23.4% annually, outpacing the market's growth rate of 11.1%. Recent board changes and dividend increases highlight ongoing shareholder engagement, though delayed SEC filings may raise concerns about financial transparency.

- In light of our recent growth report, it seems possible that América Móvil. de's financial performance will exceed current levels.

- Click here to discover the nuances of América Móvil. de with our detailed financial health report.

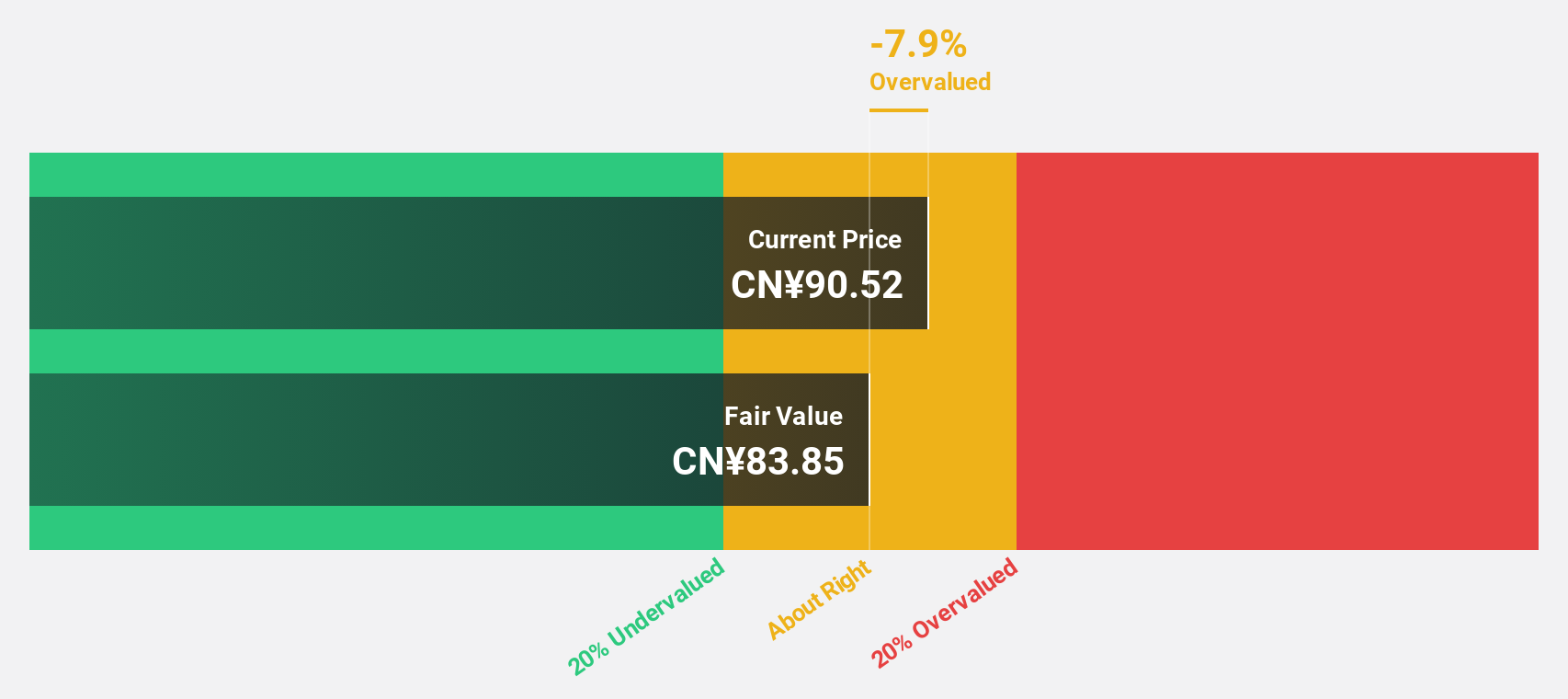

Suzhou TFC Optical Communication (SZSE:300394)

Overview: Suzhou TFC Optical Communication Co., Ltd. operates in the optical communication industry, focusing on the development and production of optical components, with a market cap of CN¥41.13 billion.

Operations: The company's revenue primarily comes from its Optical Communication Device segment, which generated CN¥3.44 billion.

Estimated Discount To Fair Value: 10.8%

Suzhou TFC Optical Communication is currently trading at CNY 74.78, slightly below its estimated fair value of CNY 83.83, suggesting potential undervaluation based on cash flows. The company reported strong financial performance with Q1 2025 net income rising to CNY 337.63 million from the previous year's CNY 278.88 million, and sales increasing significantly year-over-year. A strategic partnership with OpenLight may enhance operational efficiencies and market positioning in silicon photonics, potentially supporting future revenue growth projections of 29.6% annually.

- Our growth report here indicates Suzhou TFC Optical Communication may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Suzhou TFC Optical Communication's balance sheet health report.

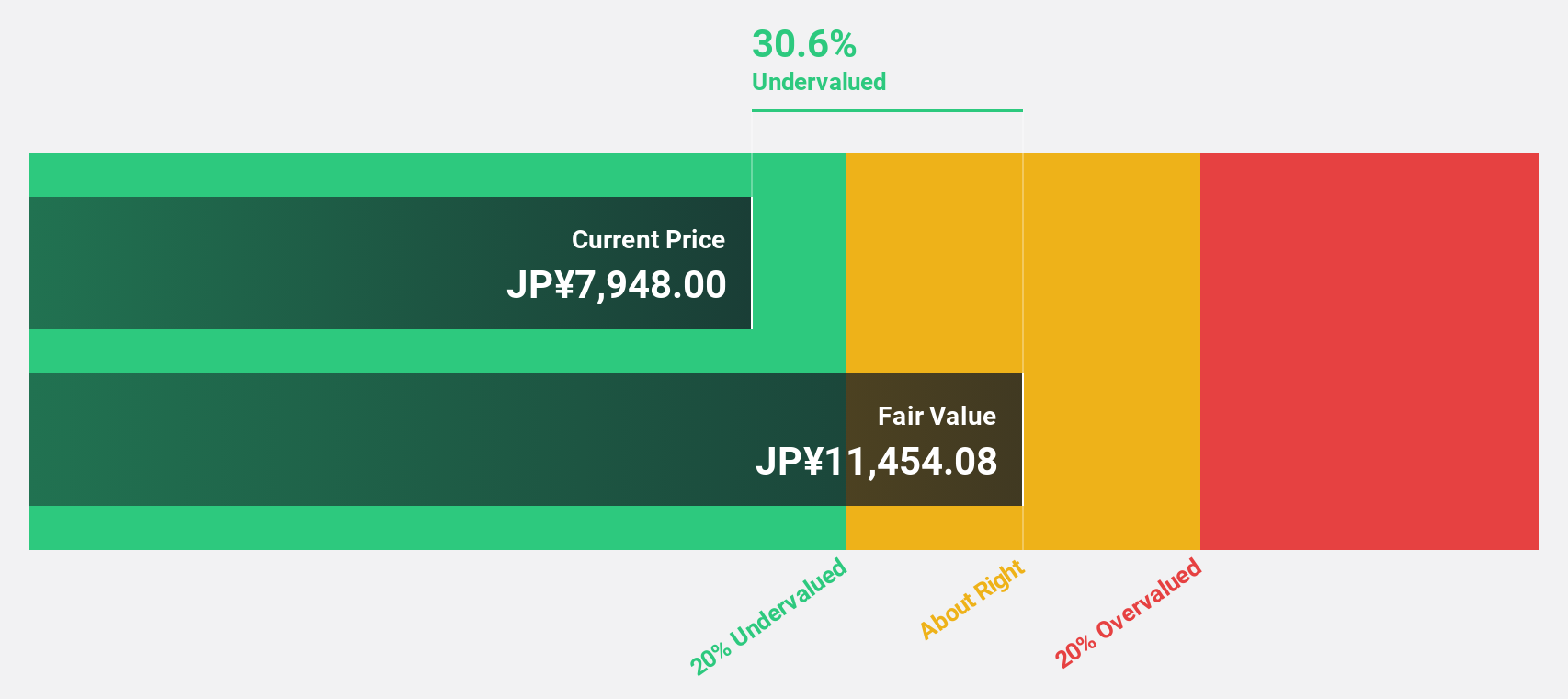

Recruit Holdings (TSE:6098)

Overview: Recruit Holdings Co., Ltd. is a company that offers HR technology and business solutions aimed at transforming the world of work, with a market cap of ¥11.96 trillion.

Operations: Recruit Holdings generates revenue through three main segments: HR Technology (¥1.13 billion), Temporary Staffing (¥1.67 billion), and Matching & Solutions (¥816.01 million).

Estimated Discount To Fair Value: 14.6%

Recruit Holdings is trading at ¥8,494, below its estimated fair value of ¥9,948.58, indicating potential undervaluation based on cash flows. Despite a volatile share price in recent months, the company forecasts earnings growth of 9.1% annually and revenue growth of 4.3%, outpacing the Japanese market average. Recent share repurchases and dividend increases reflect a commitment to shareholder returns while supporting long-term business strategies for sustainable profit growth.

- Our expertly prepared growth report on Recruit Holdings implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Recruit Holdings stock in this financial health report.

Summing It All Up

- Discover the full array of 516 Undervalued Global Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300394

Suzhou TFC Optical Communication

Provides optical communication devices in Mainland China and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives