- Mexico

- /

- Wireless Telecom

- /

- BMV:AMX B

3 Global Growth Companies With Up To 28% Insider Ownership

Reviewed by Simply Wall St

In a week marked by volatility in global markets, with U.S. stocks declining amid Treasury market fluctuations and renewed tariff threats, investors are keenly observing how these macroeconomic factors impact growth companies worldwide. As uncertainty looms over trade policies and economic forecasts, insider ownership can be a crucial indicator of confidence in a company's long-term potential, offering a compelling angle for those assessing growth opportunities amidst the current market conditions.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.5% | 23.4% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Vow (OB:VOW) | 13.1% | 81% |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.3% |

| Laopu Gold (SEHK:6181) | 22% | 40.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Lokotech Group (OB:LOKO) | 14.5% | 58.1% |

| Elliptic Laboratories (OB:ELABS) | 25.8% | 79% |

We'll examine a selection from our screener results.

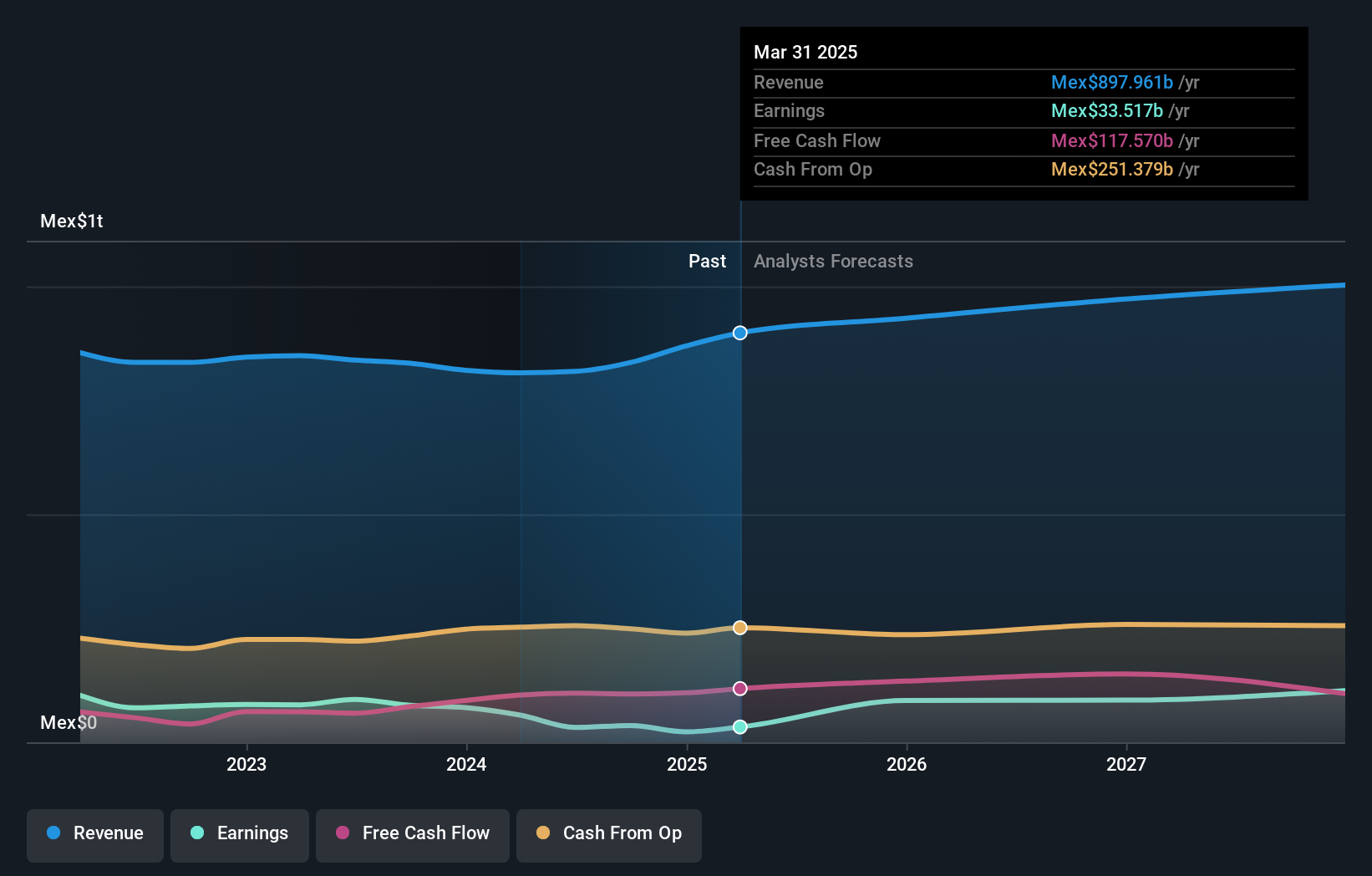

América Móvil. de (BMV:AMX B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: América Móvil, S.A.B. de C.V. is a telecommunications company offering services across Latin America and internationally, with a market cap of MX$1.02 trillion.

Operations: The company generates revenue from cellular services amounting to MX$897.96 billion.

Insider Ownership: 22.1%

América Móvil's insider ownership aligns with its growth trajectory, as earnings are forecast to grow significantly at 23.43% annually, outpacing the market. Despite a high debt level and lower profit margins compared to last year, the company trades at 43.8% below estimated fair value, suggesting potential undervaluation. Recent board appointments and dividend increases indicate strategic stability, although revenue growth lags behind market expectations at 3.7% annually.

- Navigate through the intricacies of América Móvil. de with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that América Móvil. de's share price might be on the cheaper side.

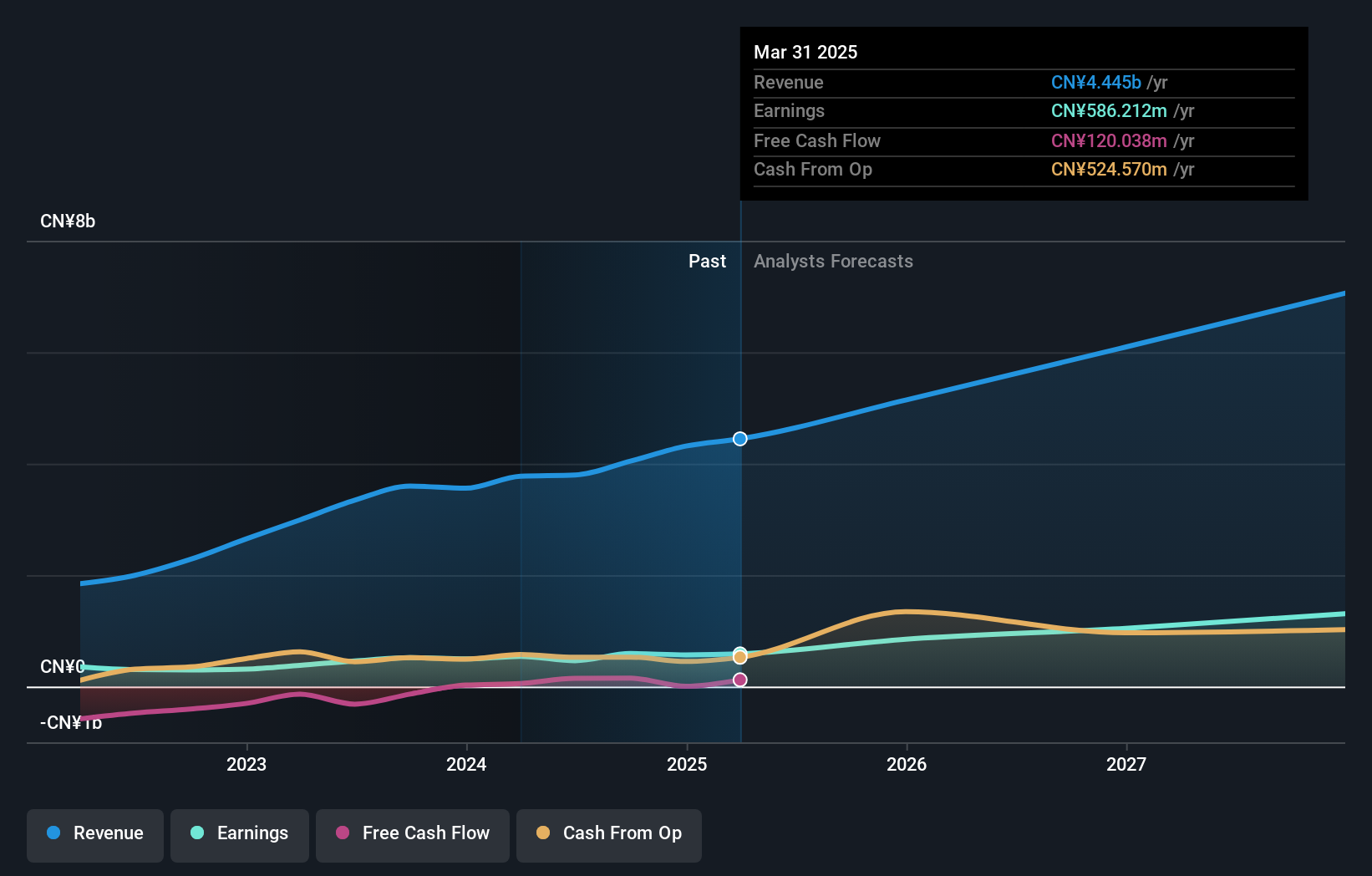

Raytron TechnologyLtd (SHSE:688002)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Raytron Technology Co., Ltd. specializes in the research, development, design, manufacturing, and sales of uncooled infrared imaging and MEMS sensor technology in China with a market capitalization of approximately CN¥26.11 billion.

Operations: Raytron Technology Co., Ltd. generates its revenue through the development and sale of uncooled infrared imaging and MEMS sensor technology within China.

Insider Ownership: 27.3%

Raytron Technology Ltd. shows promising growth potential, with earnings projected to grow significantly at 24.65% annually, surpassing the market average. Despite a forecasted low return on equity of 14.4%, recent developments like the innovative thermal camera for medical use and steady revenue growth—up to CNY 1.14 billion in Q1—highlight its expansion capabilities. The company’s share buyback program further underscores confidence in its future prospects and commitment to enhancing shareholder value.

- Delve into the full analysis future growth report here for a deeper understanding of Raytron TechnologyLtd.

- Our expertly prepared valuation report Raytron TechnologyLtd implies its share price may be too high.

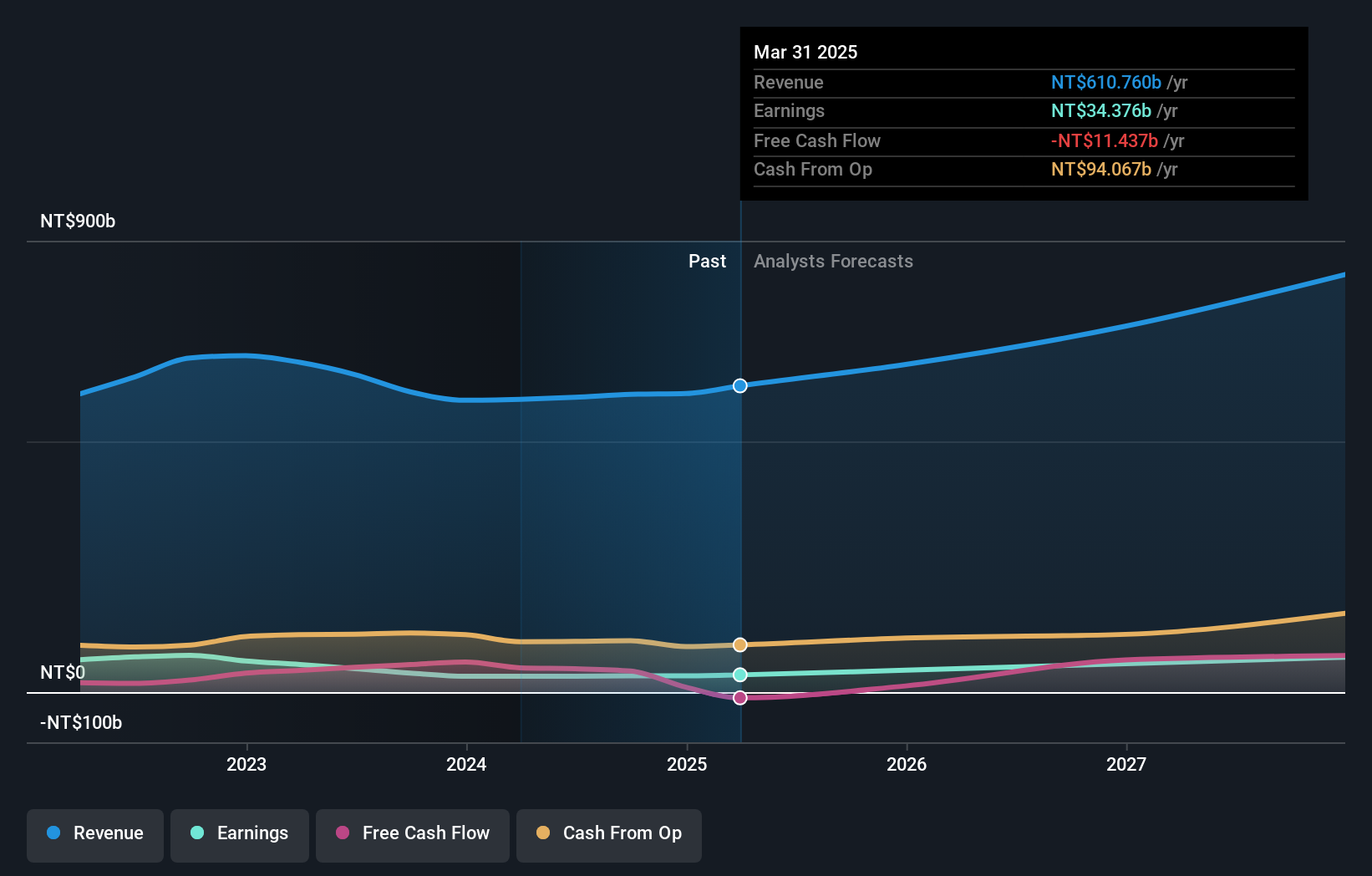

ASE Technology Holding (TWSE:3711)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ASE Technology Holding Co., Ltd. offers semiconductor packaging and testing as well as electronic manufacturing services globally, with a market cap of approximately NT$619.31 billion.

Operations: ASE Technology Holding Co., Ltd. generates revenue through its semiconductor packaging (NT$276.77 billion), testing (NT$58.94 billion), and electronic assembly services (NT$310.28 billion) across various international markets.

Insider Ownership: 28.5%

ASE Technology Holding is poised for robust growth, with earnings expected to rise significantly at 24.9% annually, outpacing the Taiwan market. Despite slower revenue growth of 10.9%, recent results show substantial gains, with Q1 2025 revenues reaching TWD 148.15 billion and net income increasing to TWD 7.55 billion year-over-year. Trading below its estimated fair value by 26.4%, the company’s financial performance suggests potential for continued expansion and shareholder value enhancement despite a low forecasted return on equity of 16.1%.

- Dive into the specifics of ASE Technology Holding here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that ASE Technology Holding is trading behind its estimated value.

Taking Advantage

- Get an in-depth perspective on all 850 Fast Growing Global Companies With High Insider Ownership by using our screener here.

- Looking For Alternative Opportunities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:AMX B

América Móvil. de

Provides telecommunications services in Latin America and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives