- Mexico

- /

- Specialty Stores

- /

- BMV:GIGANTE *

Grupo Gigante, S. A. B. de C. V.'s (BMV:GIGANTE) Popularity With Investors Is Under Threat From Overpricing

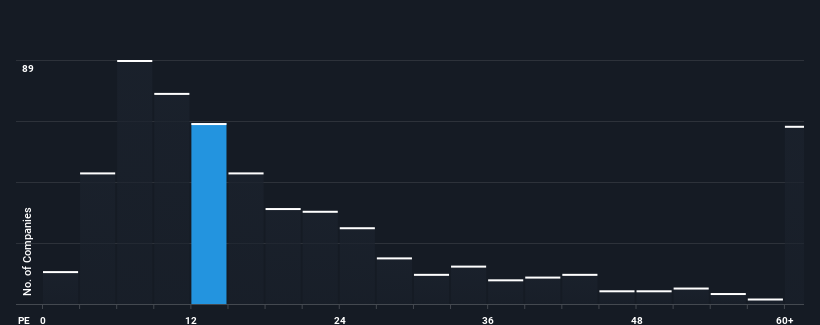

With a median price-to-earnings (or "P/E") ratio of close to 13x in Mexico, you could be forgiven for feeling indifferent about Grupo Gigante, S. A. B. de C. V.'s (BMV:GIGANTE) P/E ratio of 13.6x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings growth that's exceedingly strong of late, Grupo Gigante S. A. B. de C. V has been doing very well. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Grupo Gigante S. A. B. de C. V

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Grupo Gigante S. A. B. de C. V's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 31%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 8.8% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Grupo Gigante S. A. B. de C. V is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Grupo Gigante S. A. B. de C. V currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. Right now we are uncomfortable with the P/E as this earnings performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Grupo Gigante S. A. B. de C. V that you should be aware of.

If you're unsure about the strength of Grupo Gigante S. A. B. de C. V's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:GIGANTE *

Grupo Gigante S. A. B. de C. V

Operates convenience stores and restaurants in Mexico, Central America, and Chile.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.