As global markets navigate the impact of rising U.S. Treasury yields, with growth stocks showing resilience amidst broader economic challenges, investors are increasingly attentive to companies with strong insider ownership—a potential indicator of confidence and alignment between management and shareholders. In this climate, identifying growth companies where insiders hold significant stakes can be particularly appealing, as these firms may exhibit robust leadership commitment and strategic focus in a fluctuating market environment.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.5% | 24.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's explore several standout options from the results in the screener.

Genomma Lab Internacional. de (BMV:LAB B)

Simply Wall St Growth Rating: ★★★★☆☆

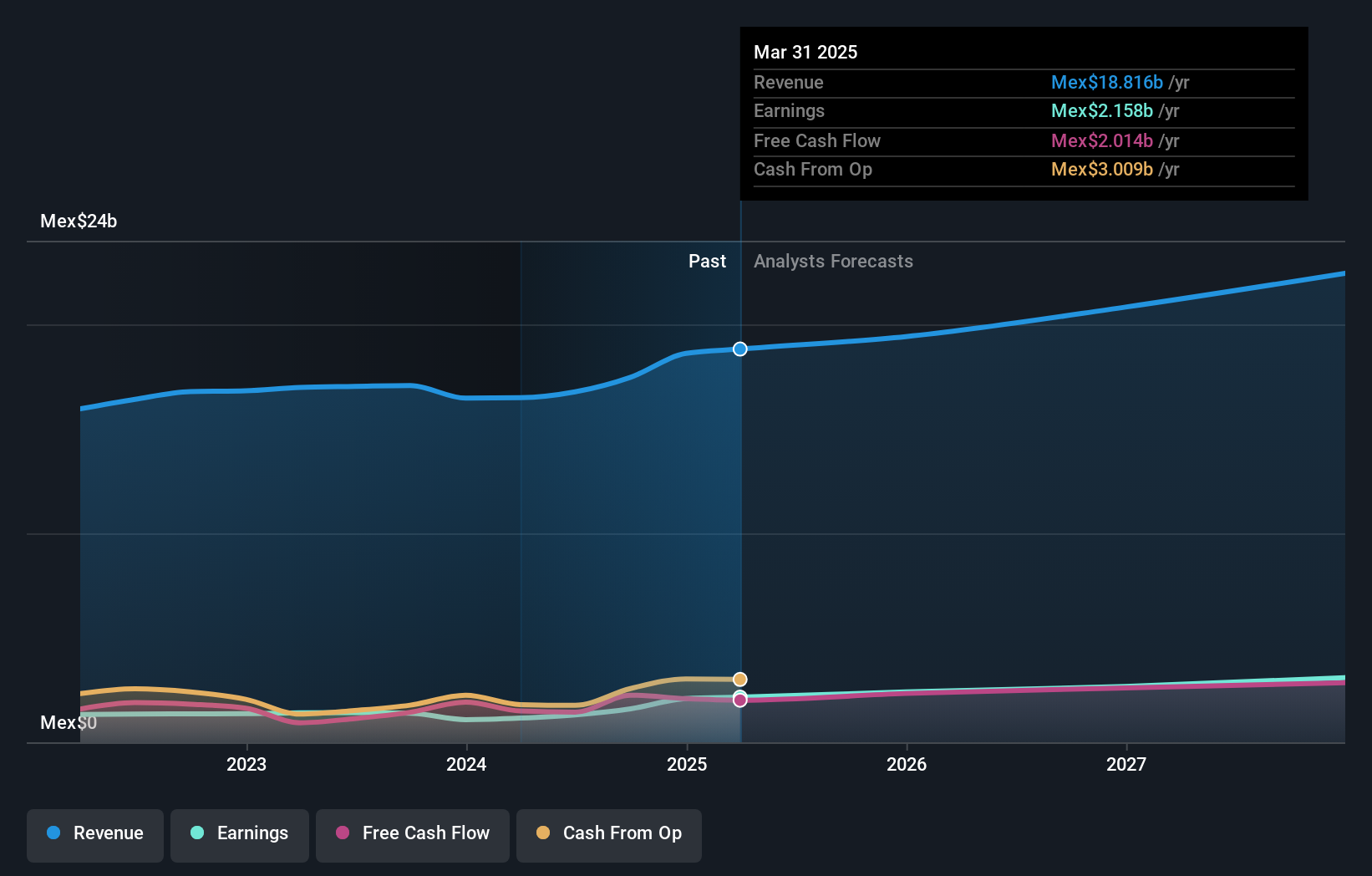

Overview: Genomma Lab Internacional, S.A.B. de C.V. operates in the pharmaceutical and personal care sectors across Latin America, with a market capitalization of MX$24.12 billion.

Operations: The company generates revenue of MX$17.47 billion from its operations in the pharmaceutical and personal care products industry.

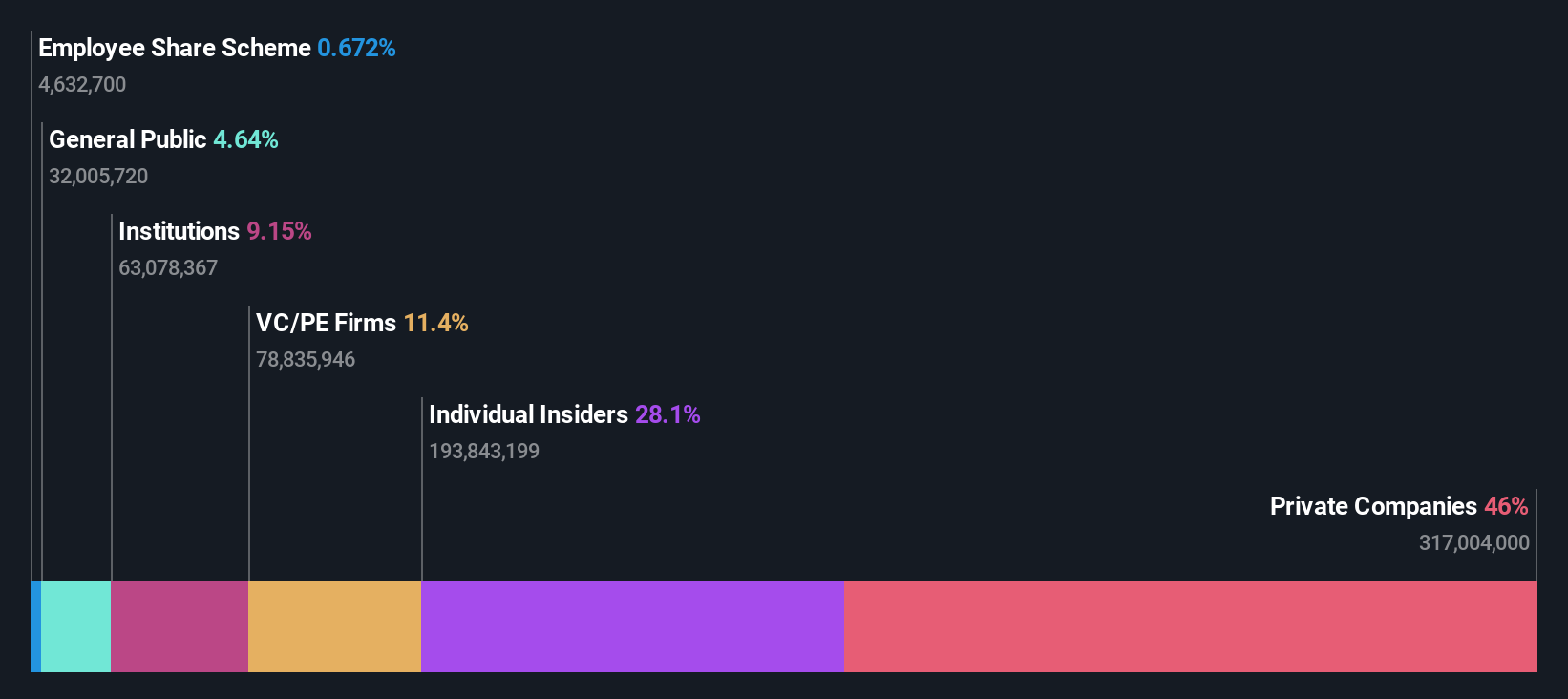

Insider Ownership: 32.6%

Genomma Lab Internacional has shown strong financial performance, with Q3 2024 sales rising to MXN 5.09 billion and net income increasing to MXN 660.06 million year-over-year. The company's earnings are forecasted to grow significantly at 20% annually, outpacing the Mexican market average of 11.4%. Despite trading below its estimated fair value, Genomma faces challenges with a high debt level and an unstable dividend history but benefits from recent GMP certification enhancing operational credibility.

- Get an in-depth perspective on Genomma Lab Internacional. de's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Genomma Lab Internacional. de's share price might be too pessimistic.

Guangdong Yuehai Feeds GroupLtd (SZSE:001313)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangdong Yuehai Feeds Group Co., Ltd. is involved in the research and development, production, and sale of aquatic feeds both in China and internationally, with a market cap of CN¥5.21 billion.

Operations: The company generates revenue through its core activities of researching, developing, producing, and selling aquatic feeds domestically and abroad.

Insider Ownership: 28.1%

Guangdong Yuehai Feeds Group Ltd. is positioned for growth with revenue expected to increase by 15.3% annually, surpassing the Chinese market average. Despite recent financial setbacks, including a net loss of CNY 67.41 million for the nine months ended September 2024, its shares trade at a substantial discount to fair value estimates. The company has completed a share buyback program, indicating confidence in its long-term prospects despite current profitability challenges and low forecasted return on equity.

- Click here and access our complete growth analysis report to understand the dynamics of Guangdong Yuehai Feeds GroupLtd.

- Our comprehensive valuation report raises the possibility that Guangdong Yuehai Feeds GroupLtd is priced lower than what may be justified by its financials.

Astroscale Holdings (TSE:186A)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Astroscale Holdings Inc. offers on-orbit service solutions and has a market cap of approximately ¥119.10 billion.

Operations: The company generates revenue from its In-Orbit Servicing Business, amounting to ¥2.51 billion.

Insider Ownership: 21.3%

Astroscale Holdings is poised for significant growth, with revenue projected to rise 43% annually, outpacing the JP market's average. Despite recent share price volatility, the company is on track to achieve profitability within three years. Recent developments include a JPY 91 million government contract awarded to a subsidiary, enhancing its growth prospects. However, its forecasted return on equity remains low at 6.6%, which may temper investor enthusiasm despite strong revenue forecasts.

- Click here to discover the nuances of Astroscale Holdings with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Astroscale Holdings' current price could be inflated.

Taking Advantage

- Click this link to deep-dive into the 1523 companies within our Fast Growing Companies With High Insider Ownership screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:LAB B

Genomma Lab Internacional. de

Provides pharmaceutical and personal care products primarily in Mexico and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives