Analysts Just Made A Major Revision To Their Genomma Lab Internacional, S.A.B. de C.V. (BMV:LABB) Revenue Forecasts

The analysts covering Genomma Lab Internacional, S.A.B. de C.V. (BMV:LABB) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

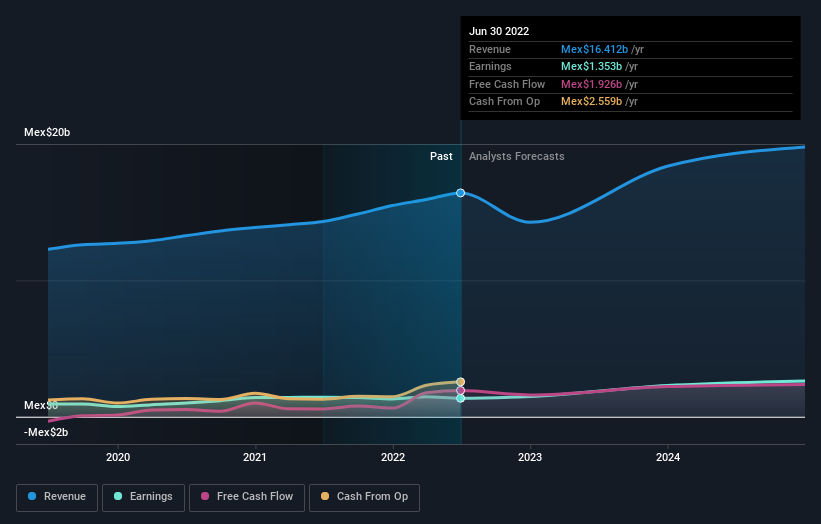

Following the latest downgrade, the four analysts covering Genomma Lab Internacional. de provided consensus estimates of Mex$14b revenue in 2022, which would reflect a not inconsiderable 13% decline on its sales over the past 12 months. Per-share earnings are expected to soar 26% to Mex$1.70. Before this latest update, the analysts had been forecasting revenues of Mex$17b and earnings per share (EPS) of Mex$1.77 in 2022. Indeed, we can see that analyst sentiment has declined measurably after the new consensus came out, with a measurable cut to revenue estimates and a small dip in EPS estimates to boot.

See our latest analysis for Genomma Lab Internacional. de

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 25% by the end of 2022. This indicates a significant reduction from annual growth of 6.8% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 5.7% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Genomma Lab Internacional. de is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Genomma Lab Internacional. de's revenues are expected to grow slower than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Genomma Lab Internacional. de after today.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Genomma Lab Internacional. de going out to 2024, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:LAB B

Genomma Lab Internacional. de

Provides pharmaceutical and personal care products primarily in Mexico and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026