Revenues Not Telling The Story For Grupo Televisa, S.A.B. (BMV:TLEVISACPO) After Shares Rise 28%

Grupo Televisa, S.A.B. (BMV:TLEVISACPO) shareholders have had their patience rewarded with a 28% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 27% in the last year.

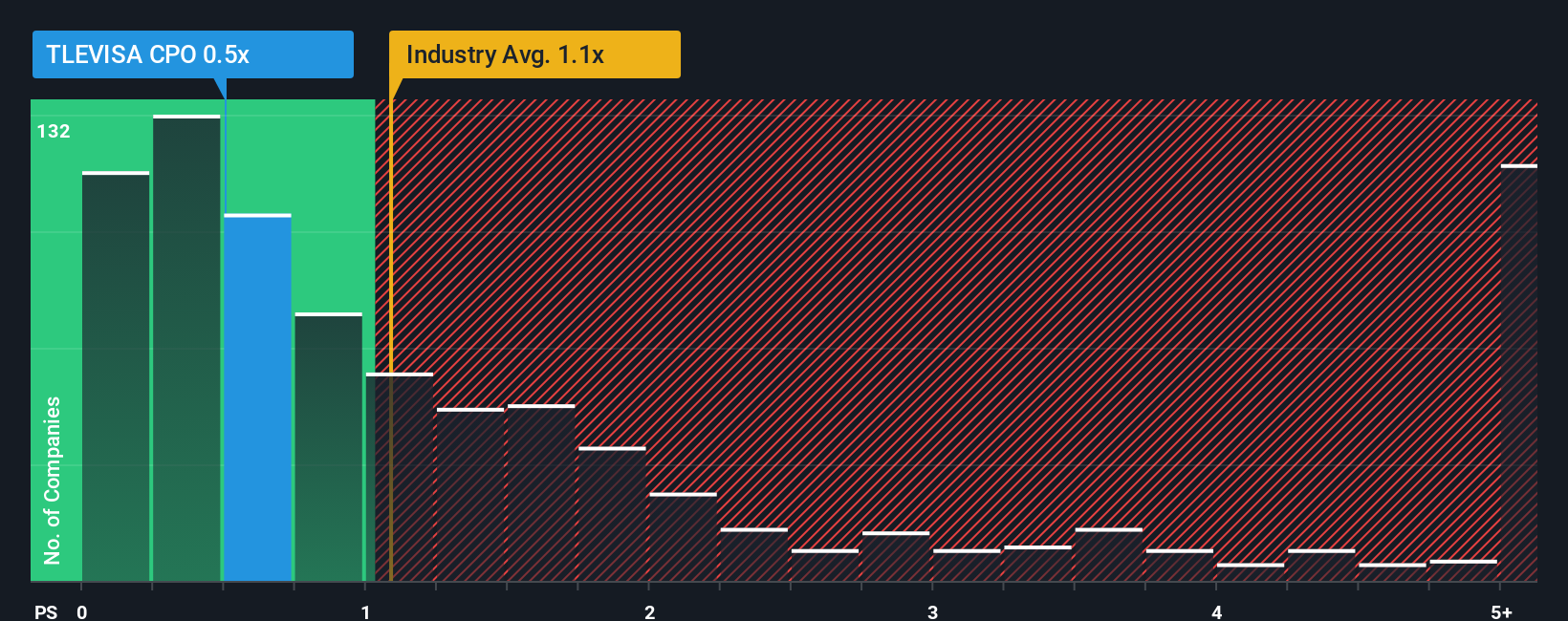

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Grupo Televisa's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Media industry in Mexico is also close to 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Grupo Televisa

What Does Grupo Televisa's P/S Mean For Shareholders?

Grupo Televisa hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Grupo Televisa's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

Grupo Televisa's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.1%. This means it has also seen a slide in revenue over the longer-term as revenue is down 21% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 2.4% each year during the coming three years according to the analysts following the company. Meanwhile, the broader industry is forecast to expand by 3.8% per annum, which paints a poor picture.

With this information, we find it concerning that Grupo Televisa is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Grupo Televisa's P/S Mean For Investors?

Its shares have lifted substantially and now Grupo Televisa's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It appears that Grupo Televisa currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Plus, you should also learn about these 3 warning signs we've spotted with Grupo Televisa (including 1 which is a bit concerning).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:TLEVISA CPO

Grupo Televisa

Owns and operates cable companies and provides direct-to-home satellite pay television system in Mexico and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives