Take Care Before Diving Into The Deep End On Megacable Holdings, S. A. B. de C. V. (BMV:MEGACPO)

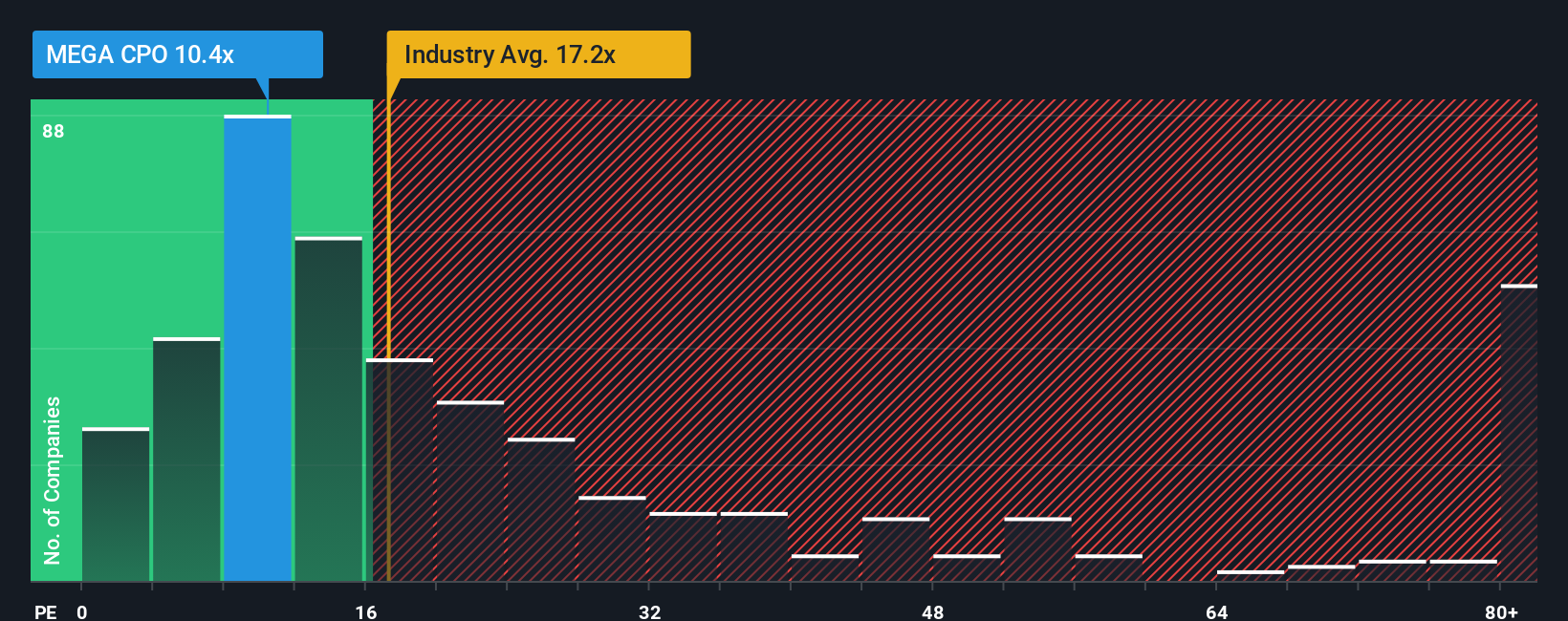

It's not a stretch to say that Megacable Holdings, S. A. B. de C. V.'s (BMV:MEGACPO) price-to-earnings (or "P/E") ratio of 10.4x right now seems quite "middle-of-the-road" compared to the market in Mexico, where the median P/E ratio is around 12x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

While the market has experienced earnings growth lately, Megacable Holdings S. A. B. de C. V's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Megacable Holdings S. A. B. de C. V

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Megacable Holdings S. A. B. de C. V's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 5.4%. Regardless, EPS has managed to lift by a handy 28% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Looking ahead now, EPS is anticipated to climb by 33% per annum during the coming three years according to the analysts following the company. With the market only predicted to deliver 11% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Megacable Holdings S. A. B. de C. V's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Megacable Holdings S. A. B. de C. V currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Megacable Holdings S. A. B. de C. V (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:MEGA CPO

Megacable Holdings S. A. B. de C. V

Engages in the installation, operation, and maintenance of cable television, internet, and telephone signal distribution systems.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026