- Mexico

- /

- Metals and Mining

- /

- BMV:MFRISCO A-1

Health Check: How Prudently Does Minera Frisco. de (BMV:MFRISCOA-1) Use Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Minera Frisco, S.A.B. de C.V. (BMV:MFRISCOA-1) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Minera Frisco. de

What Is Minera Frisco. de's Debt?

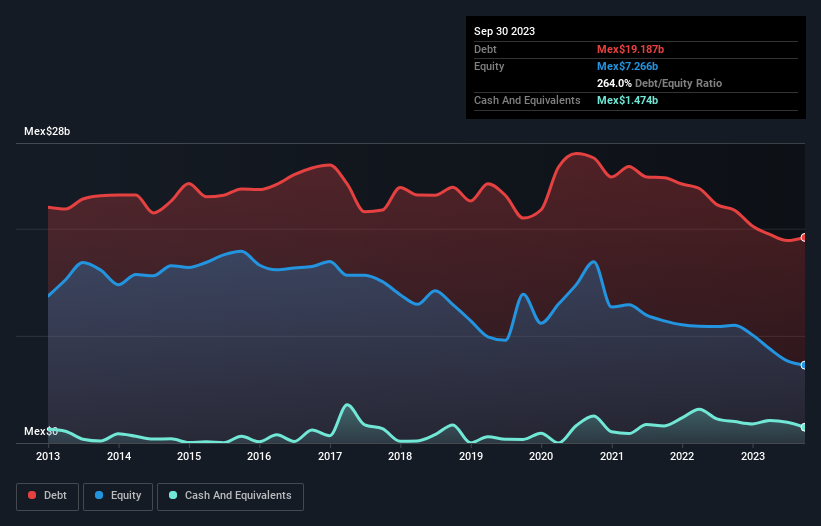

As you can see below, Minera Frisco. de had Mex$19.2b of debt at September 2023, down from Mex$21.7b a year prior. However, because it has a cash reserve of Mex$1.47b, its net debt is less, at about Mex$17.7b.

How Strong Is Minera Frisco. de's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Minera Frisco. de had liabilities of Mex$9.72b due within 12 months and liabilities of Mex$14.8b due beyond that. On the other hand, it had cash of Mex$1.47b and Mex$1.34b worth of receivables due within a year. So it has liabilities totalling Mex$21.7b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the Mex$13.2b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Minera Frisco. de would probably need a major re-capitalization if its creditors were to demand repayment. When analysing debt levels, the balance sheet is the obvious place to start. But it is Minera Frisco. de's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Minera Frisco. de had a loss before interest and tax, and actually shrunk its revenue by 30%, to Mex$9.3b. That makes us nervous, to say the least.

Caveat Emptor

While Minera Frisco. de's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost Mex$70m at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. But on the bright side the company actually produced a statutory profit of Mex$129m and free cash flow of Mex$1.0b. So one might argue that there's still a chance it can get things on the right track. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Minera Frisco. de (of which 1 makes us a bit uncomfortable!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:MFRISCO A-1

Minera Frisco. de

Engages in the exploration and exploitation of mining lots for the production and sale of gold and silver doré in Mexico.

Acceptable track record with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.