- Mexico

- /

- Metals and Mining

- /

- BMV:MFRISCO A-1

Did Changing Sentiment Drive Minera Frisco. de's (BMV:MFRISCOA-1) Share Price Down A Painful 87%?

Minera Frisco, S.A.B. de C.V. (BMV:MFRISCOA-1) shareholders should be happy to see the share price up 27% in the last week. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Like a ship taking on water, the share price has sunk 87% in that time. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The important question is if the business itself justifies a higher share price in the long term.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for Minera Frisco. de

Minera Frisco. de isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Minera Frisco. de reduced its trailing twelve month revenue by 2.0% for each year. That's not what investors generally want to see. The share price fall of 33% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. Fear of becoming a 'bagholder' may be keeping people away from this stock.

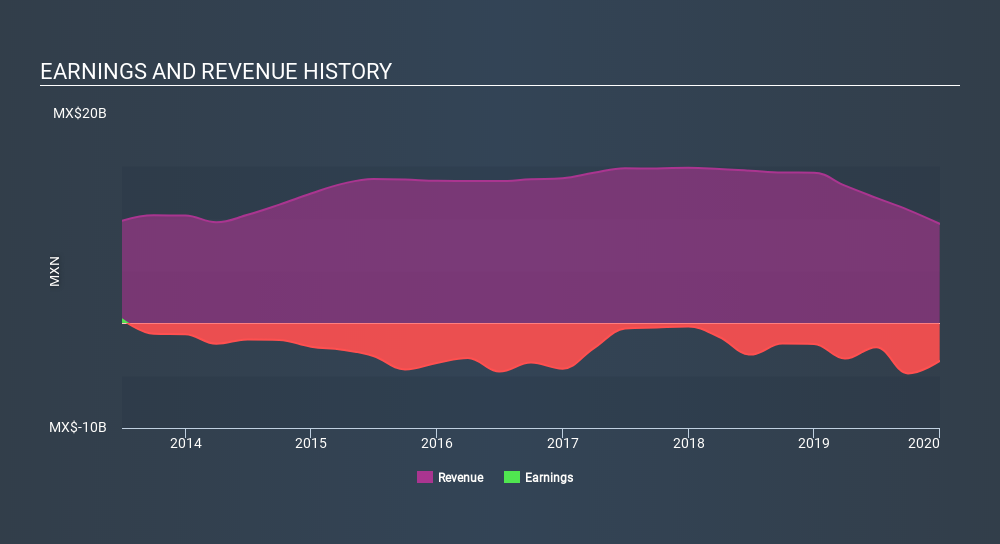

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that Minera Frisco. de shareholders are down 57% for the year. Unfortunately, that's worse than the broader market decline of 16%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 33% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Minera Frisco. de (of which 2 make us uncomfortable!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MX exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BMV:MFRISCO A-1

Minera Frisco. de

Engages in the exploration and exploitation of mining lots for the production and sale of gold and silver doré in Mexico.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives