Returns On Capital Are Showing Encouraging Signs At Convertidora Industrial. de (BMV:CONVERA)

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Speaking of which, we noticed some great changes in Convertidora Industrial. de's (BMV:CONVERA) returns on capital, so let's have a look.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Convertidora Industrial. de is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.19 = Mex$211m ÷ (Mex$1.9b - Mex$779m) (Based on the trailing twelve months to March 2021).

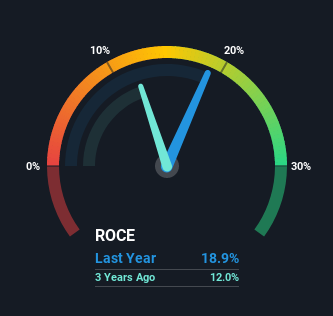

Thus, Convertidora Industrial. de has an ROCE of 19%. In absolute terms, that's a satisfactory return, but compared to the Packaging industry average of 8.9% it's much better.

See our latest analysis for Convertidora Industrial. de

In the above chart we have measured Convertidora Industrial. de's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Convertidora Industrial. de here for free.

What The Trend Of ROCE Can Tell Us

Convertidora Industrial. de has not disappointed with their ROCE growth. The figures show that over the last five years, ROCE has grown 197% whilst employing roughly the same amount of capital. So our take on this is that the business has increased efficiencies to generate these higher returns, all the while not needing to make any additional investments. It's worth looking deeper into this though because while it's great that the business is more efficient, it might also mean that going forward the areas to invest internally for the organic growth are lacking.

Another thing to note, Convertidora Industrial. de has a high ratio of current liabilities to total assets of 41%. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

The Bottom Line On Convertidora Industrial. de's ROCE

To sum it up, Convertidora Industrial. de is collecting higher returns from the same amount of capital, and that's impressive. Given the stock has declined 34% in the last five years, this could be a good investment if the valuation and other metrics are also appealing. So researching this company further and determining whether or not these trends will continue seems justified.

If you'd like to know more about Convertidora Industrial. de, we've spotted 3 warning signs, and 2 of them are potentially serious.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you’re looking to trade Convertidora Industrial. de, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:CONVER A

Convertidora Industrial. de

Engages in the production and conversion of plastic films for use as flexible packaging in Mexico and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success