- Japan

- /

- Professional Services

- /

- TSE:6532

Three Companies That May Be Trading Below Their Estimated Value In November 2024

Reviewed by Simply Wall St

In November 2024, global markets are reacting strongly to recent political and economic developments, with U.S. stocks reaching record highs amid expectations of accelerated growth and lower corporate taxes following a Republican electoral victory. This market optimism presents a unique opportunity for investors to consider stocks that may be trading below their estimated value; identifying such opportunities requires careful analysis of fundamentals and potential growth prospects in the context of current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$178.25 | CA$354.07 | 49.7% |

| KMC (Kuei Meng) International (TWSE:5306) | NT$125.00 | NT$248.24 | 49.6% |

| Aidma Holdings (TSE:7373) | ¥1698.00 | ¥3388.64 | 49.9% |

| Adventure (TSE:6030) | ¥3590.00 | ¥7109.49 | 49.5% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.35 | CN¥22.56 | 49.7% |

| Laboratorio Reig Jofre (BME:RJF) | €2.87 | €5.74 | 50% |

| Medios (XTRA:ILM1) | €14.76 | €29.48 | 49.9% |

| BuySell TechnologiesLtd (TSE:7685) | ¥3925.00 | ¥7814.84 | 49.8% |

| Delixi New Energy Technology (SHSE:603032) | CN¥17.95 | CN¥35.78 | 49.8% |

| Cellnex Telecom (BME:CLNX) | €32.47 | €64.68 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

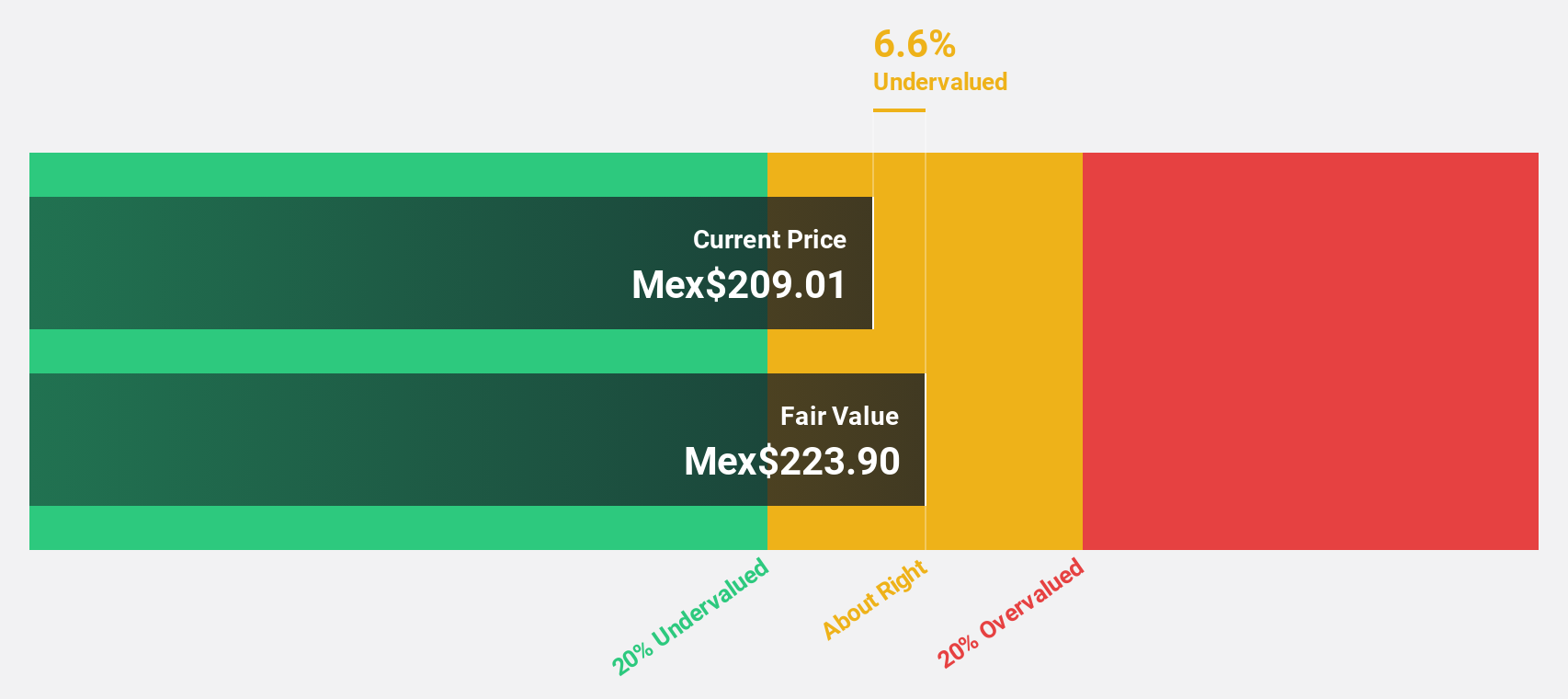

Quálitas Controladora. de (BMV:Q *)

Overview: Quálitas Controladora, S.A.B. de C.V. operates as an auto insurance company across Mexico, El Salvador, Costa Rica, Peru, and the United States with a market cap of MX$52.56 billion.

Operations: The company's revenue primarily stems from its operations in the auto insurance sector across Mexico, El Salvador, Costa Rica, Peru, and the United States.

Estimated Discount To Fair Value: 38%

Quálitas Controladora is trading at MX$137.92, significantly below its estimated fair value of MX$222.43, indicating potential undervaluation based on cash flows. Recent earnings growth of 49.1% and a forecasted annual profit increase of 13.1% suggest robust financial health, though its dividend yield of 5.8% isn't well covered by free cash flows. Analysts anticipate a stock price rise by 24.5%, reflecting confidence in future performance despite moderate revenue growth expectations.

- Our expertly prepared growth report on Quálitas Controladora. de implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Quálitas Controladora. de.

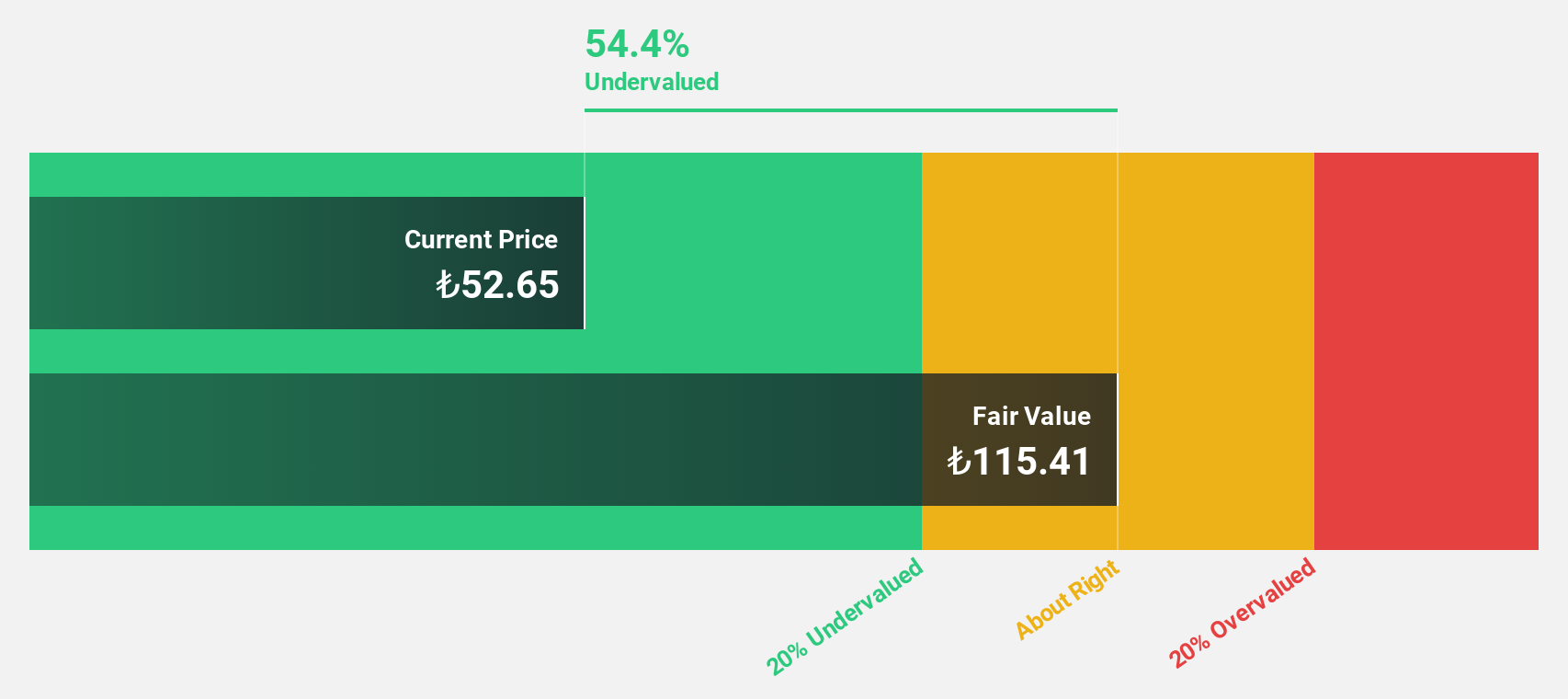

Coca-Cola Içecek Anonim Sirketi (IBSE:CCOLA)

Overview: Coca-Cola Içecek Anonim Sirketi, along with its subsidiaries, produces, sells, and distributes sparkling and still beverages across Turkey, Pakistan, Central Asia, and the Middle East with a market cap of TRY129.83 billion.

Operations: The company's revenue from non-alcoholic beverages amounts to TRY95.24 billion.

Estimated Discount To Fair Value: 30.8%

Coca-Cola Içecek Anonim Sirketi is trading at TRY 46.4, below its estimated fair value of TRY 67.03, highlighting potential undervaluation based on cash flows. Despite a decline in recent net income and profit margins compared to last year, the company is forecasted to experience significant earnings growth of over 20% annually. Revenue growth projections exceed both market expectations and historical performance, suggesting strong future cash flow potential despite current challenges.

- In light of our recent growth report, it seems possible that Coca-Cola Içecek Anonim Sirketi's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Coca-Cola Içecek Anonim Sirketi.

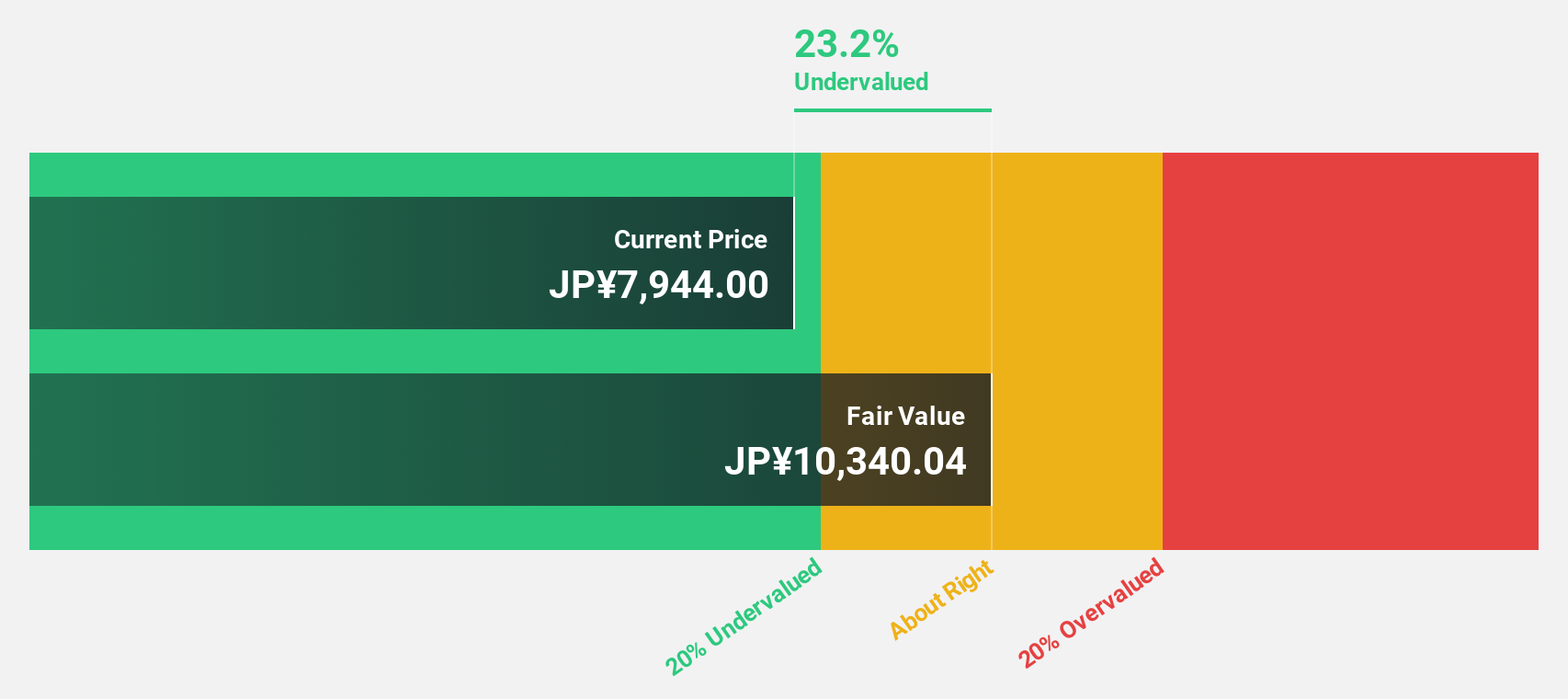

BayCurrent Consulting (TSE:6532)

Overview: BayCurrent Consulting, Inc. offers consulting services in Japan and has a market cap of ¥808.04 billion.

Operations: Revenue segments for BayCurrent Consulting, Inc. are not specified in the provided text.

Estimated Discount To Fair Value: 43.4%

BayCurrent Consulting is trading at ¥5,314, significantly below its estimated fair value of ¥9,396.41, indicating potential undervaluation based on cash flows. While earnings grew 15.7% over the past year and are forecasted to grow annually by 19.08%, revenue growth is expected to be slower than 20% per year but still outpace the broader Japanese market's growth rate of 4.2%.

- The growth report we've compiled suggests that BayCurrent Consulting's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in BayCurrent Consulting's balance sheet health report.

Where To Now?

- Click here to access our complete index of 890 Undervalued Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BayCurrent Consulting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6532

Flawless balance sheet with reasonable growth potential.