- Mexico

- /

- Household Products

- /

- BMV:KIMBER A

Share Price Aside, Kimberly-Clark de México S. A. B. de C. V (BMV:KIMBERA) Has Delivered Shareholders A 7.7% Return.

For many, the main point of investing is to generate higher returns than the overall market. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Kimberly-Clark de México, S. A. B. de C. V. (BMV:KIMBERA) shareholders for doubting their decision to hold, with the stock down 13% over a half decade. The good news is that the stock is up 3.8% in the last week.

View our latest analysis for Kimberly-Clark de México S. A. B. de C. V

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

While the share price declined over five years, Kimberly-Clark de México S. A. B. de C. V actually managed to increase EPS by an average of 7.1% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past.

Generally speaking we'd expect to see stronger share price increases on the back of sustained EPS growth, but other metrics may hold a clue to why the share price performance is relatively modest.

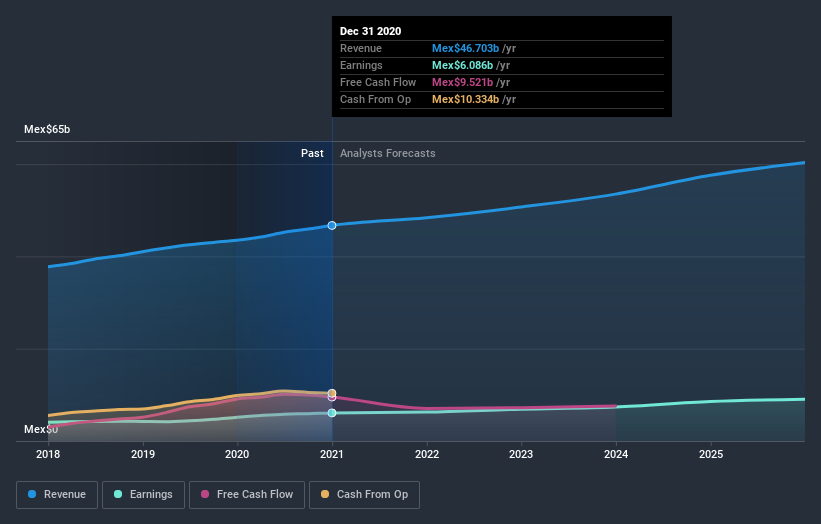

In contrast to the share price, revenue has actually increased by 7.1% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Kimberly-Clark de México S. A. B. de C. V has improved its bottom line lately, but what does the future have in store? So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Kimberly-Clark de México S. A. B. de C. V's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Its history of dividend payouts mean that Kimberly-Clark de México S. A. B. de C. V's TSR of 7.7% over the last 5 years is better than the share price return.

A Different Perspective

Kimberly-Clark de México S. A. B. de C. V shareholders are up 11% for the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 1.5% over half a decade This suggests the company might be improving over time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Kimberly-Clark de México S. A. B. de C. V .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MX exchanges.

If you’re looking to trade Kimberly-Clark de México S. A. B. de C. V, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kimberly-Clark de México S. A. B. de C. V might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:KIMBER A

Kimberly-Clark de México S. A. B. de C. V

Manufactures, distributes, and sells disposable products in Mexico.

Undervalued with excellent balance sheet and pays a dividend.