- Mexico

- /

- Household Products

- /

- BMV:KIMBER A

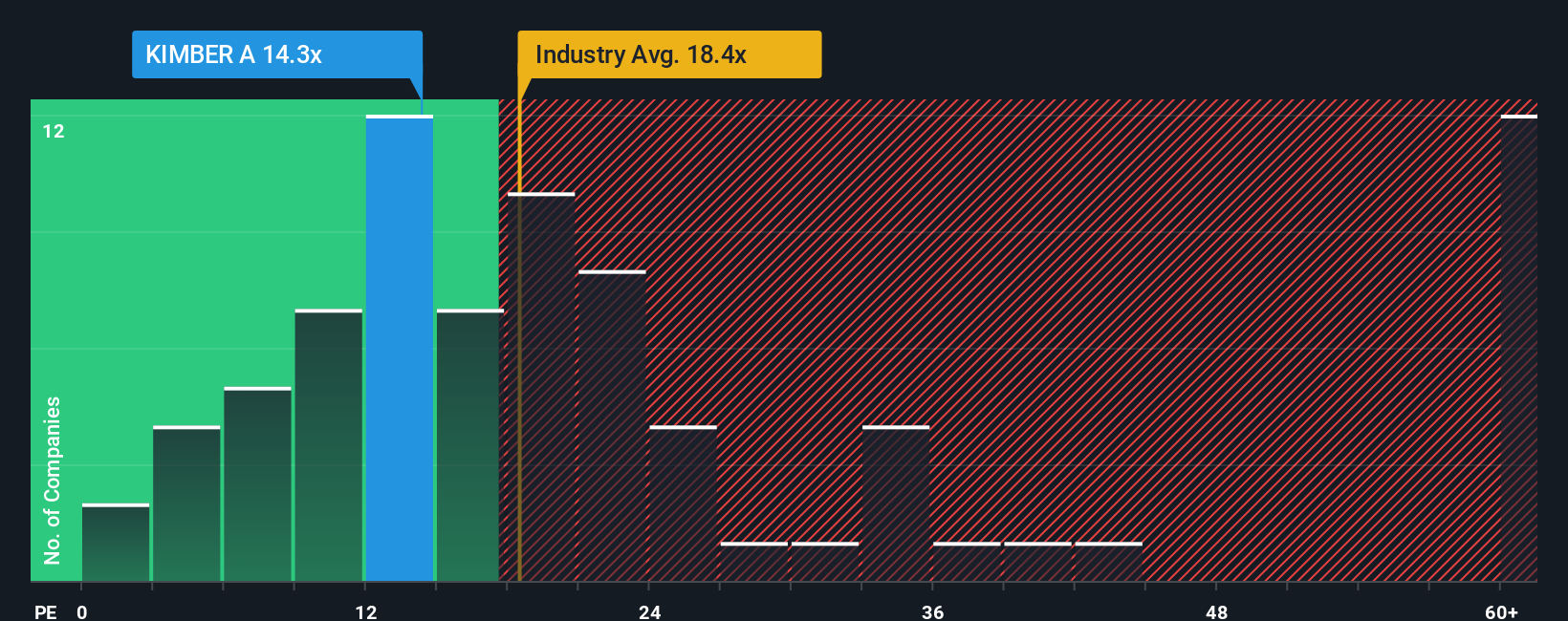

Kimberly-Clark de México, S. A. B. de C. V.'s (BMV:KIMBERA) Shares May Have Run Too Fast Too Soon

It's not a stretch to say that Kimberly-Clark de México, S. A. B. de C. V.'s (BMV:KIMBERA) price-to-earnings (or "P/E") ratio of 14.3x right now seems quite "middle-of-the-road" compared to the market in Mexico, where the median P/E ratio is around 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's inferior to most other companies of late, Kimberly-Clark de México S. A. B. de C. V has been relatively sluggish. It might be that many expect the uninspiring earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Check out our latest analysis for Kimberly-Clark de México S. A. B. de C. V

Does Growth Match The P/E?

In order to justify its P/E ratio, Kimberly-Clark de México S. A. B. de C. V would need to produce growth that's similar to the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow EPS by an impressive 93% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 4.7% per year over the next three years. That's shaping up to be materially lower than the 13% per annum growth forecast for the broader market.

In light of this, it's curious that Kimberly-Clark de México S. A. B. de C. V's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

What We Can Learn From Kimberly-Clark de México S. A. B. de C. V's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Kimberly-Clark de México S. A. B. de C. V's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Kimberly-Clark de México S. A. B. de C. V that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Kimberly-Clark de México S. A. B. de C. V might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:KIMBER A

Kimberly-Clark de México S. A. B. de C. V

Manufactures, distributes, and sells disposable products in Mexico.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives