In February 2025, global markets are navigating a complex landscape marked by tariff uncertainties and mixed economic indicators. While U.S. stocks have faced recent declines due to tariff announcements, small-cap indices like the S&P MidCap 400 and Russell 2000 continue to show modest year-to-date gains despite these challenges. In such an environment, identifying undiscovered gems requires a keen eye for companies with strong fundamentals that can withstand broader market volatility and capitalize on niche opportunities within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Ohashi Technica | NA | 4.58% | -14.04% | ★★★★★★ |

| Otec | 8.17% | 3.43% | 1.06% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Komori | 9.28% | 8.79% | 64.70% | ★★★★★☆ |

| CMC | 1.42% | 1.60% | 10.14% | ★★★★★☆ |

| Marusan Securities | 5.46% | 0.83% | 4.55% | ★★★★★☆ |

| Nippon Ski Resort DevelopmentLtd | 43.84% | 7.58% | 32.78% | ★★★★★☆ |

| Mr Max Holdings | 54.12% | 0.97% | 4.23% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Grupo Herdez. de (BMV:HERDEZ *)

Simply Wall St Value Rating: ★★★★★☆

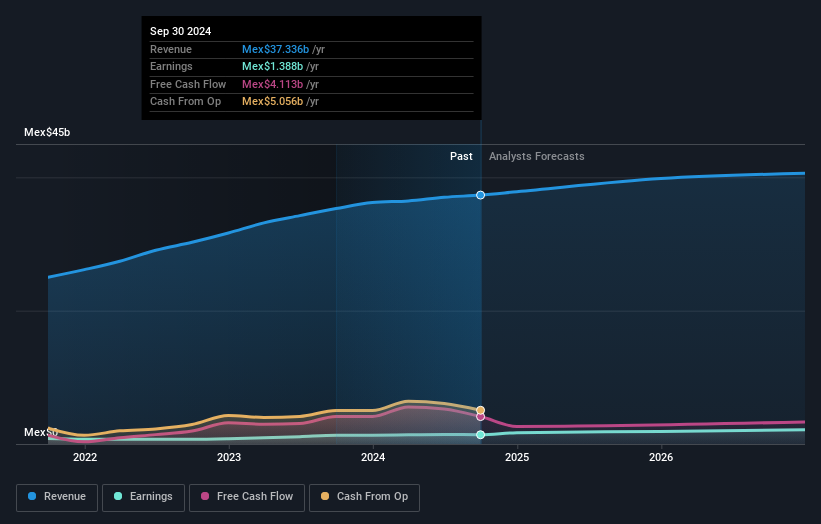

Overview: Grupo Herdez, S.A.B. de C.V. is a food company involved in the manufacture, purchase, distribution, and marketing of canned and packed food products both in Mexico and internationally, with a market cap of MX$17.81 billion.

Operations: The company's revenue streams include exports (MX$3.21 billion), momentum (MX$5.07 billion), and canned food (MX$29.06 billion).

Grupo Herdez, a notable player in the food sector, has shown a promising trajectory with earnings growth of 6.2% over the past year, surpassing the industry average of 5.9%. The company’s interest payments are well-covered by EBIT at 7.8 times, and its net debt to equity ratio stands at a satisfactory 39.1%. Despite an increase in debt to equity ratio from 36.4% to 54.6% over five years, Herdez is trading significantly below fair value estimates by about 68.6%. With high-quality earnings and positive free cash flow, it offers potential for future growth amidst market expansion efforts and operational improvements.

Union Coop (DFM:UNIONCOOP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Union Coop operates hypermarkets and consumer cooperatives in the United Arab Emirates, with a market capitalization of approximately AED4.26 billion.

Operations: Union Coop generates revenue primarily from its retail segment, which accounts for AED1.72 billion, and a smaller portion from e-commerce at AED125.72 million.

Union Coop, a smaller player in the consumer retailing sector, has shown resilience despite earnings declining by 14% annually over the past five years. The company is trading at 2.5% below its estimated fair value, indicating potential undervaluation. Notably, Union Coop boasts high-quality past earnings and remains debt-free for five years, which enhances its financial stability. Although last year's earnings growth of 32% lagged behind the industry average of nearly 50%, it still highlights positive momentum. With consistent free cash flow generation—US$282 million recently—it seems well-positioned to navigate future challenges and opportunities effectively.

- Dive into the specifics of Union Coop here with our thorough health report.

Examine Union Coop's past performance report to understand how it has performed in the past.

Suzhou West Deane New Power ElectricLtd (SHSE:603312)

Simply Wall St Value Rating: ★★★★★☆

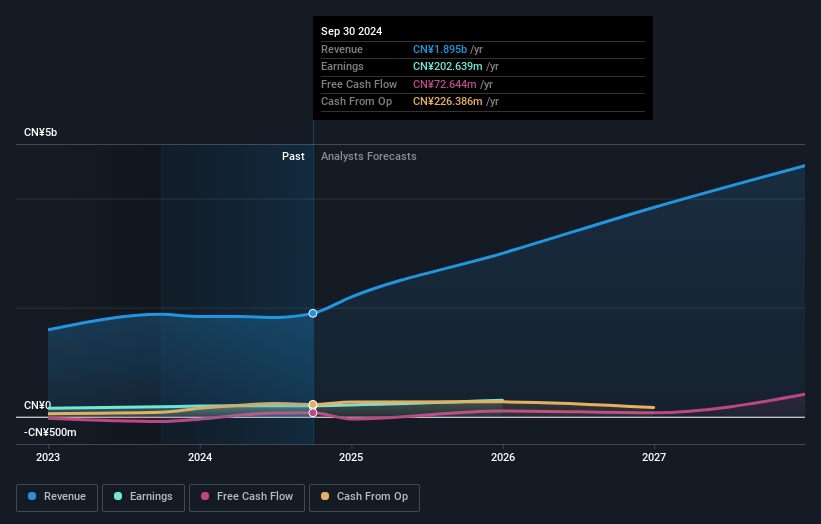

Overview: Suzhou West Deane New Power Electric Co., Ltd. is an engineering and manufacturing company that provides laminated bus bar products globally, with a market capitalization of CN¥5.49 billion.

Operations: West Deane generates revenue primarily from its electrical machinery and equipment manufacturing segment, amounting to CN¥1.90 billion. The company's cost structure and profitability metrics are not detailed in the provided information.

Suzhou West Deane New Power Electric Ltd. stands out with its earnings growth of 11.5% over the past year, surpassing the Electrical industry average of 1.1%. The company trades at a significant discount, valued at 40.6% below estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. Financially robust, it boasts more cash than total debt and generates positive free cash flow as seen in recent quarters with figures like US$68.92 million and US$72.64 million in June and September respectively in 2024, indicating strong operational efficiency and financial health moving forward into future growth prospects.

Next Steps

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4690 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BMV:HERDEZ *

Grupo Herdez. de

A food company, engages in the manufacture, purchase, distribution, and marketing of canned and packed food products in Mexico and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives