- Mexico

- /

- Hospitality

- /

- BMV:HCITY *

Hoteles City Express. de's (BMV:HCITY) earnings trajectory could turn positive as the stock rallies 18% this past week

While it may not be enough for some shareholders, we think it is good to see the Hoteles City Express, S.A.B. de C.V. (BMV:HCITY) share price up 21% in a single quarter. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. In that time the share price has delivered a rude shock to holders, who find themselves down 69% after a long stretch. Some might say the recent bounce is to be expected after such a bad drop. But it could be that the fall was overdone.

While the last five years has been tough for Hoteles City Express. de shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for Hoteles City Express. de

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Hoteles City Express. de became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

Revenue is actually up 8.8% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

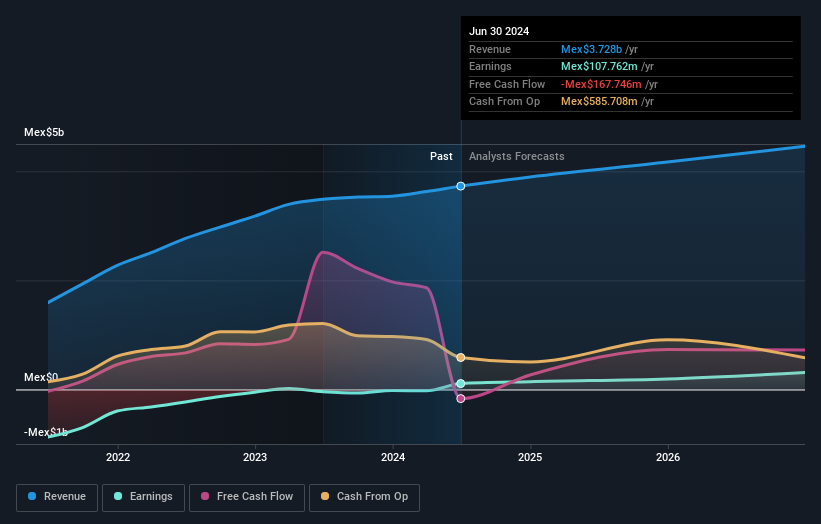

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how Hoteles City Express. de has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Hoteles City Express. de's financial health with this free report on its balance sheet.

A Different Perspective

Investors in Hoteles City Express. de had a tough year, with a total loss of 13%, against a market gain of about 8.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 11% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Hoteles City Express. de has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Mexican exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hoteles City Express. de might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BMV:HCITY *

Hoteles City Express. de

Develops and operates a chain of limited-service hotels in Mexico, Costa Rica, Colombia, and Chile.

Good value with reasonable growth potential.