- China

- /

- Construction

- /

- SHSE:605289

Top Growth Companies With Insider Ownership In October 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate adjustments and fluctuating economic indicators, the S&P 500 Index has shown resilience with notable advances, particularly in utilities and real estate sectors. Amidst this backdrop, investors often seek growth companies with high insider ownership as these stocks can provide unique insights into confidence levels from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

Underneath we present a selection of stocks filtered out by our screen.

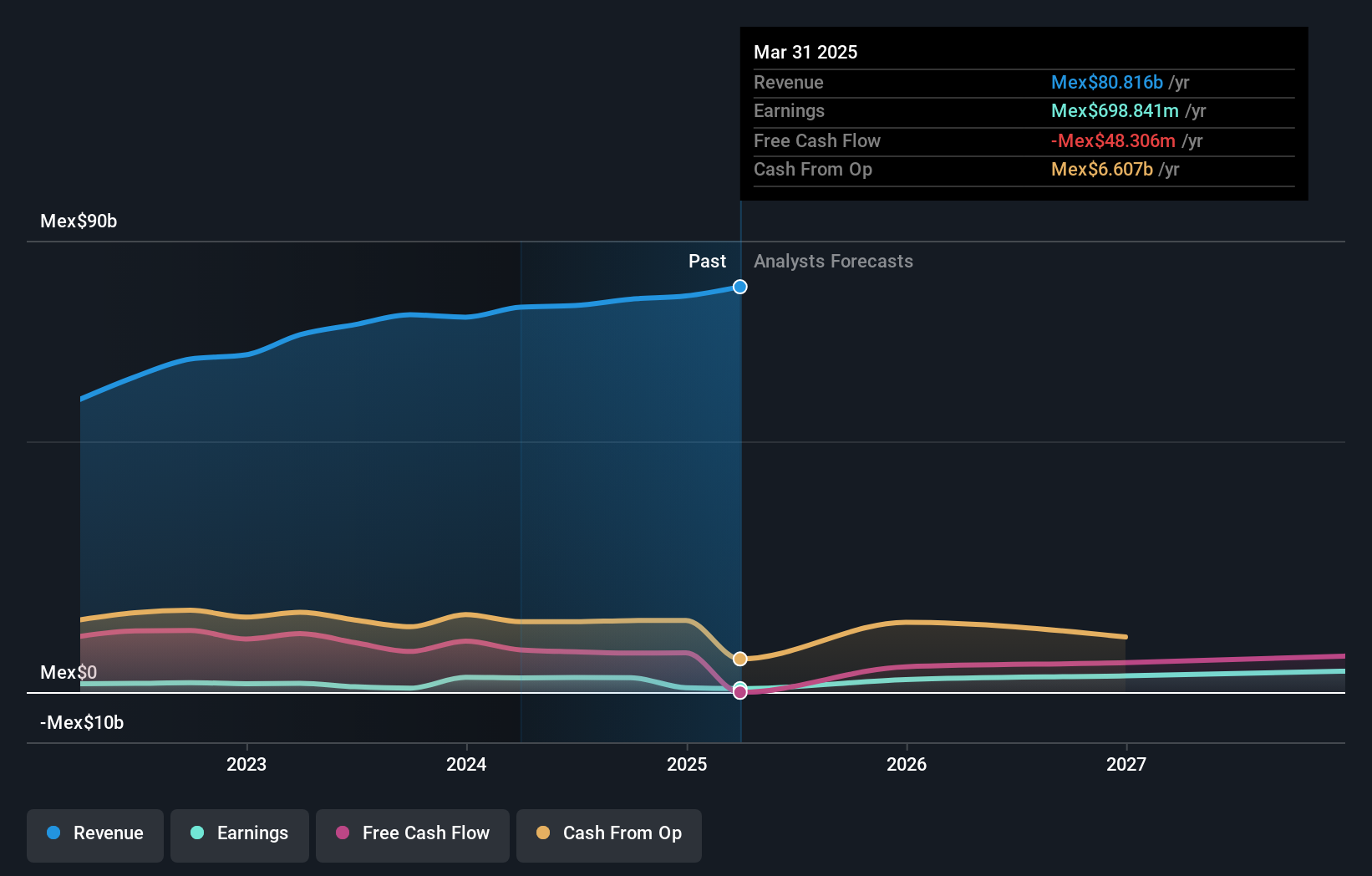

Alsea. de (BMV:ALSEA *)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alsea, S.A.B. de C.V. operates restaurants across Latin America and Europe with a market capitalization of MX$44.80 billion.

Operations: Alsea generates its revenue from operating restaurants in Latin America and Europe.

Insider Ownership: 38.5%

Earnings Growth Forecast: 24.1% p.a.

Alsea's earnings are forecast to grow significantly at 24.1% annually, outpacing the MX market average of 11.5%. Despite a lower-than-industry-average P/E ratio of 17.5x, Alsea's revenue is expected to increase by 9.1% per year, surpassing the market growth rate of 7.3%. However, recent financials show a decline in net income for Q2 and six months ending June 2024 compared to the previous year, indicating potential challenges ahead.

- Get an in-depth perspective on Alsea. de's performance by reading our analyst estimates report here.

- The analysis detailed in our Alsea. de valuation report hints at an deflated share price compared to its estimated value.

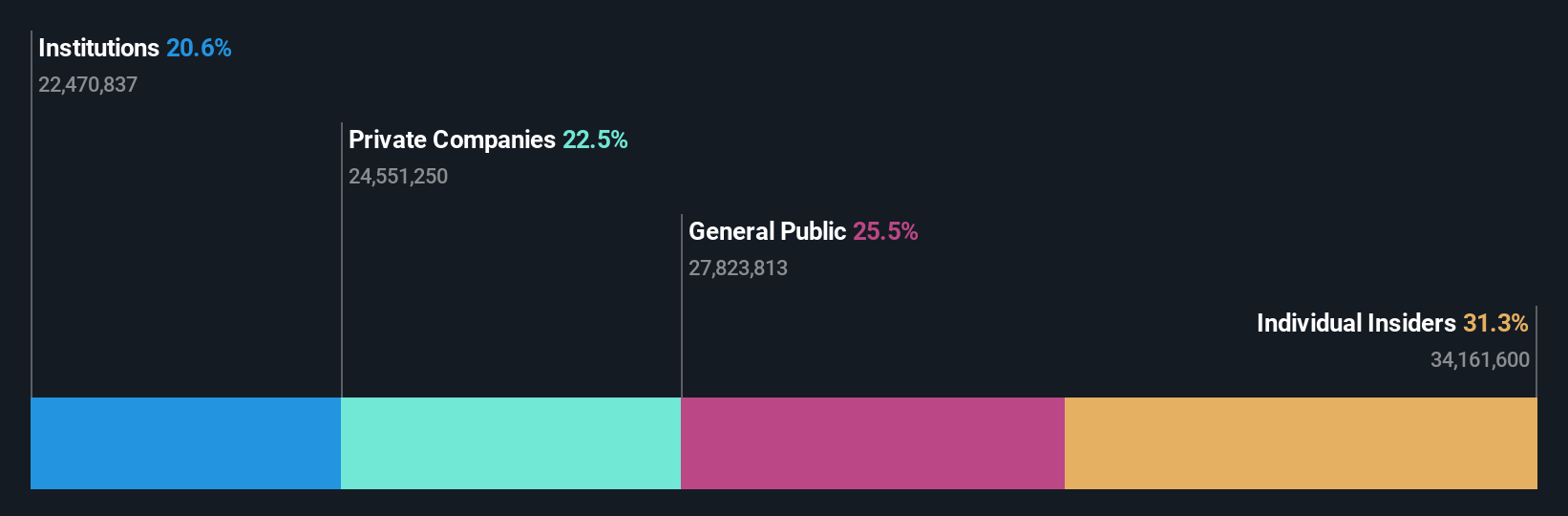

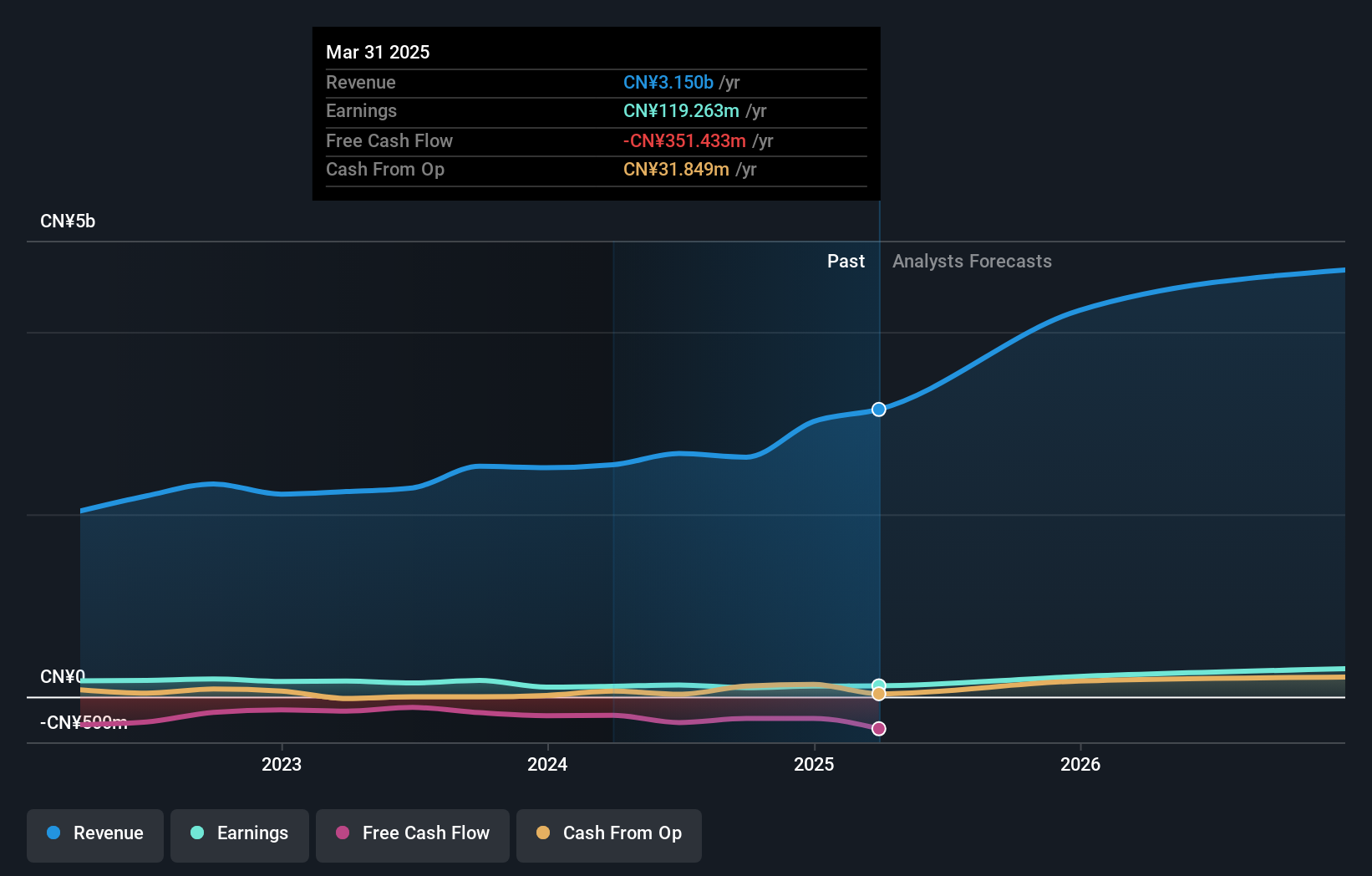

Shanghai Luoman Technologies (SHSE:605289)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Luoman Lighting Technologies Inc. focuses on the development and manufacturing of lighting products, with a market cap of CN¥3.39 billion.

Operations: The company's revenue primarily comes from its Landscape Lighting Project segment, contributing CN¥601.88 million, followed by Landscape Lighting Design at CN¥6.35 million and Landscape Lighting and Other Services at CN¥46.66 million.

Insider Ownership: 29.7%

Earnings Growth Forecast: 39.9% p.a.

Shanghai Luoman Technologies is poised for substantial growth, with earnings forecasted to rise significantly at 39.9% annually, surpassing the CN market average of 23.8%. Revenue is also expected to grow faster than the market at 27% per year. Despite impressive past earnings growth and high insider ownership, recent financials reveal a drop in net income from CNY 35.62 million to CNY 5.13 million for H1 2024, suggesting near-term profitability challenges.

- Navigate through the intricacies of Shanghai Luoman Technologies with our comprehensive analyst estimates report here.

- The analysis detailed in our Shanghai Luoman Technologies valuation report hints at an inflated share price compared to its estimated value.

Guangdong Shenling Environmental Systems (SZSE:301018)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Shenling Environmental Systems Co., Ltd. operates in the environmental systems sector and has a market cap of CN¥6.60 billion.

Operations: Guangdong Shenling Environmental Systems Co., Ltd. does not have specific revenue segments listed in the provided text.

Insider Ownership: 38.7%

Earnings Growth Forecast: 42.9% p.a.

Guangdong Shenling Environmental Systems is positioned for robust growth, with earnings projected to increase significantly at 42.9% annually, outpacing the CN market's 23.8%. Revenue is expected to grow at 26.2% per year, faster than the market rate of 13.5%. Recent amendments to its business scope and articles of association reflect strategic adaptability. Despite high insider ownership supporting alignment with shareholder interests, share price volatility and low dividend coverage by free cash flows present potential risks.

- Unlock comprehensive insights into our analysis of Guangdong Shenling Environmental Systems stock in this growth report.

- Upon reviewing our latest valuation report, Guangdong Shenling Environmental Systems' share price might be too optimistic.

Turning Ideas Into Actions

- Explore the 1480 names from our Fast Growing Companies With High Insider Ownership screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605289

Shanghai Luoman Technologies

Provides urban and rural landscape lighting solutions in China.

Mediocre balance sheet very low.

Market Insights

Community Narratives