- Mexico

- /

- Consumer Durables

- /

- BMV:ARA *

Party Time: One Broker Just Made Major Increases To Their Consorcio ARA, S. A. B. de C. V. (BMV:ARA) Earnings Forecast

Celebrations may be in order for Consorcio ARA, S. A. B. de C. V. (BMV:ARA) shareholders, with the covering analyst delivering a significant upgrade to their statutory estimates for the company. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with the analyst modelling a real improvement in business performance. The market seems to be pricing in some improvement in the business too, with the stock up 5.1% over the past week, closing at Mex$4.70. Could this big upgrade push the stock even higher?

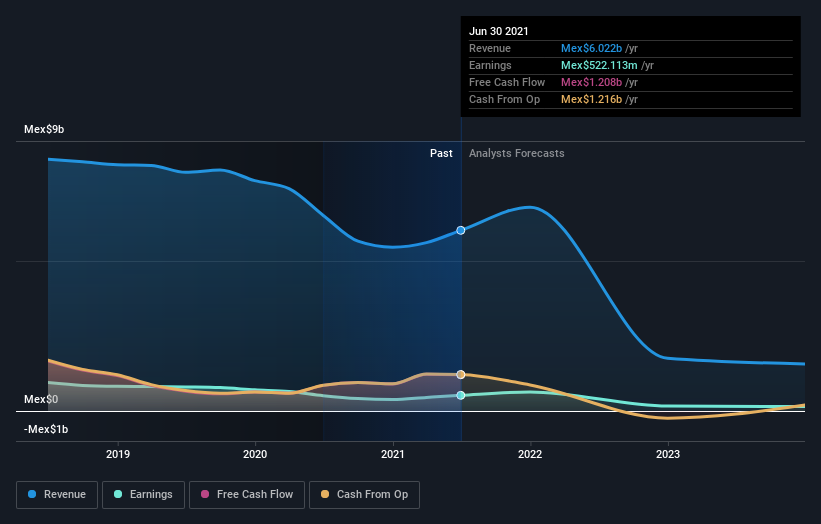

Following the upgrade, the most recent consensus for Consorcio ARA S. A. B. de C. V from its lone analyst is for revenues of Mex$6.8b in 2021 which, if met, would be a solid 13% increase on its sales over the past 12 months. Statutory earnings per share are anticipated to reduce 9.5% to Mex$0.50 in the same period. Previously, the analyst had been modelling revenues of Mex$5.9b and earnings per share (EPS) of Mex$0.37 in 2021. There has definitely been an improvement in perception recently, with the analyst substantially increasing both their earnings and revenue estimates.

View our latest analysis for Consorcio ARA S. A. B. de C. V

With these upgrades, we're not surprised to see that the analyst has lifted their price target 6.0% to Mex$6.48 per share. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Consorcio ARA S. A. B. de C. V analyst has a price target of Mex$10.00 per share, while the most pessimistic values it at Mex$2.95. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how think this business will perform. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. One thing stands out from these estimates, which is that Consorcio ARA S. A. B. de C. V is forecast to grow faster in the future than it has in the past, with revenues expected to display 27% annualised growth until the end of 2021. If achieved, this would be a much better result than the 5.1% annual decline over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 10% annually. Not only are Consorcio ARA S. A. B. de C. V's revenues expected to improve, it seems that the analyst is also expecting it to grow faster than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that the analyst upgraded their earnings per share estimates for this year, expecting improving business conditions. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Consorcio ARA S. A. B. de C. V could be worth investigating further.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Consorcio ARA S. A. B. de C. V going out as far as 2023, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you decide to trade Consorcio ARA S. A. B. de C. V, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BMV:ARA *

Consorcio ARA S. A. B. de C. V

Engages in designing, promoting, building, and selling housing developments in Mexico.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives