Here's Why We Don't Think BMIT Technologies's (MTSE:BMIT) Statutory Earnings Reflect Its Underlying Earnings Potential

Broadly speaking, profitable businesses are less risky than unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. This article will consider whether BMIT Technologies' (MTSE:BMIT) statutory profits are a good guide to its underlying earnings.

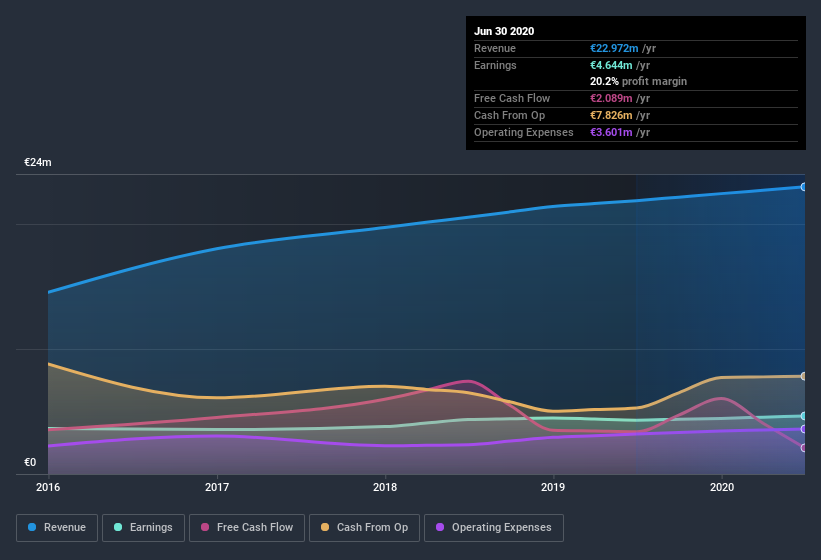

We like the fact that BMIT Technologies made a profit of €4.64m on its revenue of €23.0m, in the last year. Happily, it has grown both its profit and revenue over the last three years, as you can see in the chart below.

View our latest analysis for BMIT Technologies

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. As a result, we think it's well worth considering what BMIT Technologies' cashflow (when compared to its earnings) can tell us about the nature of its statutory profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of BMIT Technologies.

A Closer Look At BMIT Technologies' Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

For the year to June 2020, BMIT Technologies had an accrual ratio of 0.32. Therefore, we know that it's free cashflow was significantly lower than its statutory profit, raising questions about how useful that profit figure really is. To wit, it produced free cash flow of €2.1m during the period, falling well short of its reported profit of €4.64m. BMIT Technologies shareholders will no doubt be hoping that its free cash flow bounces back next year, since it was down over the last twelve months.

Our Take On BMIT Technologies' Profit Performance

As we have made quite clear, we're a bit worried that BMIT Technologies didn't back up the last year's profit with free cashflow. As a result, we think it may well be the case that BMIT Technologies' underlying earnings power is lower than its statutory profit. Sadly, its EPS was down over the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you'd like to know more about BMIT Technologies as a business, it's important to be aware of any risks it's facing. When we did our research, we found 2 warning signs for BMIT Technologies (1 is concerning!) that we believe deserve your full attention.

This note has only looked at a single factor that sheds light on the nature of BMIT Technologies' profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade BMIT Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BMIT Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About MTSE:BMIT

BMIT Technologies

Provides digital infrastructure and managed services in Malta.

Medium-low risk and fair value.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Increasing revenue at high costs relies on membership to convert to spend

Google - The world's first "Full Stack AI Sovereign"

Substantial founder ownership speaks to the strength of its business

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks